We’ve put together a list of every Theme 3 past paper question we could find from the Edexcel A-Level Economics test. The questions in this article are intended to help you study for your Economics A-Level and cover topics like business costs and revenue, monopolies, economies of scale, and the labour market. Theme 3 is a microeconomics topic that covers business economics and builds on the material you learned in Theme 1.

What is the Edexcel A-Level Economics test?

The Edexcel A-Level Economics test is an A-Level that prepares British students for university degrees in economics and related subjects like business studies. The two-year qualification is taken in the final two years of secondary school and covers subjects like supply and demand, monetary policy, and business economics.

Pearson Edexcel offers the Edexcel A-Level Economics test but the subject is also offered by AQA and other exam boards. Edexcel is a privately-owned British education and exams body founded in 1996, which was acquired by Pearson plc. in 2005.

Where did we get these Edexcel Economics A-Level Past Paper Theme 3 Questions?

We went through all of the available past papers published by Edexcel to find these Theme 3 questions. Our goal is to offer an easy list of all the Edexcel A-Level Economics past paper questions on Theme 3 so you don’t have to go through every past paper yourself. You’ll find the questions included in this article as well as an answer key as a downloadable pdf at the end of this page.

Want questions for other topics in A-Level Economics? You can find more A-Level Economics Past Paper Questions here.

What is included in Edexcel Economics Theme 3?

Theme 3 in the Edexcel Economics A-Level specification focused on microeconomics in a business context. You’ll learn about business growth, costs and revenue, market structures, and the labour market as a part of studying Theme 3. The following are some of the core topics in Edexcel A-Level Economics Theme 3.

- Business growth: Business growth is the expansion of a business’s output and market share through either organic growth or mergers and acquisitions. Organic growth is when a business grows by reinvesting profits whereas mergers and acquisitions is a way businesses grow by combining with other businesses.

- Business revenue: Business revenue is all the money coming into a business from the sale of products and services. Revenue differs from profit in that profit is revenue minus a business’ costs.

- Business costs: Business costs are any expenses a business pays in the process of producing products or operating itself. These costs include costs for materials as well as rent on factories and labour costs.

- Economies of scale: Economies of scale are efficiencies that businesses gain as they increase their output. A business may pay less per unit to produce 1,000 tables compared to 100 tables because it can buy wood in bulk for a lower price, for example.

- Monopoly: A monopoly is a market structure in which only one business sells a good or service and consumers have no alternatives. Monopolies generally result in higher prices for consumers.

- Perfect competition: Perfect competition is a market structure in which many businesses sell an identical good or service, affording the consumer maximum choice. Businesses operating in highly competitive markets often have to compete on price, driving down prices for consumers.

- The labour market: The labour market is the economic term for the costs of wages and availability of employees. Wages and quantity in the labour market are determined by supply and demand, much like any other market.

You can check out our Edexcel A-Level Economics Notes here.

Question 1: Edexcel 9ECO November 2021 Paper 1

Patrick Street Productions produces musicals. Its latest production is ‘It’s a Wonderful Life’ and the total cost of this production is $200 000. The ticket price is $40. The theatre has a capacity of 300 seats. The company aims for revenue maximisation. If this is achieved, revenue from ticket sales will cover 30% of total costs. Charitable donations contribute 12.5% towards total cost and a government subsidy ensures the production covers all of its costs.

(a) Calculate the total revenue from ticket sales for ‘It’s a Wonderful Life’, assuming it is shown only five times, all at full capacity. You are advised to show your working. (2 points)

(b) Calculate the value of the government subsidy necessary for this production to cover all of its costs. (2 points)

(c) Which one of the following conditions is necessary for revenue maximisation to occur? (1 point)

A Average revenue equals average cost

B Average revenue equals marginal cost

C Marginal revenue equals average revenue

D Marginal revenue equals zero

Question 2: Edexcel 9ECO November 2020 Paper 1

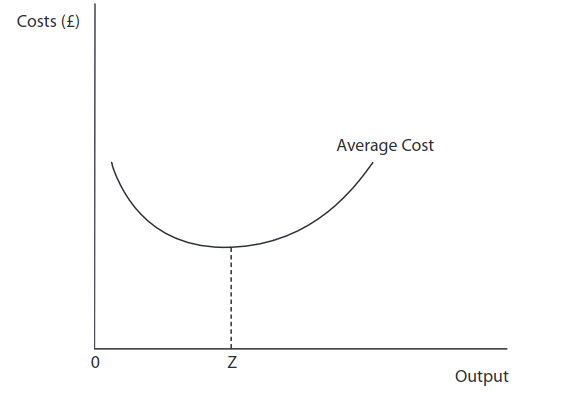

The following illustrates the daily average cost curve for a doughnut producer:

(a) Explain what happens to total cost at output levels greater than Z. (2 points)

(b) At output levels greater than Z, which one of the following correctly identifies what will happen to the cost? (1 point)

Average fixed cost Average variable cost Marginal cost

A Falls Falls Rises

B Falls Rises Rises

C Rises Rises Falls

D Rises Rises Rises

(c) For a luxury doughnut producer the average selling price is £2. The average variable cost is 40% of the selling price and its fixed cost per day is £300. Calculate total costs per day assuming it produces 400 doughnuts per day. (2 points)

Question 3: Edexcel A-Level Economics 9ECO June 2019 Paper 1

According to the Royal Mail, more hair and beauty salons opened on UK high streets last year than any other type of independent business, with a net increase of 10%, representing 626 new salons.

(a) The UK hair and beauty industry is an example of monopolistic competition because: (1 point)

A firms spend nothing on advertising and research

B the industry is dominated by a few large firms

C the products are homogenous

D there are low barriers to entry and exit

(b) Draw a cost and revenue diagram to show the long-run equilibrium of a firm in monopolistic competition. (4 points)

Question 4: Edexcel A-Level Economics 9ECO June 2019 Paper 1

In 2016, the insurance group Esure undertook a demerger with its GoCompare price comparison website.

(a) The most likely reason for this demerger was to: (1 point)

A benefit from external economies of scale

B benefit from internal economies of scale

C focus more on its core business

D increase its market share

Following the demerger, GoCompare announced in 2017 a profit of £17.5 million, up 21.5% on 2016. Total revenue in 2017 was £75.8 million, up 4.1% on 2016.

(b) Calculate, using the information provided, the total costs of GoCompare in 2016. (4 points)

Question 5: Edexcel A-Level Economics 9ECO June 2018 Paper 1

The number of individual weekly ticket sales from UK National Lottery games operated by Camelot was 73 million in the financial year 2015–2016.

The sale price of each lottery ticket was £2. This figure included 24 pence of tax revenue on each ticket sold.

(a) Calculate the weekly revenue received by Camelot after paying the tax to the government. You are advised to show your working. (2 points)

Research conducted for HMRC estimated the cross elasticity of demand for using gaming machines to be 1.28 in response to changes in the price of national lottery tickets.

In October 2013 Camelot increased the price of a national lottery ticket from £1 to £2.

(b) Explain the likely impact of the price increase of national lottery tickets on the demand for using gaming machines. (2 points)

In 2016 a coastal flood defence scheme was completed at Broomhill Sands in Kent, protecting people, homes and businesses. A £30 million grant from the National Lottery paid for the scheme.

(c) The most likely reason for this grant is to ensure the: (1 points)

A exclusivity of Broomhill Sands

B provision of a private good

C provision of a public good

D rivalry of Broomhill Sands

Question 6: Edexcel A-Level Economics 9ECO June 2018 Paper 1

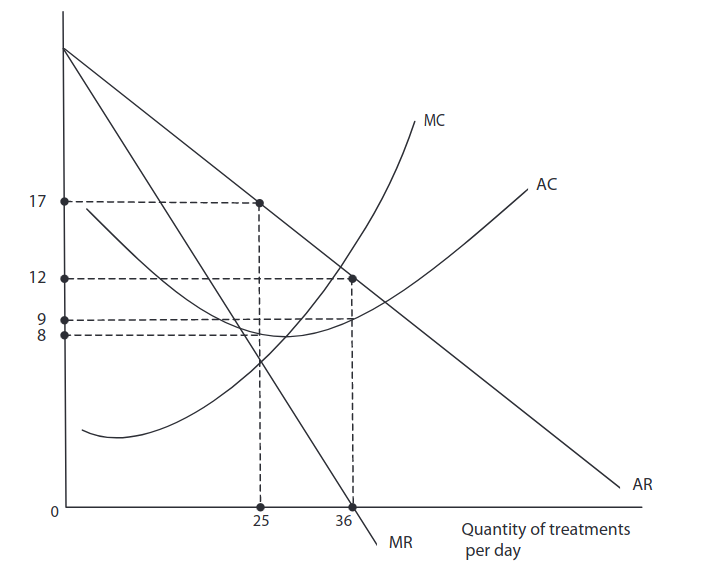

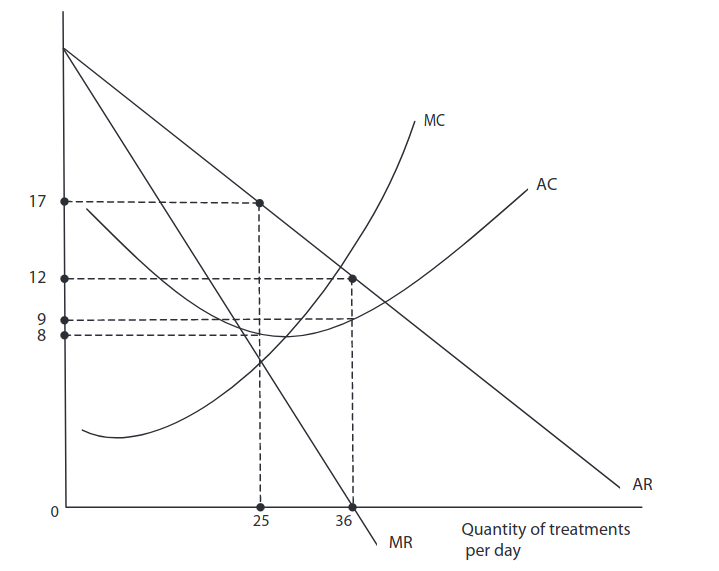

Emily owns and operates a nail ink salon. The diagram shows the cost and revenue curves for treatments at her nail ink salon. Initially, Emily sets her price to maximise profits.

Costs, Revenue

per treatment (£)

(a) Calculate the change in total supernormal profit if Emily changes her objective from profit maximisation to revenue maximisation. You are advised to show your working. (4 points)

(b) Emily now decides to change her objective from revenue maximisation to sales maximisation. This change will lead to: (1 point)

A a decrease in the number of customers

B a decrease in the price of treatments

C an increase in productive efficiency

D an increase in the level of profit

Question 7: Edexcel A-Level Economics 9ECO June 2017

Between 2010 and 2015 the average price of tea in the UK increased from £7.20 per kilo to £8.48 per kilo. Over the same period the quantity of tea purchased fell from 97 million kilos to 76 million kilos.

(a) Assume that the change in the quantity of tea purchased was only caused by the change in the price of tea. Calculate the price elasticity of demand for tea in response to the rise in its price. You are advised to show your working. (2 point)

(b) Calculate the change in total sales revenue for UK tea retailers between 2010 and 2015. You are advised to show your working. (2 points)

(c) Estimates for the demand for black tea in the UK suggest that it is an inferior good. This implies it has a negative: (1 point)

A cross elasticity of demand

B income elasticity of demand

C price elasticity of demand

D price elasticity of supply

Question 8: Edexcel 9ECO June 2017 Paper 1

In 2015 JCB, the construction equipment manufacturer, experienced a 6% fall in revenue. This resulted from a reduction in sales of construction equipment to emerging markets.

(a) Draw a cost and revenue diagram to show the likely impact of a reduction in sales of construction equipment on JCB’s profits. (4 points)

In India JCB has a strong brand image and a 50% share of the market for construction equipment. This means the construction equipment market in India is likely to have a low level of: (1 point)

A concentration

B contestability

C private ownership

D specialisation

Question 9: Edexcel A-Level Economics 9ECO June 2017 Paper 1

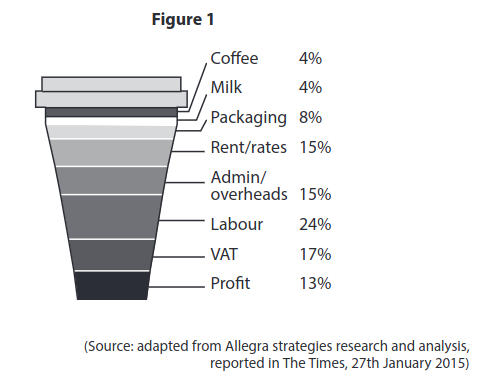

Figure 1 shows the distribution of the revenue received from the sale of a Starbucks cappuccino drink priced at £2.27 in 2015.

