What is the Edexcel A-Level Economics test?

The Edexcel A-Level Economics test is an economics-focused qualification offered to British students in their final two years of secondary school study. A-levels are typically taken as courses intended to lead to University or other further education. A-level economics students will often go on to study economics or a similar subject at University.

The Edexcel A-Level Economics test is offered by Pearson Edexcel. The main alternative to Edexcel is the AQA A-Level Economics course.

Edexcel is a privately-owned British education and exams body founded in 1996. Edexcel has been owned by Pearson plc. since 2005. Edexcel produces qualifications and tests for the British education system and is the UK’s largest entity offering educational qualifications.

Where did we get these Edexcel Economics A-Level Past Paper Elasticities Questions?

We found these Edexcel Economics A-Level past paper questions on elasticities by sifting through all of the publicly available Edexcel past papers. We picked out all of the past paper questions on price and income elasticities and compiled them into the list in this article.

Want questions for other topics in A-Level Economics? You can find more A-Level Economics Past Paper Questions here.

What is price elasticity of demand?

Price elasticity of demand is a measure of how responsive demand for a product is to changes in price for that product. Price elasticity of demand is calculated as the per cent change in demand divided by the per cent change in price.

A price elasticity of demand greater than 1 or lower than -1 is considered elastic, meaning demand responds meaningfully to price. A price elasticity of demand that is between -1 and 1 is considered inelastic, meaning demand changes only a little in response to changes in price.

What is income elasticity of demand?

Income elasticity of demand is a measure of how responsive demand for a product is to changes in the buyer’s income. Incomes may increase as an economy performs well and unemployment falls. Higher incomes are likely to drive increases in demand for certain goods, especially luxury goods.

Income elasticity of demand is calculated as the percentage change in demand over the percentage change in income. An income elasticity of demand of greater than 1 or less than -1 is considered elastic, meaning demand for a good changes significantly in response to changes in income. An income elasticity of demand between 1 and -1 is considered inelastic, meaning the relationship is limited.

You can check out our Edexcel A-Level Economics Notes here.

What is price elasticity of supply?

Price elasticity of supply is a measure of how responsive supply for a good is to the price of that good. We would generally expect that an increase in a product’s price would encourage more businesses to produce that good.

The price elasticity of supply is calculated as the percent change in supply over the percent change in price. A product with a price elasticity of supply of greater than 1 or less than -1 is considered elastic, meaning that there is a significant relationship between price and supply.

Question 1: Edexcel 9ECO June 2019 Paper 1

Between 2016 and 2017 the average price of new build houses in the UK rose by an estimated 5.4%

(a) With reference to the data provided, calculate the price elasticity of supply for new house builds between 2016 and 2017. You are advised to show your workings. (2 points)

(b) A 2.5% increase in new build house prices in one region of the UK causes a 10% increase in the number of houses built. Ceteris paribus, this suggests that supply of new house builds is: (1 point)

A perfectly price elastic

B perfectly price inelastic

C relatively price elastic

D relatively price inelastic

(c) Explain one factor that is likely to determine the price elasticity of supply of new house builds. (2 points)

Question 2: Edexcel 9ECO June 2019 Paper 1

Extract A

Energy price cap to fix ‘broken’ market in UK

The Prime Minister recently said that the regulator Ofgem (Office of Gas and Electricity Markets) should limit electricity and gas suppliers’ most expensive tariffs. Under the planned new legislation, the energy bills of 11 million households will be capped for as long as five years. The government claimed this cap could save households up to £100 a year. This legislation would force Ofgem to change the licence conditions for energy suppliers so that they are required to cap electricity and gas prices. The measure will apply to anyone on a standard variable tariff, the expensive plans that customers are moved to when cheaper, fixed-price deals end. Ofgem will need to consult energy companies on how the cap is calculated, the government said. The Prime Minister repeated her claim that she had to act because the ‘market is broken’, a charge the big energy companies reject. “I have been clear that our broken energy market has to change – it has to offer fairer prices for millions of loyal customers who have been paying hundreds of pounds too much,” she said.

However, Michael Lewis, chief executive of E.ON said “the government must guard against any unintended consequences that undermine customer service and push up prices as a whole. A price cap will not be good for customers. It will reduce competition and innovation”. Smaller suppliers such as First Utility said the Big Six had only themselves to blame for the cap, because they had kept millions of people on standard variable tariffs.

