This article contains a list of all the Theme 2 questions featured in Edexcel A-Level Economics past papers. We compiled these questions as a study aid to help you revise Theme 2 topics like inflation, aggregate supply and demand, output gaps, and the multiplier. Theme 2 is a content section in the Edexcel A-Level Economics specification and teaches the groundwork of macroeconomics in a UK context, which Theme 4 will later build on by addressing global macroeconomics.

What is the Edexcel A-Level Economics test?

The Edexcel A-Level Economics test is an economics-focused qualification taken by students in their final two years of secondary school. Most students take the A-Level in Economics with the goal of securing a place at university studying Economics or a similar subject.

Pearson Edexcel offers the Edexcel A-Level Economics test. Edexcel is a privately-owned British education and exams body founded in 1996 that was acquired by Pearson plc. since 2005. Edexcel is the UK’s largest educational qualifications company.

Where did we get these Edexcel Economics A-Level Past Paper Theme 2 Questions?

We got these Edexcel Economics A-Level past paper questions on Theme 2 by going through every published Edexcel past paper. Our goal in compiling this list was to make it easy to study Theme 2 questions altogether without having to search through 20+ different Edexcel past papers. The questions are listed in the article below and you can find a downloadable pdf of the answer key at the end of the page.

Want questions for other topics in A-Level Economics? You can find more A-Level Economics Past Paper Questions here.

What is included in Edexcel Economics Theme 2?

Theme 2 is a macroeconomics section in the Edexcel A-Level Economics specification. The unit covers macroeconomics at a national level with a focus on the UK economy. You’ll cover topics like inflation, aggregate demand, the multiplier effect, and supply-side policies when studying Theme 2. The Theme 2 section lays the groundwork that you’ll build on when you study Theme 4, which covers macroeconomics at a global level. The core concepts in Edexcel A-Level Economics’ Theme 2 are as follows.

- Economic growth: Economic growth is an increase in an economy’s output, measured as an increase in Gross Domestic Product (GDP).

- Inflation: Inflation is an increase in an economy’s money supply that exceeds the growth in that economy’s output. Inflation is characterised by a general increase in prices and a fall in the purchasing power of money.

- GDP: Gross Domestic Product (GDP) is a measure of the total output of an economy measured by adding the prices of all the goods produced in an economy together.

- Aggregate demand: Aggregate demand is the total demand for all goods in an economy. We would expect aggregate demand to increase as incomes rise because consumers have more money to spend in an economy.

- Aggregate supply: Aggregate supply is the total amount of goods produced in an economy. We would expect aggregate supply to increase as an economy develops more physical infrastructure to produce goods or as a workforce becomes more productive.

- The multiplier: The multiplier is a measure of how much government spending stimulates economic growth and it relies on the marginal propensity of an economy’s population to consume.

- Output gaps: The output gap is the difference between the actual output of an economy and its potential output. The potential output is the most that an economy could produce if all of its resources were used efficiently.

- Trade-offs in macroeconomic objectives: Trade-offs in macroeconomic objectives come when policymakers’ goals are in tension with one another. For example, most governments wish to pursue high economic growth and low inflation but significant economic growth often leads to inflation.

- Supply-side policies: Supply-side policies are government policies that are intended to increase the productivity of private companies through deregulation, tax cuts, and investment.

- Demand-side policies: Demand-side policies are government policies intended to stimulate consumption by increasing public spending on services like healthcare, public schooling, and welfare. One example of a demand-side policy is direct stimulus payments to individuals, which is used to stimulate economic growth.

You can check out our Edexcel A-Level Economics Notes here.

Question 1: Edexcel A-Level Economics 9EC0 Paper 2 November 2021

It has been estimated that if climate change led to the world’s temperature rising 2.5 °C compared to the temperature in 2010, then global GDP per capita would be 15% lower by 2100. If temperatures rise by 4 °C compared to the temperature in 2010, then by 2100 global GDP per capita would decline by more than 30%.

Evaluate the potential trade-offs between environmental protection and other macroeconomic objectives. (25 points)

Question 2: Edexcel A-Level Economics 9ECO Paper 2 June 2018

Extract A

UK companies use forward currency market

The Norfolk-based picture frames maker Nielsen Bainbridge recently made forward contracts in the foreign exchange market to reduce the impact of currency fluctuations. The pound’s post-Brexit referendum depreciation has been a test of nerve for Nielsen Bainbridge and many other importers. At present the company’s suppliers are located in Europe or China. “Currency therefore has a big impact on our business and the margins we can obtain,” says Ms Burdett, the Finance Director. Forward contracts enable institutions, businesses and individuals to lock in an exchange rate over a certain period of time regardless of how the rate moves during that time. Ms Burdett buys currency as soon as Nielsen Bainbridge confirms a large order as a way to fix costs. One third of UK business managers are considering shifting from EU to UK suppliers.