(a) Which one of the following is a fixed cost to Starbucks? (1 point)

A Coffee

B Milk

C Packaging

D Rent

(b) Explain the difference between fixed costs and variable costs. (2 points)

(c) With reference to Figure 1, calculate the profit (in pence) for a cappuccino drink.

You are advised to show your working. (2 points)

Question 10: Edexcel A-Level Economics 9ECO November 2021 Paper 3

Extract C

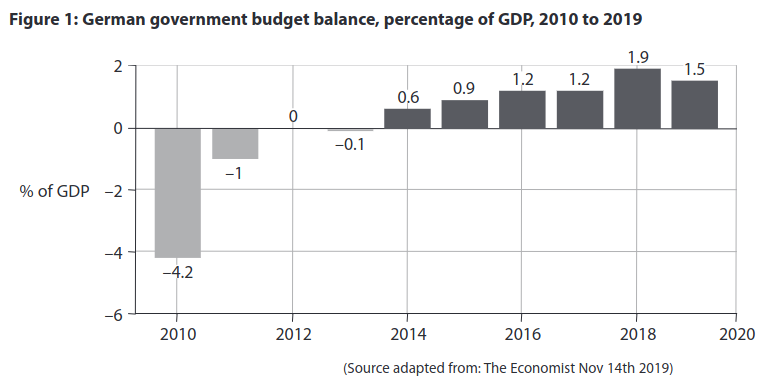

Why Germany keeps to budget rules despite a slowdown in growth

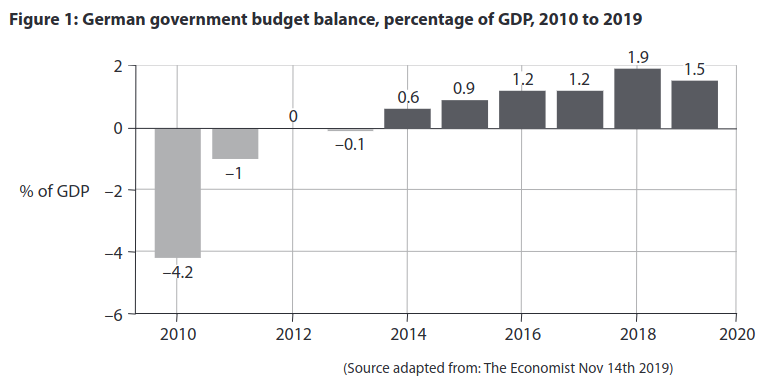

Germany’s economic boom is over, as it has entered recession. During the last ten years of economic growth well over 4 million jobs were created. The fear of recession has revived a debate in Germany: should the government spend more to stimulate growth? It is written into the German constitution that the fiscal deficit cannot be greater than 0.35% of GDP, once the effects of the economic cycle have been removed. Germany’s budget has been in surplus since 2014 and the government is always reluctant to increase spending which would create a deficit. In 2018, aided by booming employment and low interest costs on existing debt, the budget ran to a surplus 1.9% of GDP.

Germany’s main trading partners have long been angered by German fiscal policy. The French President criticised Germany’s budget and current account surpluses that “always occur at the expense of others”.

Large parts of Germany’s infrastructure need significant investment. As the economy has slowed, a decision to run a balanced-budget policy has become harder to defend. In wealthy regions of Germany, crumbling schools have been closed for fear of collapse, and information and mobile technology on a wide scale needs to be modernised. The World Economic Forum reported that accessibility of fibre optic broadband also “remains the privilege of the few”. However, private sector firms, such as major motor manufacturers, are still willing to invest in new technology and the profitability of some of these firms, in the long run, benefits as a result.

The state development bank puts Germany’s investment shortfall at €138 billion (£120 billion). Arguments for a much more expansionary fiscal policy have failed to influence government policy. Big government programmes, such as a recent package to reduce Germany’s carbon emissions, are only implemented when they satisfy fiscal rules.

Extract D

Germany drops to number 7 in the Global Competitiveness Index

Despite being the largest economy in the European Union, Germany’s competitiveness is declining, according to the World Economic Forum (WEF). Germany dropped four places in the WEF’s Global Competitiveness Index, coming in as the seventh-most competitive economy. Out of the 103 indicators used in the report, Germany received lower scores in 53 areas in 2019.

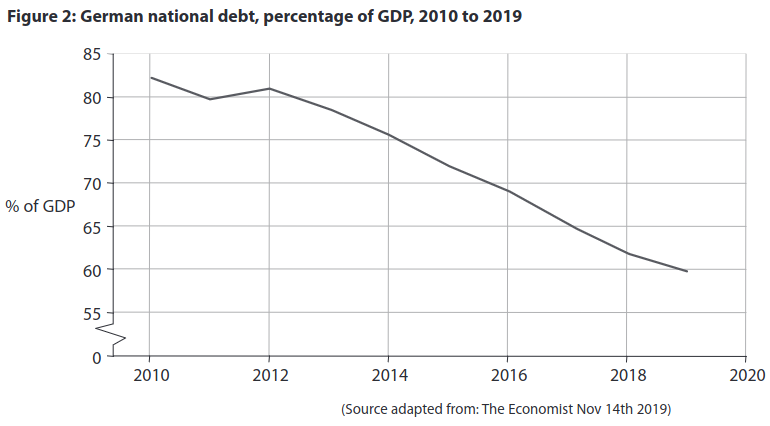

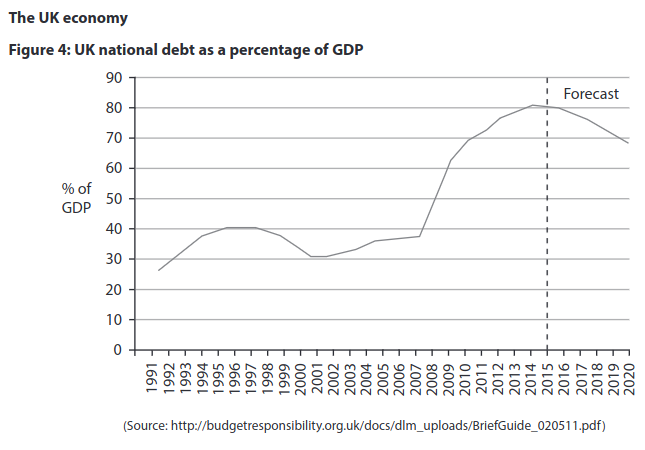

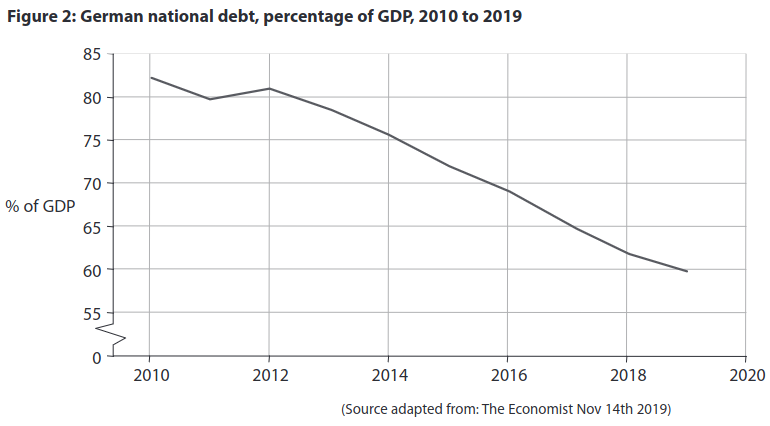

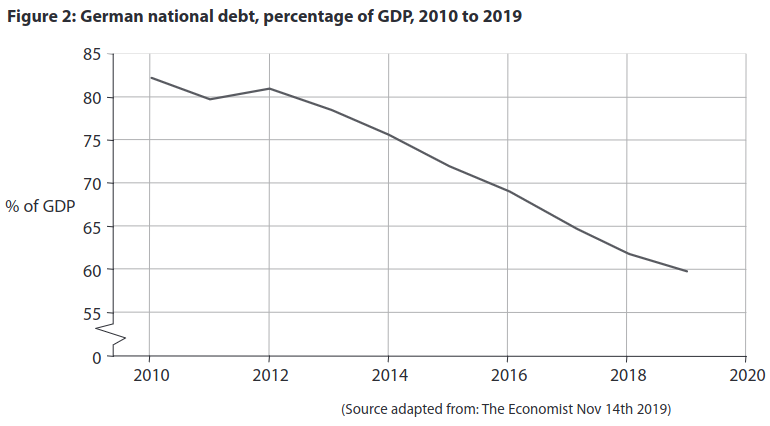

(a) Explain one reason why a country such as Germany wants to avoid an increase in the national debt relative to GDP (Figure 2). (5 points)

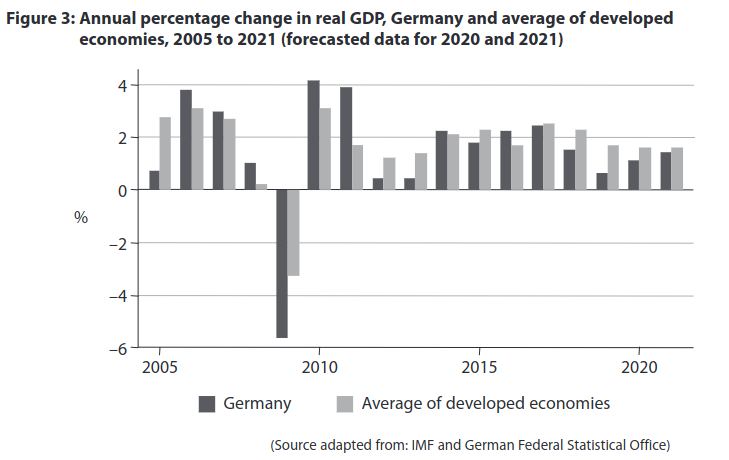

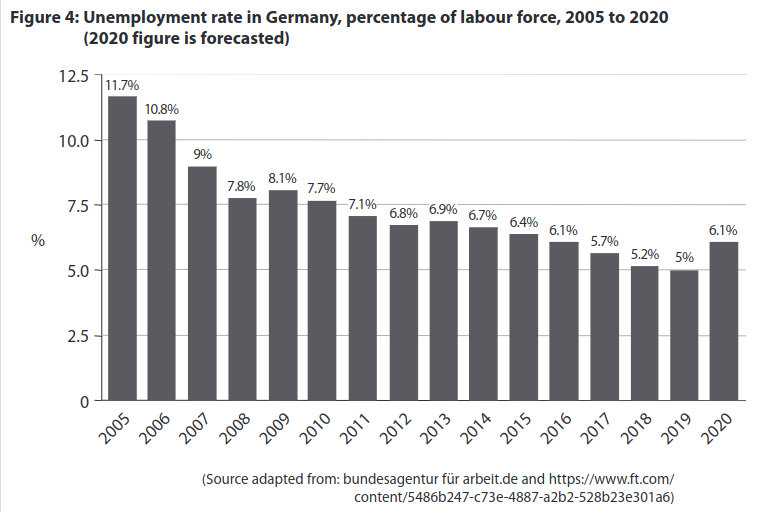

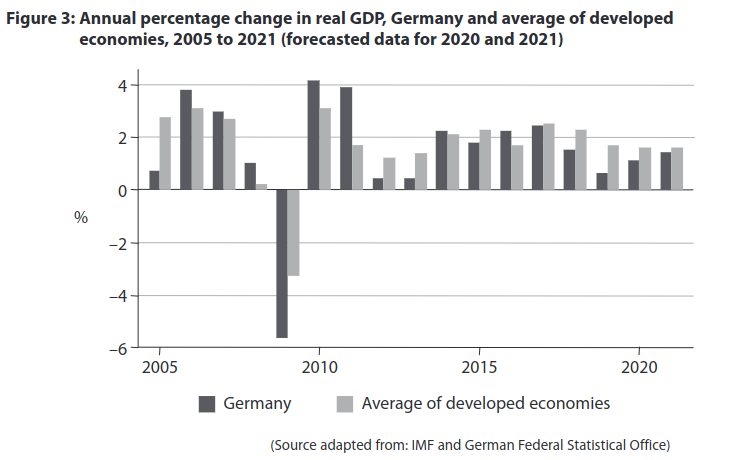

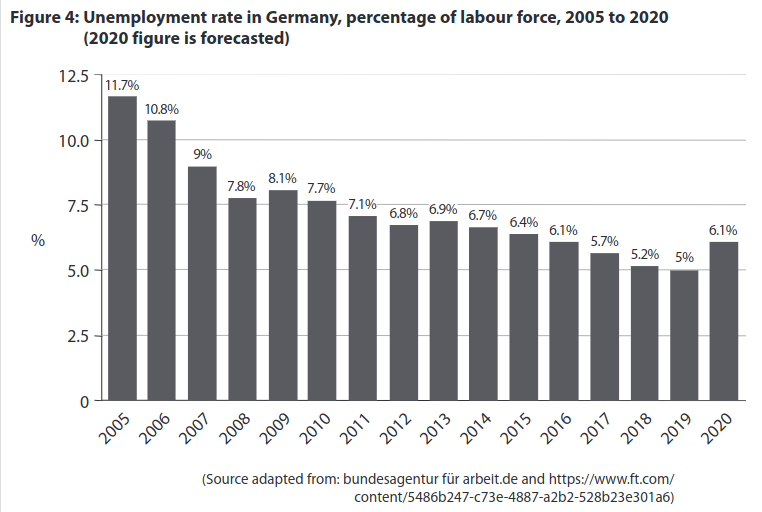

(b) Examine two likely effects of the forecast change in the rate of unemployment between 2019 to 2020, on firms in Germany. Refer to Figure 4 in your answer. (8 points)

(c) Discuss the likely impact of investment in new technology on the profitability of firms in Germany, as described in Extract C line 20. Use a cost and revenue diagram to support your answer. (12 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic factors which are likely to determine the rate of economic growth in Germany relative to other developed economies. (25 points)

OR

(e) Evaluate the microeconomic and macroeconomic impacts of ‘a much more expansionary fiscal policy’ (Extract C line 23) on the German economy. (25 points)

Question 11: Edexcel A-Level Economics 9ECO November 2020

Extract D

The end of the High Street?