Extract B

BT profit rises

BT Group, which includes BT Openreach and BT Retail, reported a rise in profit as revenue increased following the integration of the consumer mobile business, EE. BT finalised the takeover of EE in August 2016, and the integration has resulted in BT controlling 35% of the mobile consumer market. The profit of the UK-based telecommunication group in its second quarter 2017 rose to £566 million.

BT Group chief executive Gavin Patterson said: “We will operate a multi-brand strategy with UK customers being able to choose a mix of BT, EE or Plusnet services, depending on which suits them best. The acquisition enables us to offer great value bundles of services and customers are set to be the winners as we compete for their business”.

Extract C

BT to slash landline charges for 1 million customers

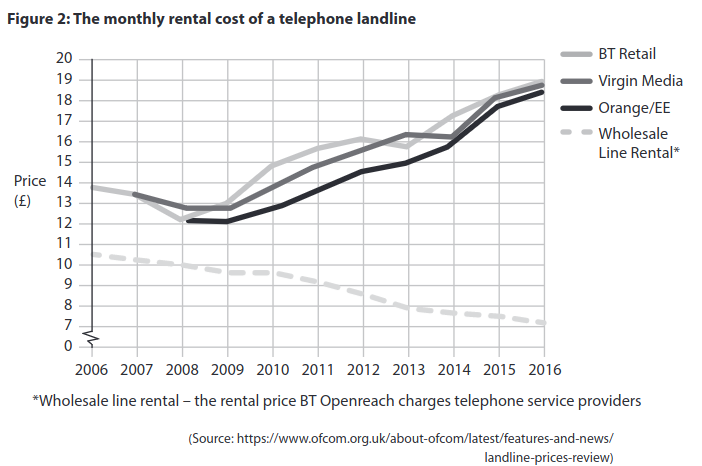

Rental charges for landline-only customers – households with a telephone-only contract but no BT broadband – will fall from £18.99 to £11.99 per month after the regulator attacked existing deals as ‘poor value for money’. This rental reduction will save a million landline-only customers £84 a year.

The regulator Ofcom (Office of Communications) said it stepped in because these bills for landline-only customers – nearly two-thirds of whom are over 65 – have “soared” in recent years. This is despite BT and other landline providers benefiting from significant cuts in the wholesale line rental cost of providing the service by BT Openreach. Many landline-only customers are elderly, and have been with BT for decades. Ofcom has focused on BT because it accounts for two-thirds of the UK’s 1.5m landline-only customers.

A spokesperson for Ofcom said “This position [of dominance] has allowed BT to increase prices without much risk of losing customers, and other providers have followed BT’s pricing lead. We expect BT’s price cut to mean other providers will follow suit”. Ofcom said that over three-quarters of BT’s landline-only customers have never switched provider, which has left them a prime target for price rises. The regulator said that all major landline providers have increased their line rental charges by between 23% and 47% in recent years, while their own costs for providing the service have fallen about 27%. Ofcom said it is also looking at measures to help people shop around for better deals with more confidence.

(a) With reference to Extract A, explain the difference between a positive statement and a normative statement. (5 points)

(b) With reference to Extract B, examine the likely benefits to consumers of the integration between BT and EE. (8 points)

(c) With reference to Extract C, assess possible reasons why many ‘landline-only’ customers do not switch to a cheaper telephone provider. (10 points)

(d) Discuss one likely reason for the rise in BT’s profit (Figure 2, Extracts B and C). Use a cost and revenue diagram to support your answer. (12 points)

(e) Discuss methods of government intervention to protect consumers within the utilities markets, such as energy and telecommunications. (15 points)