Extract B

Bank of England seeking to prevent future bank bailouts

The Bank of England has ordered big lenders in the UK to find £116 billion of funding to ensure that taxpayers will never again have to bail out the banking sector. The Bank intends to publish details of how each of the big lenders would cope in the event they find themselves in a situation similar to Royal Bank of Scotland and Lloyds Banking Group, which needed £65 billion of taxpayer bailouts during the 2008 Global Financial Crisis. This had a significant negative impact on the UK government’s national debt and, many would argue, increased the need for contractionary fiscal policy. Having said that, the UK government sold all its shares in Lloyds Banking Group in 2017 and, according to the Chancellor of the Exchequer, “recovered every penny of its investment in Lloyds”. Sir Jon Cunliffe, the deputy governor at the Bank responsible for financial stability, said regulators needed to let banks fail in a similar way that traditional companies collapse. This has not been possible in the past because of the risk that savers lose their money and because a system did not exist to allow banks to be put into insolvency. “Just like when other businesses fail, losses arising from bank failure would be imposed on shareholders and investors. This protects the public from loss and incentivises banks to operate more prudently,” said Cunliffe.

Extract C

Bank of England tells lenders to increase capital reserves

The Bank of England has told lenders they will need to build a special reserve worth £11.4 billion by the end of 2018 as it tries to make banks more resilient to the risk posed by mounting consumer debt. This reserve of assets that can be readily turned into cash is a way of forcing banks to set aside capital reserves in good times in order to keep lending to the wider economy at a steady level, even during an economic downturn. In 2017 the Bank of England told UK banks it would raise the reserve ratio, relative to all assets, from zero to 0.5% and also forecast a further increase to 1% by the end of 2017. The move is not intended to directly reduce consumer demand for credit, which in 2017 grew by 10.3% on an annual basis, but it may well lead to banks becoming less willing to lend to consumers. Since the Bank of England has recently become increasingly concerned about consumer borrowing, including rising car loans and credit card debt, this may be no bad thing as far as the Bank of England is concerned, even if it does have a negative impact on the wider economy.

Analysts are concerned about the impact on consumer confidence of rising inflation, partly caused by a falling pound. With falling real incomes consumers could become more vulnerable to falling behind with their credit card and personal loan repayments. Despite these concerns, the UK economy recently recorded the lowest rate of unemployment since 1975.

(a) With reference to Extract A, explain the role of forward markets in currencies. (5 points)

(b) With reference to Extract A and Figure 1, examine the likely impact of the change in the sterling exchange rate on the UK economy. (8 points)

(c) With reference to the last paragraph in Extract C, assess the impact of a fall in real incomes on subjective happiness. (10 points)

(d) With reference to Extract C, discuss the potential conflicts between macroeconomic objectives when the central bank attempts to control inflation. (12 points)

(e) Discuss whether providing substantial government financial support to banks is the best policy response during a financial crisis. (15 points)

Question 3: Edexcel A-Level Economics 9EC0 November 2021 Paper 2

After the Global Financial Crisis of 2008, the US President introduced expansionary fiscal policies of $800 billion. The International Monetary Fund estimated that the multiplier at the time was approximately 1.5.

(a) Which one of the following is a withdrawal from the circular flow of income? (1 points)

A Exports

B Government spending

C Investment

D Taxation

(b) Calculate the total final increase in US aggregate demand as a result of the President’s ‘expansionary fiscal policies’, assuming no other changes. (2 points)

(c) Explain the impact of annual fiscal deficits on the US national debt. (2 points)

Question 4: Edexcel A-Level Economics 9EC0 June 2017 Paper 2

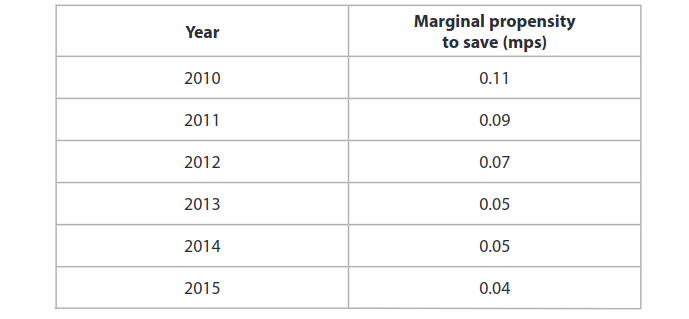

The table below shows the marginal propensity to save data for an economy.

(a) Explain one possible reason for the changes in the marginal propensity to save as shown in the table.

(b) Explain the likely effect of a fall in the marginal propensity to save on the value of the multiplier if other things remain equal.

An economy has a marginal propensity to save of 0.1, a marginal propensity to tax of 0.2 and marginal propensity to import of 0.1.

(c) Which one of the following is the correct size of the multiplier? (1 point)

A 0.4

B 0.6

C 1.7

D 2.5

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.