Homebase, the UK’s second‑largest do‑it‑yourself (DIY) retailer, made £20–40 million a year profit up to 2016. The Australian conglomerate Wesfarmers bought Homebase for £340 million in 2016, and began to rebrand 24 stores under its own name. It scaled back on curtain, cushion and other homeware sales in favour of power tools and building materials.

In 2018 Wesfarmers sold the DIY chain for £1, in the face of “extremely challenging” market conditions and excess store space. The chain was bought by restructuring specialist Hilco, which had also rescued the music chain HMV in 2013, and the stores have gone back to using the Homebase name. Over 70% of Homebase stores are currently losing money and the new owner wants to exit loss‑making stores and agree to rent reductions, as sales fell 10% in 2018. Homebase has gone back to popular products and brands dropped by its previous owner Wesfarmers.

The closures will add to the mounting job losses on Britain’s high streets. About 25 000 jobs have gone in the first seven months of 2018, according to analysis by an economics thinktank. A further 8 300 jobs are under threat at suppliers, with the multiplier effect meaning that GDP is £1.5 billion less than projected.

Several Marks & Spencer clothing stores closed their doors for the last time as the high‑street chain pushes ahead with a transformation plan. It plans to close 100 stores by 2022. Toys R Us, Poundworld and Maplin have shut down completely, while New Look, Mothercare and Carpetright have plans to close hundreds of stores as losses rise sharply.

Increasing rents and higher business rates have occurred at the same time as falling consumer confidence. Meanwhile, House of Fraser employees and pensioners are nervously awaiting more details about their future. The £90 million rescue deal by Sports Direct, the sportswear chain controlled by Mike Ashley, will protect 16 000 jobs for the time being.

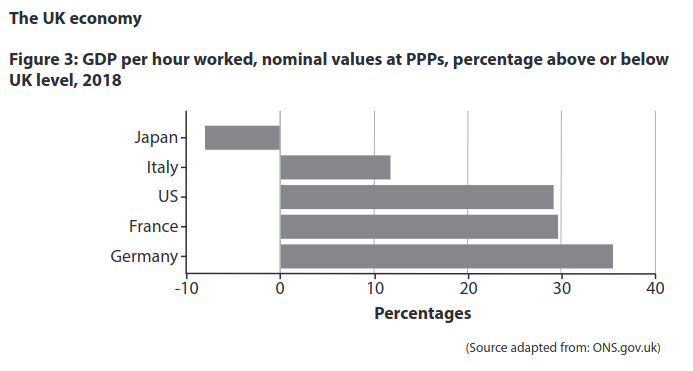

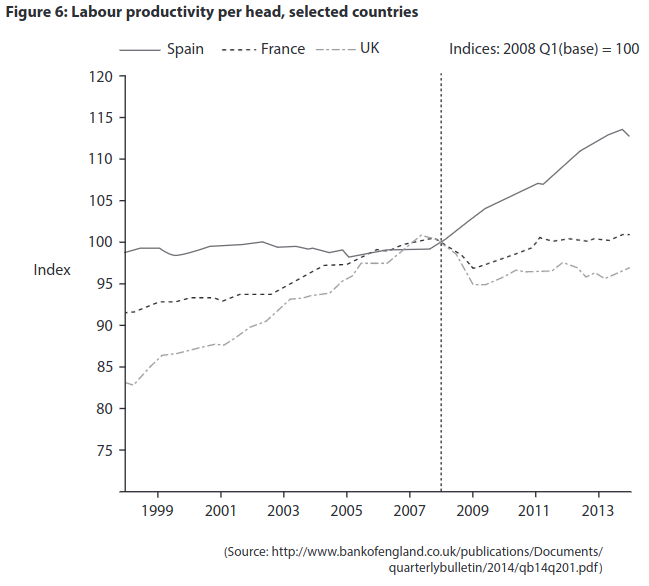

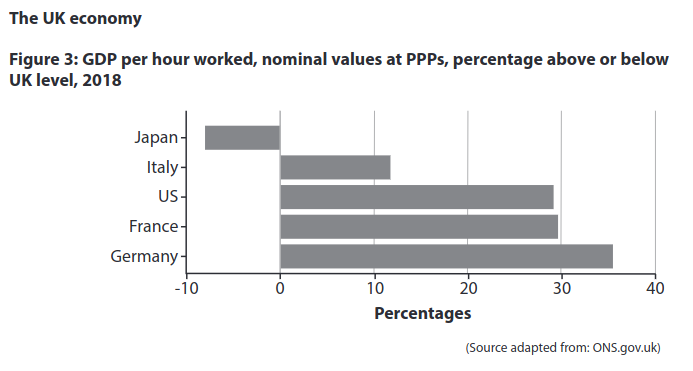

(a) With specific reference to Figure 3, explain why productivity is measured by ‘GDP per hour worked, nominal values at PPPs’. (5 points)

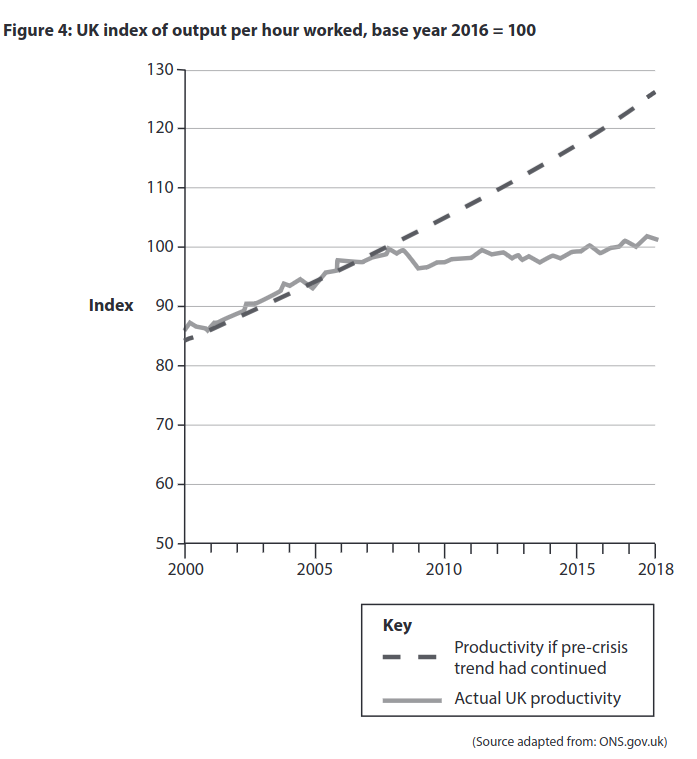

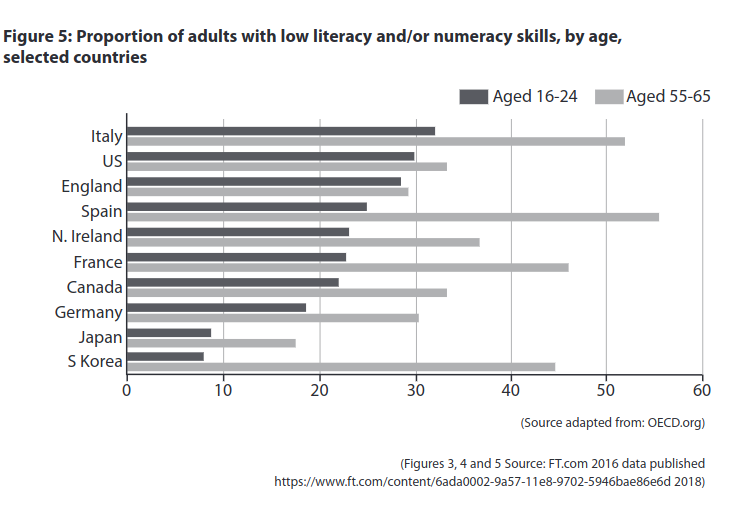

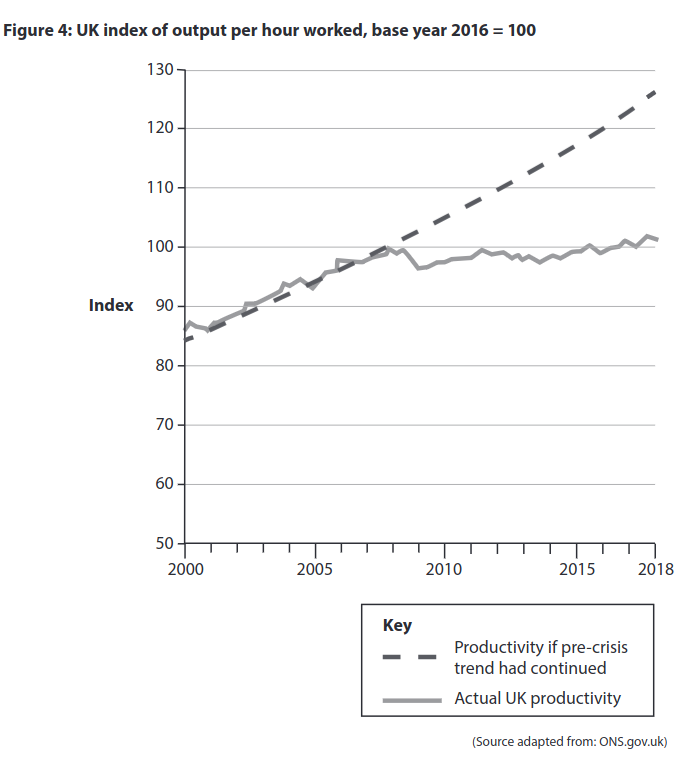

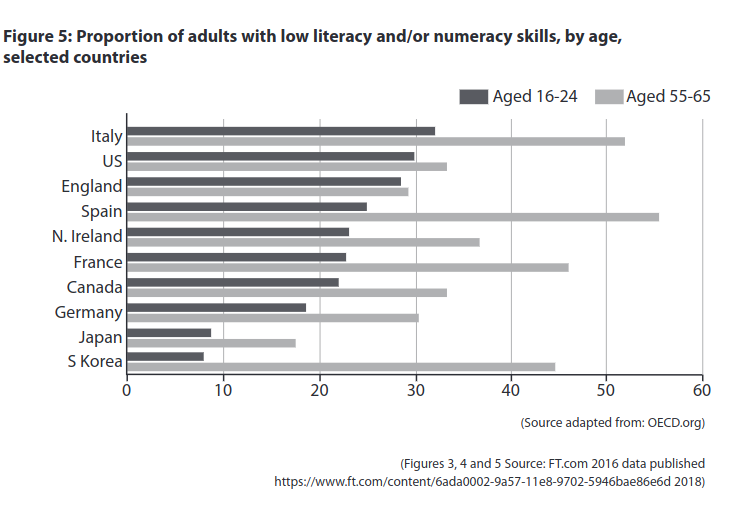

(b) Apart from literacy and numeracy skills in young workers, examine one reason for the trend in productivity in the UK, over the period shown in Figure 4. (8 points)

(c) Discuss factors that are causing many high street retailers in the UK to close some branches or shut down completely. Use a cost and revenue diagram to support your answer (12 points).