Question 3: Edexcel A-Level Economics 9ECO June 2018 Paper 1

Extract A

Competition and Markets Authority (CMA) report into the UK energy market

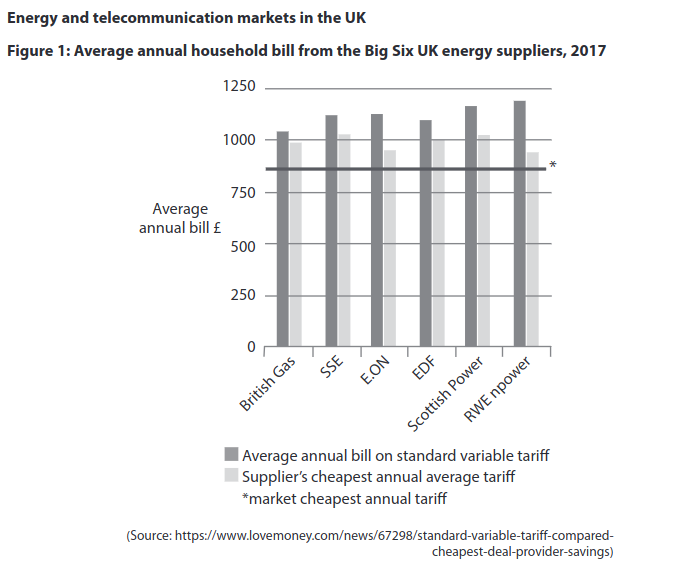

An investigation into the UK energy market by the CMA concluded that customers have been paying £1.4 billion a year more than they would in a fully competitive market. It found that 70% of domestic customers of the six largest energy firms were on an expensive standard rate. These customers could each save over £300 a year by switching to a cheaper deal but appear reluctant to do so.

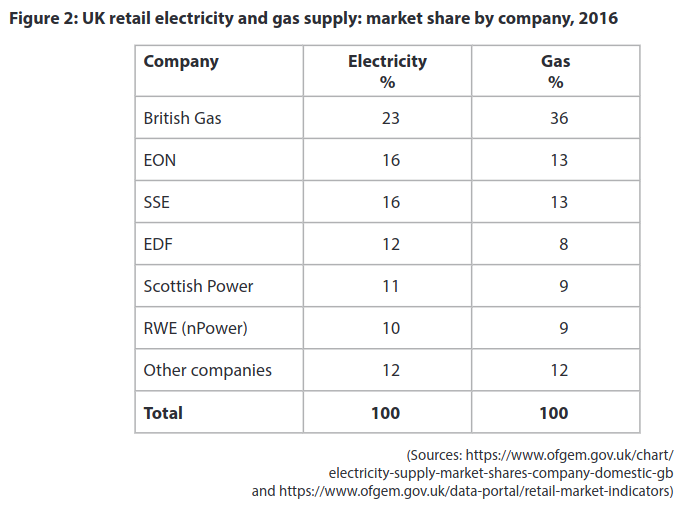

However, the CMA investigation found no evidence of anti-competitive practices by firms. There has even been an increase in new entrant energy suppliers over recent years and their combined market share has reached 12% in both gas and electricity supply. To protect consumers, the CMA has introduced various measures to open up and increase competition in the UK energy market. These include:

- the creation of a database designed to help consumers switch energy suppliers – rivalsuppliers can directly contact these customers

- the conversion of all homes to smart energy meters making it easier for customers to measure energy consumption and switch supplier

- new rules to protect the four million vulnerable customers using prepaid meters – this includes a temporary price cap until smart meters have been installed.

Extract B

Proposals to regulate profits in the UK energy market

Currently energy retail companies make an average profit of 7% of total revenue. The Chairman of the Competition and Markets Authority (CMA) suggested that these profits are as much as five times higher than they should be, given the companies’ limited role in marketing, metering and billing customers. He recommended a profit cap of 1.25% of total revenue.

However, Scottish Power criticised proposals for regulating profits saying that it would reduce investment in the energy industry and undermine long-term energy provision. The firm claimed that such a low rate of return is below the profit margin made by supermarkets.

All six large energy firms are vertically integrated – producing as well as distributing gas and electricity. This can provide efficiency benefits but also harm competition.

Extract C

Skills shortages in the UK energy sector

The energy sector is facing a skills shortage of engineers and technicians. Some 29% of employers in the gas and electricity industries report unfilled job vacancies compared with an average of 18% across all industries.

A lack of information and advice on career prospects for young people is partly to blame – many graduates have a negative image of the work involved. There is also a lack of students taking science, technology, engineering and maths-based subjects at school and university. Less than one-fifth of the energy sector’s workforce are women.

The energy sector is characterised by an ageing workforce – data from the UK Labour Force Survey reveal that around two-thirds of workers are aged over 50. These cannot easily be replaced as a long time period is required for training and developing workers’ skills in a highly regulated industry.