EITHER

(d) Evaluate possible microeconomic and macroeconomic policies which could be used to improve UK competitiveness. (25 poitns)

OR

(e) Evaluate the microeconomic and macroeconomic effects of a decline in the literacy and numeracy skills of a country’s young workers. (25 points)

Question 12: Edexcel A-Level Economics 9ECO June 2017 Paper 3

Extract C

The National Living Wage (NLW)

The Government has announced that from 2016 it will introduce a Living Wage Premium that will apply on top of the National Minimum Wage (NMW) for employees aged 25 and over to deliver a National Living Wage (NLW) for those people. The main NMW will continue to be set for all employees aged 21 and over, so that those aged 21 to 24 will continue to be subject only to that rate.

The effective minimum wage for the 25+ age group will therefore be over 13% higher in 2020 than would otherwise have been the case, and result in a 0.3% increase in wage costs overall. Further impacts on real GDP are estimated to be higher productivity (+0.3%) but lower average hours worked (-0.2%) and higher unemployment. Overall real GDP is forecast to fall by 0.1% as a result of the NLW. However these forecasts depend on estimates of the likely elasticity of demand for labour.

Academic evidence suggests that changes to the NMW since 1999 have led to only limited effects on demand for labour in the UK. The types of work that will be affected are relatively labour intensive, which may limit the scope for firms to substitute toward using capital. Firms may also be expected to shift demand in favour of the under-25s given that they will not be subject to the NLW, which all else being equal would lead to a smaller reduction in overall labour demand. Some of the reduction in employees could also be partially offset by a rise in self-employment. But increasing the NLW to a higher proportion of median earnings may lead to bigger effects than have been experienced in the past.

Extract D

The productivity puzzle in the UK

Since the onset of the 2007–2008 financial crisis, labour productivity growth in the UK has been exceptionally weak. Despite some modest improvements in 2013, whole-economy output per hour remains around 16% below the level implied by its pre-crisis trend. Even taking into account possible measurement issues and changes in the size of the service sector, this shortfall is large and is often referred to as the ‘productivity puzzle’.

Measures of productivity can be used to inform estimates of an economy’s ability to grow without generating excessive inflationary pressure, which makes understanding recent movements important for the conduct of monetary policy. During the initial phases of the recession, companies appear to have acted flexibly by holding on to labour and lowering levels of capacity utilisation in response to weak demand conditions. But the protracted weakness in productivity and the strength in employment growth over the past two years suggest that other factors are likely to be having a more persistent impact on the level of productivity. These factors are reduced investment in both physical and intangible capital, such as innovation and training, and failings in the labour market such as immobility of labour and under-employment of skilled workers. Some economists explain this by using the concept of an output gap.

(a) With reference to Extract D (line 18), explain the meaning of the term ‘output gap’. Use an aggregate demand and aggregate supply diagram in your answer. (5 points)

(b) With reference to Figures 4 and 5 and your own knowledge, examine the relationship between the national debt as a proportion of GDP and the fiscal deficit. (8 points)

(c) Discuss the likely impact of the National Living Wage on the profitability of firms. Use a cost and revenue diagram in your answer. (12 points)

EITHER

(d) With reference to the information provided and your own knowledge, evaluate the likely microeconomic and macroeconomic influences on the UK’s international competitiveness. (25 points)

OR

(e) With reference to the information provided and your own knowledge, evaluate the microeconomic and macroeconomic effects of a government policy of cutting public expenditure rather than raising taxes as a means of reducing a fiscal deficit. (25 points)

Question 13: Edexcel A-Level Economics 9EC0 November 2021 Paper 1

Extract A

Marginal productivity of cabin crew

Cabin crew are responsible for loading passengers and providing in-flight meals. United Airlines is planning to reduce the number of its cabin crew members onboard international flights. The airline currently operates its planes with one more cabin crew member than its competitors. The marginal productivity of this additional crew member may be low. By reducing the number of its cabin crew members United Airlines will be able to operate more efficiently and compete more effectively.

(a) Explain the likely impact of diminishing marginal productivity of labour on cabin crew staffing levels. Refer to Extract A in your answer. (5 points)

Question 14: Edexcel A-Level Economics 9EC0 November 2021 Paper 1

The national living wage, the minimum wage for 25-year-olds and over, is expected to rise to more than £10.50 an hour in 2024 compared with £8.72 in 2020. The wage does not apply to the UK’s self-employed and ‘gig economy’ workers.

Some economists said the increase was ambitious. Business groups warned that employers in sectors such as social care could be hit hard. In large parts of the north of England the living wage has already reached two-thirds of local median earnings, said Professor Shackleton.

Evaluate the disadvantages of a significant increase in the national living wage on a specific labour market, such as that for social care workers. (25 points)

Question 15: Edexcel A-Level Economics 9EC0 November 2020 Paper 1

Extract A

The case for nationalisation

Privatisation has not made the rail industry cheaper to operate, despite the promise from one government source that it would see private companies bringing: “more competition, greater efficiency and a wider choice of services”.

One reason, suggest the critics, is fragmentation. Instead of pushing British Rail into the private sector as a single supplier the government chose to break it into three components of track, train operators and rolling stock i.e. the trains and carriages. This has encouraged each part of the rail industry to prioritise its own profits rather than collaborating to improve the system.

Privatisation, meanwhile, never really worked. The rail network of 2 500 stations and 32 000 km of tracks was renationalised in 2001. This has encouraged the government’s transport secretary, a supporter of private sector involvement, to argue that the state Network Rail monopoly should be removed so that companies can bid to build new rail lines to upgrade the railway.

The privately-owned train operators are now the subject of fierce criticism, due to overcrowding and cancelled services. Private companies are supposed to compete to win a bid to be the train operator for a region for a short number of years. However in recent years the number of private companies bidding or renewing their contract as rail operators has fallen. In May 2018 the government rescued the East Coast line by renationalising it. The line had been run by the private rail operator Virgin Rail, which was suffering lower passenger numbers and revenue than forecast.

Some argue that there is a simple solution: reunite track and train in the only feasible manner, nationalisation.

Extract B

Southern Rail boss paid £495 000

The Chief Executive of Southern Rail, the private-sector train operator that has become associated with delays, losses, cancellations and strikes, was paid £495 000 last year. This increased calls for nationalisation and a maximum wage for executives at companies with government contracts. In contrast the average base pay for a train driver in the UK is £47 705, although they can earn up to £63 000.

(c) Assess whether complete nationalisation of the rail industry might protect employees. (10 points)

Question 16: Edexcel A-Level Economics 9EC0 June 2019 Paper 1

(c) Explain one advantage to a firm of using division of labour when organising its production process. (2 point)

Question 17: Edexcel A-Level Economics 9EC0 June 2018 Paper 1

Extract C

Skills shortages in the UK energy sector

The energy sector is facing a skills shortage of engineers and technicians. Some 29% of employers in the gas and electricity industries report unfilled job vacancies compared with an average of 18% across all industries.

A lack of information and advice on career prospects for young people is partly to blame – many graduates have a negative image of the work involved. There is also a lack of students taking science, technology, engineering and maths-based subjects at school and university. Less than one-fifth of the energy sector’s workforce are women.

The energy sector is characterised by an ageing workforce – data from the UK Labour Force Survey reveal that around two-thirds of workers are aged over 50. These cannot easily be replaced as a long time period is required for training and developing workers’ skills in a highly regulated industry.

Urgent action is required by businesses and the government to reduce labour immobility to benefit the energy sector. This action could include policies to increase investment in training programmes, recruit skilled workers from overseas, change the industry image and deal with its ageing workforce.

(e) With reference to Extract C and your own knowledge, discuss policies businesses and government might implement to reduce labour immobility to benefit the energy sector. (15 points)

Question 18: Edexcel A-Level Economics 9EC0 November 2020 Paper 2

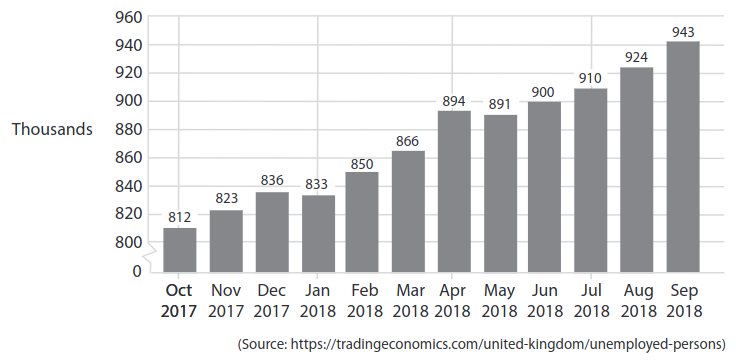

Number of unemployed persons, UK, as measured by the claimant count, thousands

(a) Calculate the percentage change in the number of UK unemployed persons between April and July 2018. You are advised to show your working. (2 points)

(b) Explain one likely reason for the increase in the number of people unemployed in the UK over the time period shown. (2 points)

(c) Which one of the following types of unemployment is most likely to be caused by a technological change in an industry? (1 point)

A Cyclical

B Real wage

C Seasonal

D Structural

Question 19: Edexcel A-Level Economics 9EC0 June 2017 Paper 2

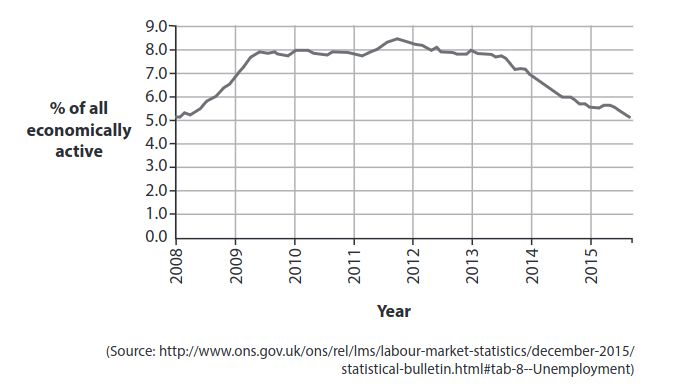

The chart below shows the UK unemployment rate, seasonally adjusted, from 2008 to 2015

(a) Which one of the following types of unemployment best explains the change in the data between 2008 and 2010? (1 point)

A Cyclical

B Frictional

C Seasonal

D Voluntary

(b) Explain the likely effects on the circular flow of income of the change in unemployment between 2013 and 2015. (4 points)

Question 20: 9EC0 November 2021 Paper 3

What is the true human cost of your £5 hand car wash (HCW)?

The UK’s hand car washes (HCWs) are extremely price competitive, but they have also been linked to modern slavery. Are they ever fair for workers? There is little agreement about how many HCWs there are in the UK. Estimates range from 10 000 to 20 000. This lack of accurate information about the industry makes government regulation very difficult. Automated car washes, with their fierce rotating bristles, used to be the first option for drivers in a hurry. Now there is more choice.

While the economy slows and incomes fail to keep up with inflation, demand for HCWs has grown. Many people see paying £5 for a car washed by someone else, rather than cleaning it at home, as a small expense which yields a high utility. But what is the true cost of a £5 car wash – and what should we be paying?

The growth of HCWs is partly the result of changes in the structure of industry in the UK. Many petrol stations have closed as drivers fill up at supermarkets. Garages and their forecourts have closed as cars become more reliable and locked into service agreements. The available sites for HCWs have therefore increased significantly and rents have fallen. HCW entrepreneurs have identified available land and have benefitted from changes in the labour market, partly as a result of EU migration. UK drivers are now able to obtain cheap and effective hand car washing. For many migrants, car washes are a first job.

“They accept car washing for a short period while they improve their language skills and move into other industries,” says Ian Clark, a professor of work and employment at Nottingham Business School. “But there are also car-wash workers without networks who are in a dead end, working there for long periods.”

Many drivers are only interested in getting the cheapest wash. If the price is very low, it probably means that workers are receiving less than the minimum wage and working in poor conditions. Crude calculations illustrate the problem. A £5 HCW employing five workers for 10 hours a day would need to wash 79 cars a day to just cover the wage costs. This assumes the workers are paid the minimum wage. This is one car every seven and a half minutes. Even if the profit can be higher on valet services, the price of which can be as little as £12 for a full inside-and-out clean, it’s hard to see how a car wash price as low as £5 pays a living wage. This ignores all other costs which HCWs incur such as business rates and rent.

Evidence from car-wash workers is limited but Clark and others have been able to build a picture of some of the tougher conditions on drenched forecourts. “Like nail bars and small garment manufacturers, car washes are what we call ‘hard-to-reach places,’” Clark explains. As part of the research, Clark and his team spoke to workers from 45 HCWs in the Midlands.

Clark and his team met and observed workers who lacked waterproof boots or trousers, or hi-vis jackets and gloves. “They’re spraying around hydrochloric acid solution for alloy wheels, breathing in the vapour and fumes,” Clark says. Some workers were paid a little over half the minimum wage.

Extract B

Government intervention in the HCW industry

There are three main areas of government intervention that might impact on labour intensive firms such as HCWs:

First, there is the planning issue which focuses on the impact on the environment, for example, the disposal and recycling of wastewater and chemicals. There could be planning regulations to prevent the use of tarmac rather than concrete on forecourts. Tarmac allows wastewater and chemicals to seep into the sub soil. It could also be a requirement to have a sludge trap to stop the waste entering waterways.

Second, there is the health and safety issue for workers. Prolonged exposure to chemicals and lack of protective clothing puts the health of workers at risk. Performance targets could involve minimum levels of protective clothing and rest breaks for the workers. Third, there is the issue of tax. The informal nature of the business type makes tax evasion easier.

Not all UK HCWs violate regulations. There are legitimate, regulated HCW firms as well as examples of good practice by independent outlets. One national supermarket, Tesco, has banned all independent hand car washes from its car parks. It is now in a partnership agreement with national car wash operator Waves. It uses a WashMark certificate of quality and compliance which was introduced by the industry to improve working conditions. Other major supermarkets are considering similar changes. One adviser believes £9 is a reasonable minimum price for a basic wash. Some pressure groups have developed a mobile phone app where evidence of unreasonable conditions can be reported by drivers.

Involving drivers in the issue, and making them demand fairer car washes, creates an incentive for good businesses to improve practices and come forward to get a WashMark Certificate.

(c) Discuss the likely effects of changes in the level of migration on firms such as HCWs in the UK. Use a labour market diagram and the information provided to support your answer. (12 points)

Question 21: Edexcel A-Level Economics 9EC0 November 2021 Paper 3

Extract C

Why Germany keeps to budget rules despite a slowdown in growth

Germany’s economic boom is over, as it has entered recession. During the last ten years of economic growth well over 4 million jobs were created. The fear of recession has revived a debate in Germany: should the government spend more to stimulate growth? It is written into the German constitution that the fiscal deficit cannot be greater than 0.35% of GDP, once the effects of the economic cycle have been removed. Germany’s budget has been in surplus since 2014 and the government is always reluctant to increase spending which would create a deficit. In 2018, aided by booming employment and low interest costs on existing debt, the budget ran to a surplus 1.9% of GDP.

Germany’s main trading partners have long been angered by German fiscal policy. The French President criticised Germany’s budget and current account surpluses that “always occur at the expense of others”.

Large parts of Germany’s infrastructure need significant investment. As the economy has slowed, a decision to run a balanced-budget policy has become harder to defend. In wealthy regions of Germany, crumbling schools have been closed for fear of collapse, and information and mobile technology on a wide scale needs to be modernised. The World Economic Forum reported that accessibility of fibre optic broadband also “remains the privilege of the few”. However, private sector firms, such as major motor manufacturers, are still willing to invest in new technology and the profitability of some of these firms, in the long run, benefits as a result.

The state development bank puts Germany’s investment shortfall at €138 billion (£120 billion). Arguments for a much more expansionary fiscal policy have failed to influence government policy. Big government programmes, such as a recent package to reduce Germany’s carbon emissions, are only implemented when they satisfy fiscal rules.

(b) Examine two likely effects of the forecast change in the rate of unemployment between 2019 to 2020, on firms in Germany. Refer to Figure 4 in your answer. (8 points)

Question 22: Edexcel A-Level Economics 9EC0 November 2020 Paper 3

Extract D

The end of the High Street?

Homebase, the UK’s second‑largest do‑it‑yourself (DIY) retailer, made £20–40 million a year profit up to 2016. The Australian conglomerate Wesfarmers bought Homebase for £340 million in 2016, and began to rebrand 24 stores under its own name. It scaled back on curtain, cushion and other homeware sales in favour of power tools and building materials.

In 2018 Wesfarmers sold the DIY chain for £1, in the face of “extremely challenging” market conditions and excess store space. The chain was bought by restructuring specialist Hilco, which had also rescued the music chain HMV in 2013, and the stores have gone back to using the Homebase name. Over 70% of Homebase stores are currently losing money and the new owner wants to exit loss‑making stores and agree to rent reductions, as sales fell 10% in 2018. Homebase has gone back to popular products and brands dropped by its previous owner Wesfarmers.

The closures will add to the mounting job losses on Britain’s high streets. About 25 000 jobs have gone in the first seven months of 2018, according to analysis by an economics thinktank. A further 8 300 jobs are under threat at suppliers, with the multiplier effect meaning that GDP is £1.5 billion less than projected.

Several Marks & Spencer clothing stores closed their doors for the last time as the high‑street chain pushes ahead with a transformation plan. It plans to close 100 stores by 2022. Toys R Us, Poundworld and Maplin have shut down completely, while New Look, Mothercare and Carpetright have plans to close hundreds of stores as losses rise sharply.

Increasing rents and higher business rates have occurred at the same time as falling consumer confidence. Meanwhile, House of Fraser employees and pensioners are nervously awaiting more details about their future. The £90 million rescue deal by Sports Direct, the sportswear chain controlled by Mike Ashley, will protect 16 000 jobs for the time being.

(a) With specific reference to Figure 3, explain why productivity is measured by ‘GDP per hour worked, nominal values at PPPs’. (5 points)

(b) Apart from literacy and numeracy skills in young workers, examine one reason for the trend in productivity in the UK, over the period shown in Figure 4. (8 points)

(e) Evaluate the microeconomic and macroeconomic effects of a decline in the literacy and numeracy skills of a country’s young workers. (25 points)

Question 23: Edexcel A-Level Economics 9EC0 November 2021 Paper 1

In many industries, such as banking, health insurance, internet search engines, pharmaceuticals, social media and telecommunications, there have been increases in market concentration.

Evaluate the possible consequences for business decision-making of increased market concentration. Refer to the industries of your choice in your answer. (25 points)

Question 24: Edexcel A-Level Economics 9EC0 November 2020 Paper 1

Extract A

The case for nationalisation

Privatisation has not made the rail industry cheaper to operate, despite the promise from one government source that it would see private companies bringing: “more competition, greater efficiency and a wider choice of services”.

One reason, suggest the critics, is fragmentation. Instead of pushing British Rail into the private sector as a single supplier the government chose to break it into three components of track, train operators and rolling stock i.e. the trains and carriages. This has encouraged each part of the rail industry to prioritise its own profits rather than collaborating to improve the system.

Privatisation, meanwhile, never really worked. The rail network of 2 500 stations and 32 000 km of tracks was renationalised in 2001. This has encouraged the government’s transport secretary, a supporter of private sector involvement, to argue that the state Network Rail monopoly should be removed so that companies can bid to build new rail lines to upgrade the railway.

The privately-owned train operators are now the subject of fierce criticism, due to overcrowding and cancelled services. Private companies are supposed to compete to win a bid to be the train operator for a region for a short number of years. However in recent years the number of private companies bidding or renewing their contract as rail operators has fallen. In May 2018 the government rescued the East Coast line by renationalising it. The line had been run by the private rail operator Virgin Rail, which was suffering lower passenger numbers and revenue than forecast.

Some argue that there is a simple solution: reunite track and train in the only feasible manner, nationalisation.

Extract B

Southern Rail boss paid £495 000

The Chief Executive of Southern Rail, the private-sector train operator that has become associated with delays, losses, cancellations and strikes, was paid £495 000 last year. This increased calls for nationalisation and a maximum wage for executives at companies with government contracts. In contrast the average base pay for a train driver in the UK is £47 705, although they can earn up to £63 000.

Nearly a third of Southern Rail trains were late in 2016 as it tried to deal with a labour dispute that involved extensive strike action. The rail trade unions are opposed to planned changes to the role of train guards, which they claim will put passenger safety at risk.

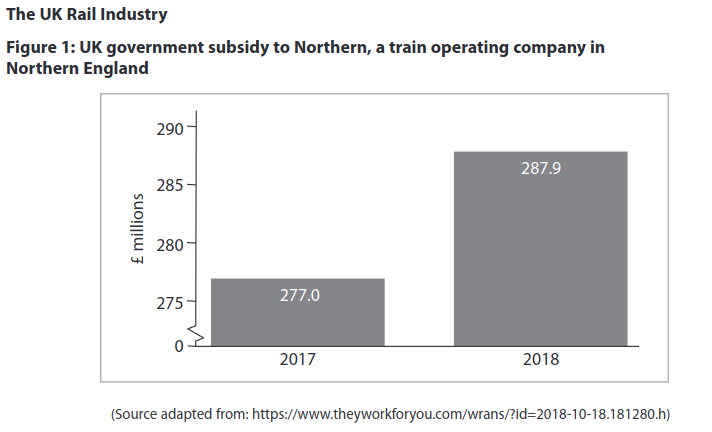

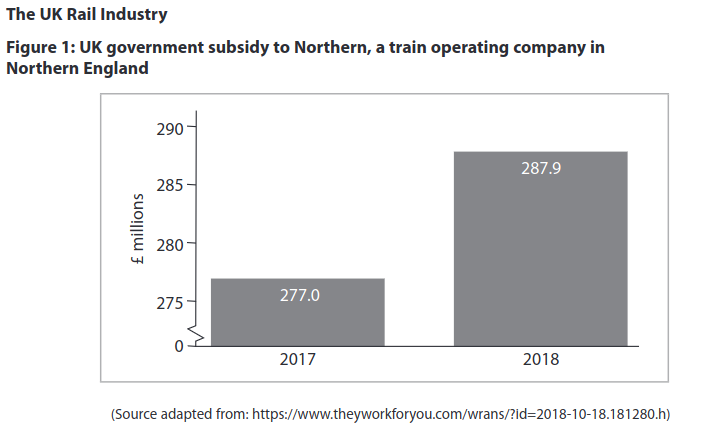

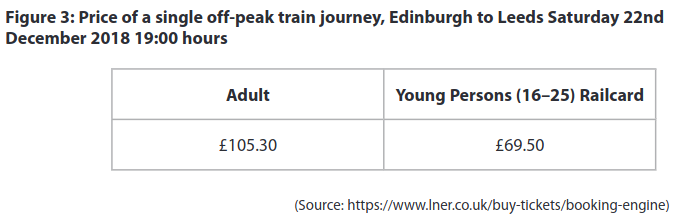

(a) Refer to Figure 1. Explain the likely effect of the change in subsidy levels between 2017 and 2018 on rail fares. Include a supply and demand diagram in your answer. (5 points)

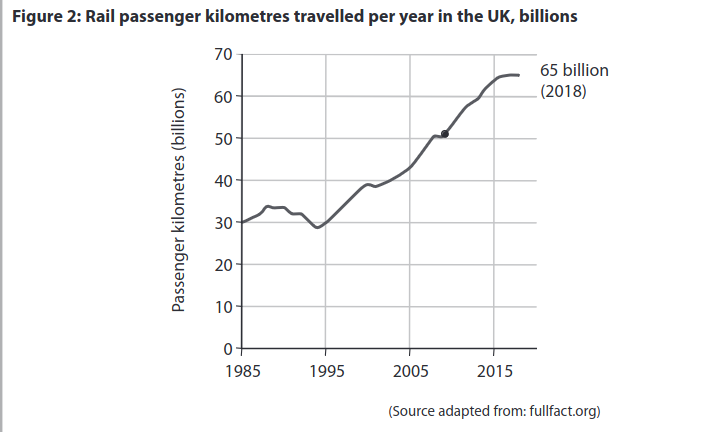

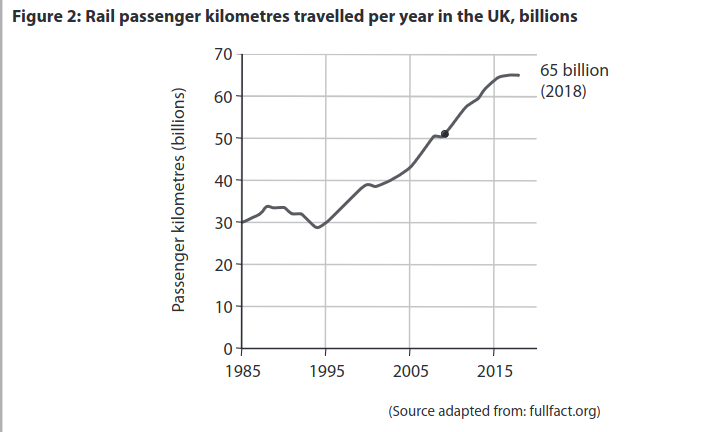

(b) With reference to Figure 2, examine two possible factors which may have influenced demand for rail travel since 2008. (8 points)

(c) Assess whether complete nationalisation of the rail industry might protect employees. (10 points)

(d) With reference to Extract A, paragraph 3, discuss whether the rail network can be considered to be a natural monopoly. (12 points)

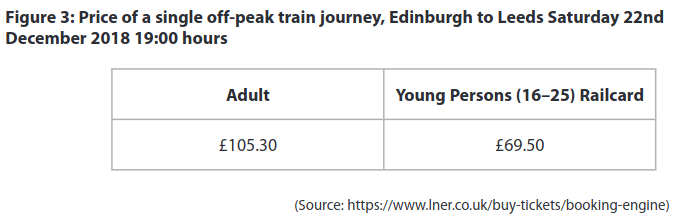

(e) Discuss the likely benefits of price discrimination to rail passengers. Use a diagram to support your answer. (15 points)

Question 25: Edexcel A-Level Economics 9EC0 November 2020 Paper 1

‘Amazon.com, the giant online retailer, has too much power.’ It uses its market power to put a squeeze on publishers, in effect driving down the prices it pays for books. If a publisher refuses, Amazon may take action by ‘delaying their delivery, raising their prices, and steering customers to other publishers’.