Urgent action is required by businesses and the government to reduce labour immobility to benefit the energy sector. This action could include policies to increase investment in training programmes, recruit skilled workers from overseas, change the industry image and deal with its ageing workforce.

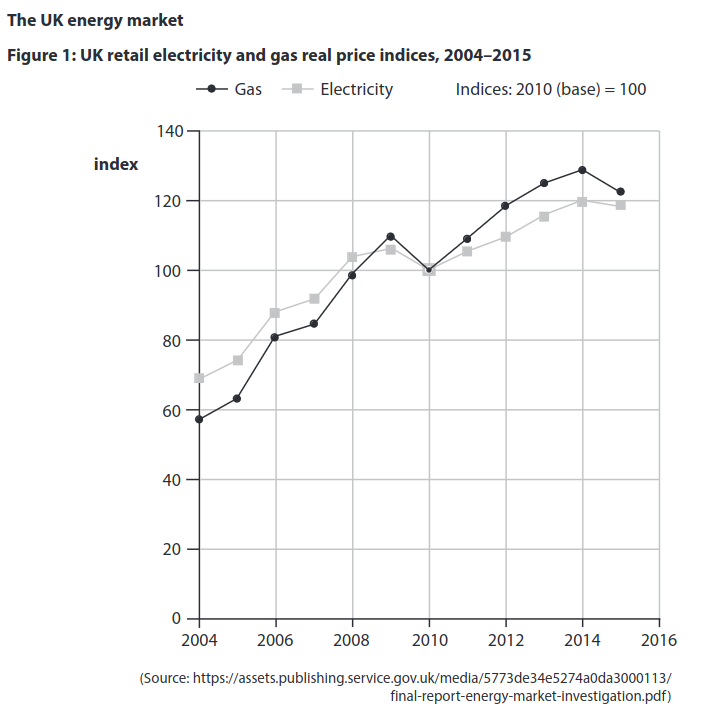

(a) With reference to Figure 1, explain one likely reason for the overall trend in the real price of gas and electricity. (5 points)

(b) With reference to Extract A, discuss the likely effectiveness of ‘measures to open up and increase competition’ in the UK energy market. (12 points)

(c) With reference to Extract B, assess how the regulation of energy suppliers’ profits is likely to affect consumers and suppliers in the energy market. (10 points)

The price elasticity of demand for electricity in the UK is estimated to be –0.35 in the short run and –0.85 in the long run.

(d) With reference to Extract A and your own knowledge, examine two possible reasons for the change in price elasticity of demand for electricity over time. (8 points)

(e) With reference to Extract C and your own knowledge, discuss policies businesses and government might implement to reduce labour immobility to benefit the energy sector. (15 points)

Question 4: Edexcel 9ECO June 2017 Paper 1

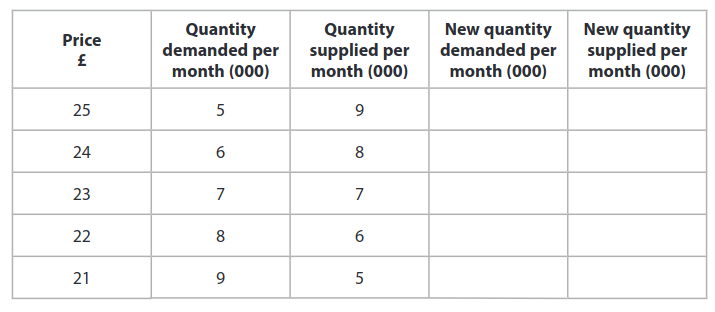

The table shows market data for e-cigarette kits. The original equilibrium price is £23.

As a result of a successful advertising campaign, demand increased by 3 000 e-cigarette kits at all prices. At the same time production costs fell leading to an increase in supply of 1 000 e-cigarette kits at all prices.

(a) Calculate the new equilibrium price and quantity following the successful advertising campaign and the fall in production costs. Use the last two columns for your working. (4 points)

(b) Research conducted in New Zealand in 2014 estimated the cross elasticity of demand for e-cigarettes to be 0.16 in response to changes in the price of tobacco. This implies that a 5% increase in the price of tobacco will cause the percentage change in demand for e-cigarettes to be: (1 point)

A -31.25

B -0.16

C 0.8

D 31.25

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.