Evaluate the likely costs of a monopsony operating in a market such as book retailing. (25 points)

Question 26: Edexcel A-Level Economics 9ECJune 2019 Paper 1

In 2016, the insurance group Esure undertook a demerger with its GoCompare price comparison website.

(a) The most likely reason for this demerger was to: (1 point)

A benefit from external economies of scale

B benefit from internal economies of scale

C focus more on its core business

D increase its market share

Following the demerger, GoCompare announced in 2017 a profit of £17.5 million, up 21.5% on 2016. Total revenue in 2017 was £75.8 million, up 4.1% on 2016.

(b) Calculate, using the information provided, the total costs of GoCompare in 2016. (4 points)

Question 27: Edexcel A-Level Economics 9EC0 June 2019 Paper 1

Extract A

Energy price cap to fix ‘broken’ market in UK

The Prime Minister recently said that the regulator Ofgem (Office of Gas and Electricity Markets) should limit electricity and gas suppliers’ most expensive tariffs. Under the planned new legislation, the energy bills of 11 million households will be capped for as long as five years. The government claimed this cap could save households up to £100 a year. This legislation would force Ofgem to change the licence conditions for energy suppliers so that they are required to cap electricity and gas prices. The measure will apply to anyone on a standard variable tariff, the expensive plans that customers are moved to when cheaper, fixed-price deals end. Ofgem will need to consult energy companies on how the cap is calculated, the government said. The Prime Minister repeated her claim that she had to act because the ‘market is broken’, a charge the big energy companies reject. “I have been clear that our broken energy market has to change – it has to offer fairer prices for millions of loyal customers who have been paying hundreds of pounds too much,” she said.

However, Michael Lewis, chief executive of E.ON said “the government must guard against any unintended consequences that undermine customer service and push up prices as a whole. A price cap will not be good for customers. It will reduce competition and innovation”. Smaller suppliers such as First Utility said the Big Six had only themselves to blame for the cap, because they had kept millions of people on standard variable tariffs.

Extract B

BT profit rises

BT Group, which includes BT Openreach and BT Retail, reported a rise in profit as revenue increased following the integration of the consumer mobile business, EE. BT finalised the takeover of EE in August 2016, and the integration has resulted in BT controlling 35% of the mobile consumer market. The profit of the UK-based telecommunication group in its second quarter 2017 rose to £566 million.

BT Group chief executive Gavin Patterson said: “We will operate a multi-brand strategy with UK customers being able to choose a mix of BT, EE or Plusnet services, depending on which suits them best. The acquisition enables us to offer great value bundles of services and customers are set to be the winners as we compete for their business”.

Extract C

BT to slash landline charges for 1 million customers

Rental charges for landline-only customers – households with a telephone-only contract but no BT broadband – will fall from £18.99 to £11.99 per month after the regulator attacked existing deals as ‘poor value for money’. This rental reduction will save a million landline-only customers £84 a year.

The regulator Ofcom (Office of Communications) said it stepped in because these bills for landline-only customers – nearly two-thirds of whom are over 65 – have “soared” in recent years. This is despite BT and other landline providers benefiting from significant cuts in the wholesale line rental cost of providing the service by BT Openreach. Many landline-only customers are elderly, and have been with BT for decades. Ofcom has focused on BT because it accounts for two-thirds of the UK’s 1.5m landline-only customers.

A spokesperson for Ofcom said “This position [of dominance] has allowed BT to increase prices without much risk of losing customers, and other providers have followed BT’s pricing lead. We expect BT’s price cut to mean other providers will follow suit”. Ofcom said that over three-quarters of BT’s landline-only customers have never switched provider, which has left them a prime target for price rises. The regulator said that all major landline providers have increased their line rental charges by between 23% and 47% in recent years, while their own costs for providing the service have fallen about 27%. Ofcom said it is also looking at measures to help people shop around for better deals with more confidence.

(a) With reference to Extract A, explain the difference between a positive statement and a normative statement. (5 points)

(b) With reference to Extract B, examine the likely benefits to consumers of the integration between BT and EE. (8 points)

(c) With reference to Extract C, assess possible reasons why many ‘landline-only’ customers do not switch to a cheaper telephone provider. (10 points)

(d) Discuss one likely reason for the rise in BT’s profit (Figure 2, Extracts B and C). Use a cost and revenue diagram to support your answer. (12 points)

(e) Discuss methods of government intervention to protect consumers within the utilities markets, such as energy and telecommunications. (15 points)

Question 28: Edexcel A-Level Economics June 2019 Paper 1

In October 2017 Scania, the Volkswagen-owned truck maker, was fined €880 million (£771 million) by the European Commission for colluding with five other truck manufacturers over a 14-year period. The firms had agreed to coordinate prices after experiencing additional costs of meeting emission regulations.

With reference to an industry of your choice, evaluate why some firms engage in collusive behaviour (25 points).

Question 29: Edexcel A-Level Economics 9EC0 June 2018 Paper 1

Emily owns and operates a nail ink salon. The diagram shows the cost and revenue curves for treatments at her nail ink salon. Initially, Emily sets her price to maximise profits.

Costs, Revenue per treatment (£)

(a) Calculate the change in total supernormal profit if Emily changes her objective from profit maximisation to revenue maximisation. You are advised to show your working. (4 points)

(b) Emily now decides to change her objective from revenue maximisation to sales maximisation. This change will lead to: (1 point)

A a decrease in the number of customers

B a decrease in the price of treatments

C an increase in productive efficiency

D an increase in the level of profit

Question 30: Edexcel A-Level Economics 9EC0 June 2018 Paper 1

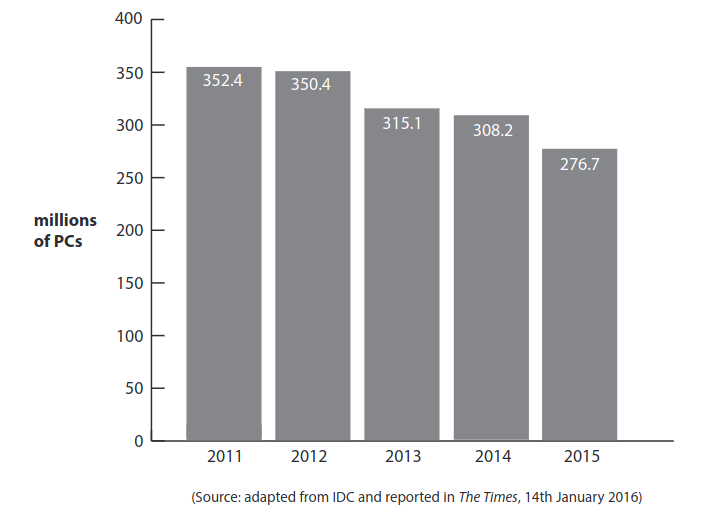

The following graph shows the global sales of personal computers (PCs) between 2011 and 2015.

(a) The percentage decrease in sales of PCs between 2011 and 2015 is: (1 point)

A 21.5

B 27.3

C 31.5

D 75.7

(b) Explain one likely reason for the decrease in sales of PCs. (2 points)

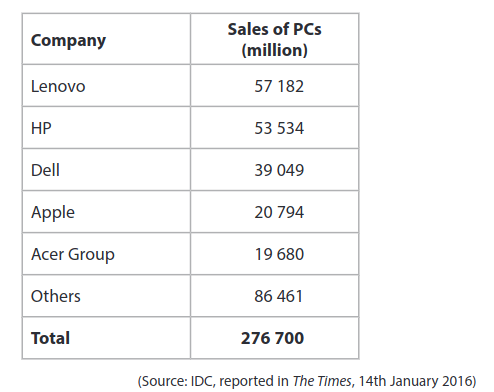

The following table shows global sales of PCs by company in 2015.

(c) Calculate the five-firm concentration ratio. You are advised to show your working. (2 points)

Question 31: Edexcel A-Level Economics 9EC0 June 2018 Paper 1

Extract A

Competition and Markets Authority (CMA) report into the UK energy market

An investigation into the UK energy market by the CMA concluded that customers have been paying £1.4 billion a year more than they would in a fully competitive market. It found that 70% of domestic customers of the six largest energy firms were on an expensive standard rate. These customers could each save over £300 a year by switching to a cheaper deal but appear reluctant to do so.

However, the CMA investigation found no evidence of anti-competitive practices by firms. There has even been an increase in new entrant energy suppliers over recent years and their combined market share has reached 12% in both gas and electricity supply. To protect consumers, the CMA has introduced various measures to open up and increase competition in the UK energy market. These include:

- the creation of a database designed to help consumers switch energy suppliers – rivalsuppliers can directly contact these customers

- the conversion of all homes to smart energy meters making it easier for customers to measure energy consumption and switch supplier

- new rules to protect the four million vulnerable customers using prepaid meters – this includes a temporary price cap until smart meters have been installed.

Extract B

Proposals to regulate profits in the UK energy market

Currently energy retail companies make an average profit of 7% of total revenue. The Chairman of the Competition and Markets Authority (CMA) suggested that these profits are as much as five times higher than they should be, given the companies’ limited role in marketing, metering and billing customers. He recommended a profit cap of 1.25% of total revenue.

However, Scottish Power criticised proposals for regulating profits saying that it would reduce investment in the energy industry and undermine long-term energy provision. The firm claimed that such a low rate of return is below the profit margin made by supermarkets.

All six large energy firms are vertically integrated – producing as well as distributing gas and electricity. This can provide efficiency benefits but also harm competition.

Extract C

Skills shortages in the UK energy sector

The energy sector is facing a skills shortage of engineers and technicians. Some 29% of employers in the gas and electricity industries report unfilled job vacancies compared with an average of 18% across all industries.

A lack of information and advice on career prospects for young people is partly to blame – many graduates have a negative image of the work involved. There is also a lack of students taking science, technology, engineering and maths-based subjects at school and university. Less than one-fifth of the energy sector’s workforce are women.

The energy sector is characterised by an ageing workforce – data from the UK Labour Force Survey reveal that around two-thirds of workers are aged over 50. These cannot easily be replaced as a long time period is required for training and developing workers’ skills in a highly regulated industry.

Urgent action is required by businesses and the government to reduce labour immobility to benefit the energy sector. This action could include policies to increase investment in training programmes, recruit skilled workers from overseas, change the industry image and deal with its ageing workforce.

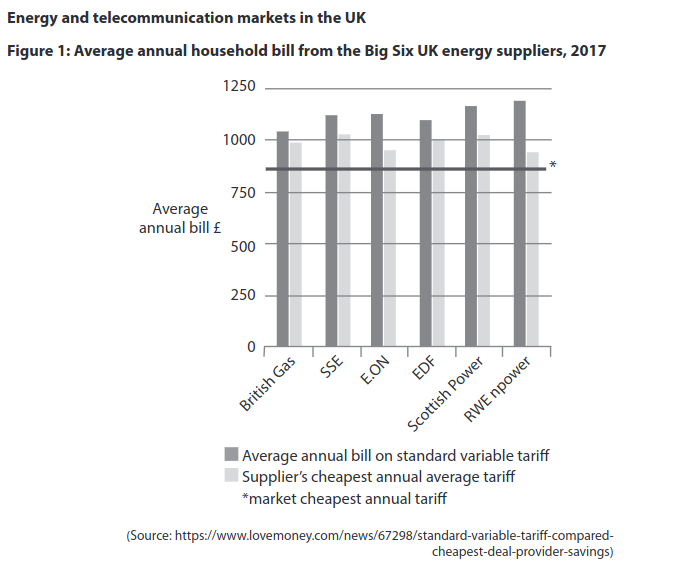

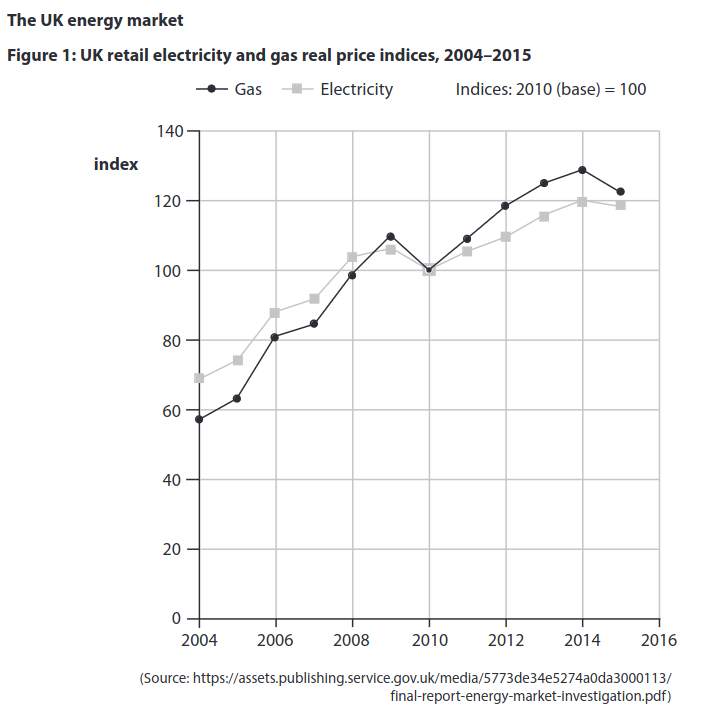

(a) With reference to Figure 1, explain one likely reason for the overall trend in the real price of gas and electricity. (5 points)

(b) With reference to Extract A, discuss the likely effectiveness of ‘measures to open up and increase competition’ in the UK energy market. (12 points)

(c) With reference to Extract B, assess how the regulation of energy suppliers’ profits is likely to affect consumers and suppliers in the energy market. (10 points)

The price elasticity of demand for electricity in the UK is estimated to be –0.35 in the short run and –0.85 in the long run.

(d) With reference to Extract A and your own knowledge, examine two possible reasons for the change in price elasticity of demand for electricity over time. (8 points)

(e) With reference to Extract C and your own knowledge, discuss policies businesses and government might implement to reduce labour immobility to benefit the energy sector. (15 points)

Question 32: Edexcel A-Level Economics 9EC0 June 2018 Paper 1

In July 2016 Apple’s share of the UK market for smartphones was 38%. Evaluate whether such a high market share for one company is in the consumer interest. Use appropriate diagrammatic analysis in your answer. (25 points)

Question 33: Edexcel A-Level Economics 9EC0 June 2017 Paper 1

Extract A

Supermarket price war puts pressure on their food suppliers

The number of food suppliers (to supermarkets) struggling to remain in business has increased by more than 50% over the past year as supermarkets engage in an intense price war. It has never been tougher for the UK’s food suppliers according to a study by accountants Begbies Traynor. It blames aggressive price-cutting by the supermarkets and delays in payments to food suppliers as the main causes of the difficulties. Further problems include food suppliers being forced to pay excessive amounts for packaging specified by supermarkets and funding in-store promotions. Almost 90% of struggling food suppliers are small and medium-sized businesses. The price war has contributed to food prices paid by consumers falling by 1.7% over the past two years.

The market shares of the big four supermarkets – Tesco, Asda, Sainsbury’s and Morrisons – are under pressure as shopping habits change. Many consumers are switching from one main weekly shop to shopping more frequently at local discount stores such as Aldi and Lidl or purchasing goods online from other grocery retailers.

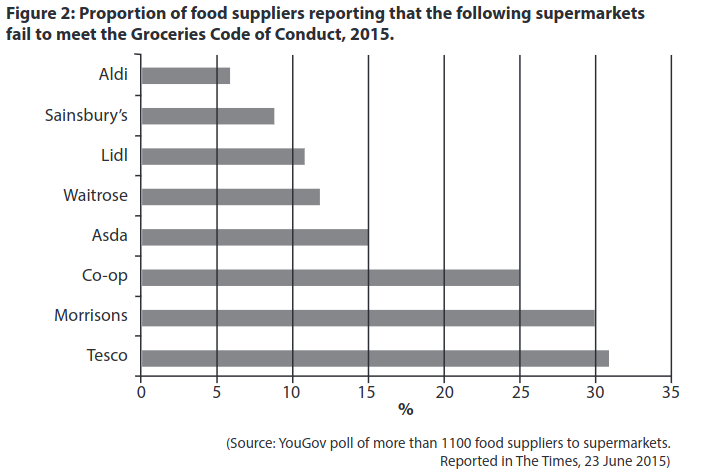

The big four supermarkets have responded by putting more pressure on their suppliers despite an investigation by the Groceries Code Adjudicator (GCA). The GCA has the power to fine supermarkets up to 1% of their annual sales revenue if they break the Groceries Code of Conduct. A YouGov study found considerable differences between the supermarkets in meeting the Code with Aldi performing well but Tesco badly. Despite the Groceries Code, many food suppliers are reluctant to complain for fear of losing contracts with the supermarkets.

Extract B

Food waste in the supply chain

A report from the British Retail Consortium reveals that supermarkets are directly responsible for around 0.2 million tonnes of food waste every year. This is due to the expiry of use-by-dates and poor handling of stock.

However, 4.1 million tonnes of food waste occurs annually in the food supply chain before it even reaches the supermarkets, indicating the existence of information gaps. The supermarkets are cooperating with food suppliers and farmers to try to reduce this waste. This involves improving forecasts for supply and demand of food and increasing the reliability of transportation and storage.

Consumers, the final stage of the supply chain, waste a further 7 million tonnes of food each year. This suggests irrational behaviour. Supermarkets are also working with consumers to reduce the waste by providing advice on how to store and use leftover food. The development of packaging designs to keep food fresher for longer is one of the innovations under way to reduce waste.

Extract C

Proposed merger activity in the supermarket sector

Analysts at Société Générale, an investment bank, have recommended a merger between

Sainsbury’s and Morrisons. They claim it would lead to increased economies of scale and market power for the combined business. Such a merger between the third and fourth largest supermarkets in Britain would have been unrealistic a few years ago due to concerns of its impact in reducing competition. However, the chances of getting permission from the Competition and Markets Authority have increased following the growth of Aldi and Lidl. Giant mergers have been approved in other sectors such as Lloyds-HBOS (banking) and British Telecom-EE (telecommunications).

The suggested merger would have its challenges. There is considerable overlap between the locations of the stores and the enlarged company would require the rationalisation and co-ordination of hundreds of thousands of employees. A new expensive IT system is likely to be required and the underlying difficult market trends would remain in the food retailing industry.

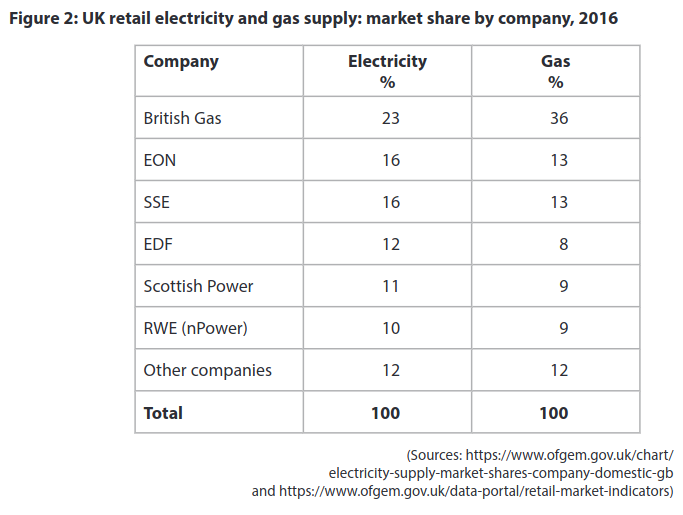

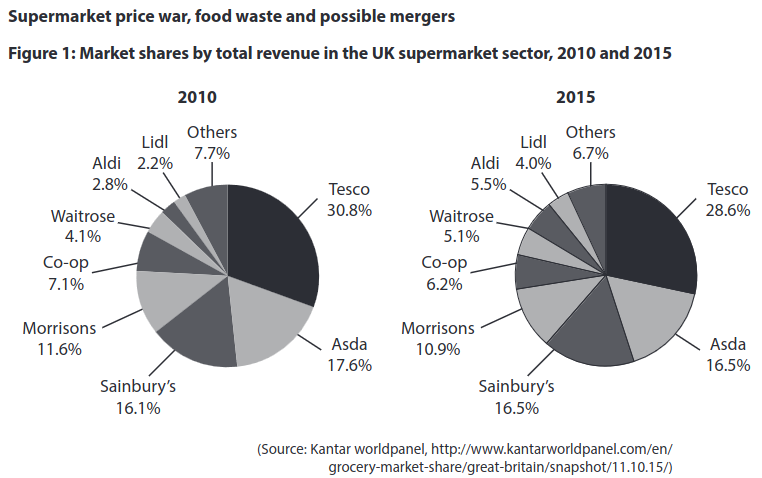

(a) With reference to Figure 1 and Extract A, explain one likely reason for the change in the four-firm concentration ratio of the supermarket sector between 2010 and 2015. (5 points)

(b) With reference to Figure 2 and Extract A, discuss the possible impact of supermarket monopsony power on both food suppliers and consumers. (12 points)

(c) Examine measures the government might use to restrict the monopsony power of supermarkets. (8 points)

(d) Assess the extent to which ‘information gaps’ (Extract B, lines 5 and 6) and ‘irrational behaviour’ (Extract B, line 11) are the main causes of food waste in the UK. (10 points)

(e) Discuss the likely problems for Sainsbury’s and Morrisons if the suggested merger between them goes ahead. Refer to Figure 1, Extract C and your own knowledge in your answer. (15 points)

Question 34: Edexcel A-Level Economics 9EC0 June 2019 Paper 3

Extract A

The effects of a total ban on advertising of HFSS foods

Food and drinks which are high in fat, salt or sugar (HFSS) tend to be sold in highly concentrated markets. Tough new rules banning advertisements for HFSS products, such as those for confectionery, fizzy drinks and potato crisps, come into effect in July 2017 as means to reduce consumption. The rules apply to media targeted at under-16s and will mean a major reduction in the number of advertisements children see for HFSS products in posters near schools, in films targeted at children, on catch-up television and in social media if it is directed at children.

There are three main factors that will determine the effectiveness of the intervention: first, whether advertising acts to expand the market share or steal rivals’ market share. Secondly, how firms in the market adapt their behaviour in response to the ban. Thirdly, what substitute products do consumers turn to if they opted out of the targeted market.

Results from a recent survey in the UK suggest that the total quantity of crisps sold would fall by around 15% in the presence of an advertising ban, or by 10% if firms respond with price cuts, since the ban acts to make the market more competitive and firms respond to the ban by, on average, lowering their prices.

The survey showed that following a ban, consumers are more likely to switch to another junk food than to a healthy food, which (in addition to the pricing response of firms) acts to partially offset any health gains from the policy.

Extract B

Taxing HFSS foods and subsidising healthy eating widens inequality

Since low-income groups spend a higher proportion of their income on food and tend to eat less healthily, they are the main targets of taxes on products that are high in fat, salt or sugar (HFSS). Subsidies on healthy food are seen as an alternative policy approach to encourage healthy eating. While data on the impact of such policies are scarce, a recent study on the distributional impacts of HFSS taxes and healthy food subsidies found that these actually widened health and fiscal inequalities. The policies tend to be regressive and favour higher-income consumers. Taxes on unhealthy food increase prices which have a greater impact on low income groups rather than higher income groups. Lower income groups prefer to buy HFSS food.

Subsidies encouraged all income groups to buy more fruit and vegetables. However, those on higher incomes proved more responsive and the average share of budget spent on healthy food actually increased for the higher income groups who were more likely to buy the subsidised healthy food and then spend the savings they had enjoyed on yet more healthy food. The diets of the higher income groups before the subsidy tended to be healthier. The choices of the higher income groups are more responsive to price changes. By contrast, lower income groups, if they responded to lower prices, often used the money saved to buy unhealthy items or something else entirely. The long-term benefits of a healthier diet are harder to grasp for consumers when information gaps exist. Often the immediate boost of a tasty treat is more appealing. Taxes and subsidies do not change that. Other strategies are needed to promote healthy eating, especially education.

Extract C

Tax on fatty foods in Denmark is an economic disaster

Denmark introduced a specific tax on saturated fat in October 2011. Recognised as a world-leading public health policy, it was abandoned just 15 months later having been both an economic and political disaster.

Indirect taxes of this sort are invariably regressive, disproportionately affecting the elderly and the poor. The specific tax led to prices rising on average 15% for highest-fat products, yielding a total decrease of 5% in the intake of saturated fat from products such as minced beef and cream. 80% of Danish consumers did not change their shopping habits at all. The behavioural change was economically damaging as consumers switched to cheaper brands and crossed the border to Sweden and Germany to do their shopping. Danish tax revenue fell as a result.

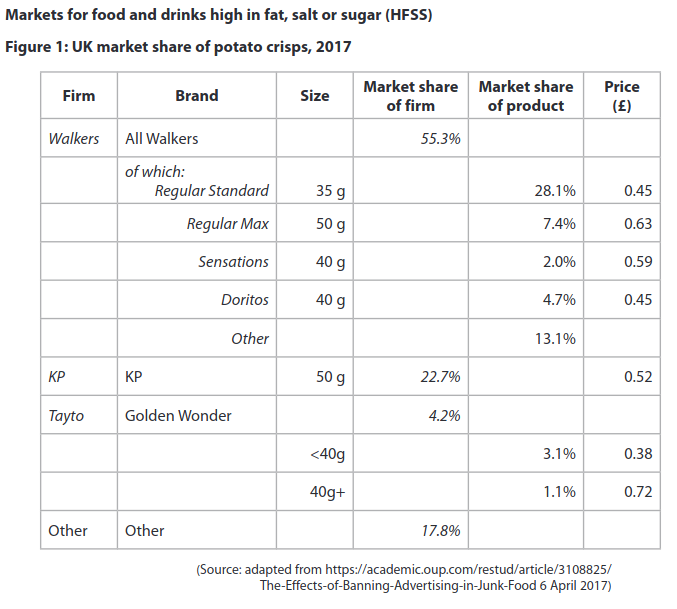

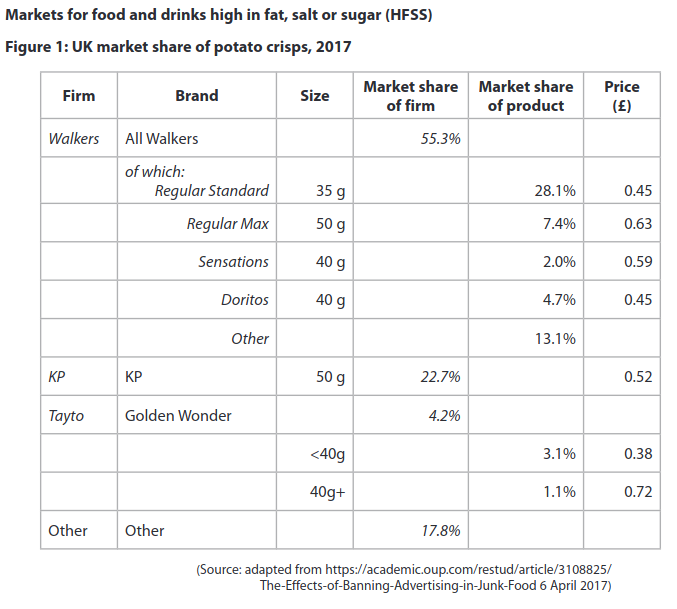

(a) With reference to Figure 1 and Extract A, explain what is meant by a ‘highly concentrated’ market for potato crisps (Extract A, lines 2–3). (5 points)

(b) Apart from changes in indirect taxes and subsidies, examine two causes of income inequality within a developed economy such as the UK. (8 points)

(c) In Extract A, lines 15–16, it was suggested that some firms may respond to the advertising ban by cutting the prices of their products.

Using game theory and the information provided in Figure 1 and Extract A, discuss the effects on firms of cutting prices in an oligopolistic market. (12 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic effects of increased government spending on education to promote healthy eating in the UK. (25 points)

OR

(e) Evaluate the likely microeconomic and macroeconomic effects of imposing a tax on HFSS foods. (25 points)

Question 35: Edexcel A-Level Economics 9EC0 June 2018 Paper 3

Extract A

Starbucks in Britain – a loss-making business?

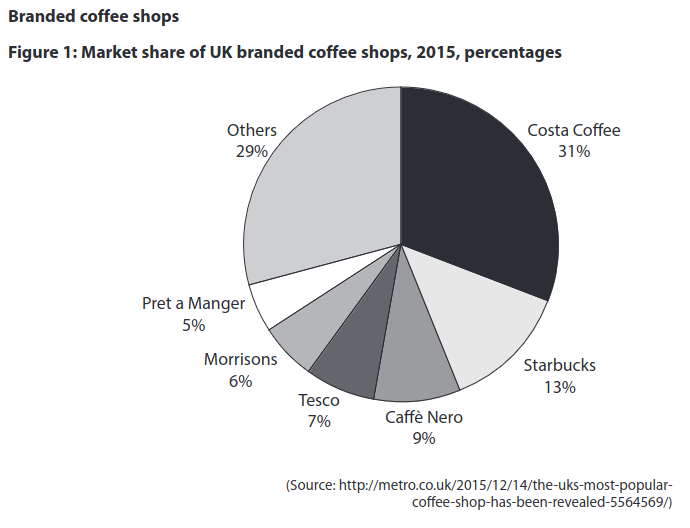

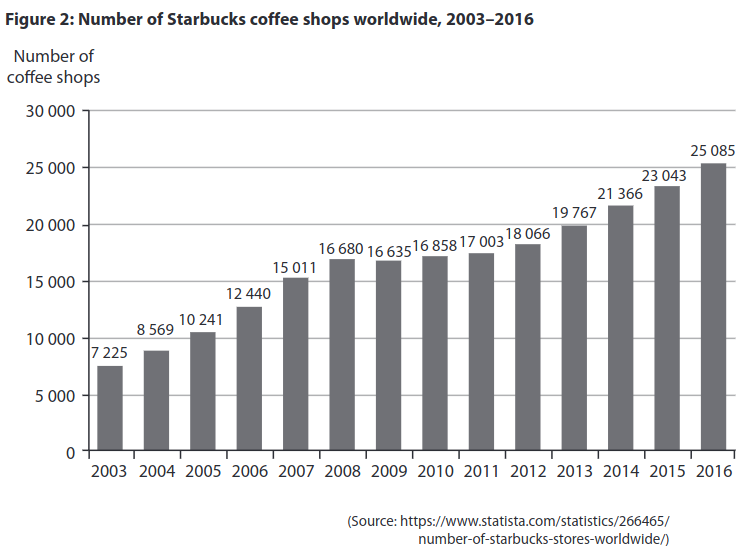

Coffee shops are among the most profitable parts of the food and drink industry, and few are doing quite as well as Starbucks, a US-based transnational company. Starbucks may be complaining of adverse global market conditions but that did not stop the world’s biggest coffee chain from reporting record annual profits in 2016. It made a profit of almost US$4.2 billion for the year, up 16% on 2015. That was mainly the result of a strong performance in its biggest market, America, where revenue rose 11%. The fastest growth was in the China and Asia Pacific region, with revenue up 23%. Howard Schultz, the CEO of Starbucks, said its Chinese coffee shops were the most efficient and profitable. While Starbucks still makes most of its profit in the US, Mr Schultz has said expansion in China will secure its future for “decades to come” and announced plans to more than double the number of shops in China to 5 000 by 2021.

However its British subsidiary, at first glance, appears to be doing less well. It has announced its first ever profit in Britain in 2015 – of just £1 million – despite opening its first coffee shop in the UK in 1998. It now has 849 UK outlets. The main reason why Starbucks has reported persistent losses in the UK is not due to a lack of demand for its coffee, but to minimise its tax bill. It is claimed that some of Starbucks’ revenue earned in the UK is transferred to its Dutch subsidiary, which is charged lower rates of tax.

Starbucks is not finding life as easy in Britain as in the USA. It faces competition from home-grown chains such as Costa and Caffè Nero. Accusations of tax avoidance have also damaged Starbucks’ sales to the benefit of its competitors. A survey found that a third less people rated Starbucks as their preferred coffee shop than they did before the tax- avoidance allegations were first published.

These issues have forced Starbucks to change its strategy. It has slowed down its expansion plans in the UK and has closed 67 underperforming coffee shops over the past year. It has also tried to repair its reputation by transferring its European headquarters from Amsterdam to London.

Extract B

Tax on disposable coffee cups?

Two and a half billion disposable cups are thrown away every year in the UK, that is, seven million every day. Only one in 400 is recycled. The UK Environment Minister has suggested that a coffee cup tax could work in a similar manner to the plastic bag charge. The 5 pence a bag charge has led to an 85% reduction in the number of bags being given out since October 2015. It is estimated that introducing a tax on disposable coffee cups would cut usage by two billion every year. One environment spokesperson, Kate Parminter, said: “We’ve seen how dramatically a small charge has affected public behaviour when it comes to the plastic bags and it is clearly time to extend it to coffee cups. Most people purchase a tea or coffee and throw away the cup without even thinking about it, but a charge would increase our awareness of the environmental impact.”

In response, another MP welcomed her comments but said he did not believe a tax was the solution. He said: “My initial reaction is charging 5p or 10p for the cup will not work. It will not encourage people to take their own cups in if a coffee goes up from £2.60 to £2.65. I suspect a more technological answer is what we need – either the composition of the disposable cups being changed so they’re more easily recyclable, or changing the technology in the recycling.”

Disposable coffee cups contain a plastic coating inside the cups which prevent them from becoming soggy, making them difficult to recycle. There are just two specialist facilities in the UK that have the required equipment to separate plastic from paper for recycling. Almost no recycled paper is used in the production of disposable cups, meaning that some 43 000 trees must be cut down annually to keep up with the demand. CO emissions of around 83 000 tonnes are generated every year for their production.

Extract C

German city of Freiburg takes action on cutting the use of disposable coffee cups

The ‘Freiburg cup’, made from dishwasher-proof plastic, can be reused hundreds of times. Cups are issued with a one-euro deposit, and can be returned to any of the participating coffee shops in the German city. The cups, which are provided to coffee shops by local councils, are washed in the cafés and bakeries that have signed up to the scheme before being reused. 56 coffee retailers have signed up, and 10 000 cups are being used.

One of the main obstacles facing a wider-reaching scheme, however, is the number of café chains in Germany that are unwilling to use unbranded multi-use cups, particularly Starbucks and McDonald’s. Starbucks already offers a discounted coffee for customers with a multi-use cup, but only if it is bearing the unmistakable Starbucks logo.

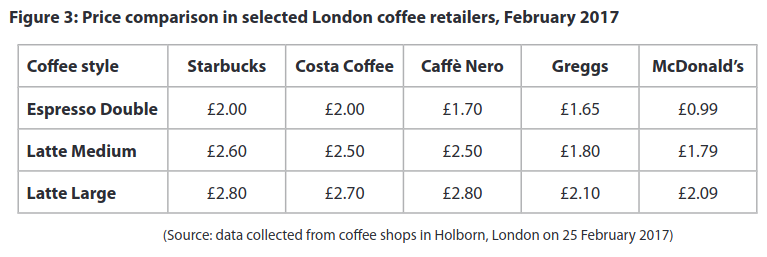

(a) With reference to Figure 1, briefly explain the market structure that best describes the UK branded coffee shop market. (5 points)

(b) With reference to Figure 3 and other information provided, discuss the price and non-price strategies that Starbucks may use to increase profitability. (12 points)

(c) Examine the advantages of using an indirect tax as a means of reducing the use of disposable coffee cups. (8 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic factors that may influence Starbucks’ decision whether to expand in a particular country. (25 points)

OR

(e) With reference to the information provided and your own knowledge, evaluate the microeconomic and macroeconomic effects of increased UK demand for coffee at branded coffee shops. (25 points)

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.