This article contains all the past paper questions we could find covering topics in Theme 4 of the Edexcel A-Level Economics test. The A-Level Economics test helps prepare students to take economics at university and Theme 4 teaches macroeconomics in a global perspective. Past paper questions included in this article cover topics like trade, monetary policy, globalisation, and currency exchange rates.

What is the Edexcel A-Level Economics test?

The Edexcel A-Level Economics test is an economics qualification administered by Pearson Edexcel and offered to British students in their final two years of study. Many students who take the Edexcel Economics A-Level go on to study Economics or a related subject at university. Other organizations also offer A-Level Economics, most prominently AQA.

Where did we get these Edexcel Economics A-Level Past Paper Questions on Theme 4?

We selected these Edexcel Economics A-Level Economics Past Paper Questions on Theme 4 by going through all of the past papers published by Edexcel and picking out questions that match the Theme 4 specification. Our goal is to make it easy for you to revise Theme 4 topics without having to go individually through every past paper. You can find the questions in this article and the answer key as a downloadable pdf at the bottom of the page.

Want questions for other topics in A-Level Economics? You can find more A-Level Economics Past Paper Questions here.

What is included in Theme 4 of the Edexcel A-Level Economics course?

Theme 4 of the Edexcel A-Level Economics course covers macroeconomics from a global perspective, covering topics like trade, currency exchanges, and global financial crisis. Theme 2 was aimed at teaching the fundamentals of macroeconomics in a UK context and Theme 4 builds on that knowledge to look at the global market. Topics covered in Theme 4 of the Edexcel A-Level Economics course include the following.

- Globalisation: Globalisation is increasing economic integration between different countries, characterised by reduced trade restrictions, global supply chains, and shared international culture.

- Specialisation and trade: Trade is the exchange of goods and services between different countries while specialisation is the focus of available resources to produce a smaller number of products more efficiently. Specialised countries will import a number of other products from foreign markets as they focus on creating a small number of goods domestically.

- Trading blocks and the World Trade Organisation: Trading blocks are international agreements aimed and reducing trade restrictions between member countries. The European Union is an example of a trading block as it prohibits tariffs on imports and

- Balance of payments: The balance of payments is a summary of economic transactions between one country and its trading partners. The balance of payments includes money spent/gained on trade as well as financial transactions like remittances.

- Exchange rates: Exchange rates are the value of one currency compared to other currencies around the world. The exchange rate of a country’s currency affects its trade and the standard of living of its citizens.

- Inequality: Inequality is a measure of economic differences between different members of a population. Wealth inequality measures disparities in wealth and assets while income inequality measures differences in salary.

- Economic development: Economic development is the process of increasing economic output and per capita income in a country with low per capita GDP. The objective of economic development is to improve standards of living.

- Central banks and monetary policy: Central banks are government organisations tasked with managing a country’s money supply. Monetary policy is any action taken by a central bank to manage the money supply, including changes in interest rates and changing bank reserve requirements.

- Public spending and fiscal policies: Public spending and fiscal policies are any money the government spends as a part of its budget, such as on healthcare, defense, and public schooling.

You can check out our Edexcel A-Level Economics Notes here.

Question 1: Edexcel A-Level Economics 9EC0 November 2021 Paper 2

The European Central Bank introduced a new round of quantitative easing (QE) in March 2020, purchasing up to €750 billion of assets. The objective of this QE was to reduce the serious risks to the effectiveness of monetary policy resulting from a significant recession. The European Central Bank’s target for inflation remains at ‘below but close to 2%’.

Evaluate the effectiveness of quantitative easing during ‘a significant recession’. (25 points)

Question 2: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

In 2018, the International Monetary Fund (IMF) lent Argentina $57 billion as part of a bailout package to help prevent the country’s government defaulting on its debts. This financial crisis also caused significant capital flight out of Argentina’s economy.

(a) Explain the role of the IMF in providing financial assistance to countries such as Argentina. (4 points)

(b) Which one of the following is most likely to happen to Argentina’s currency value as a result of capital flight, assuming it is operating with a floating exchange rate system? (1 point)

A Appreciation

B Depreciation

C Devaluation

D Revaluation

Question 3: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

Extract A

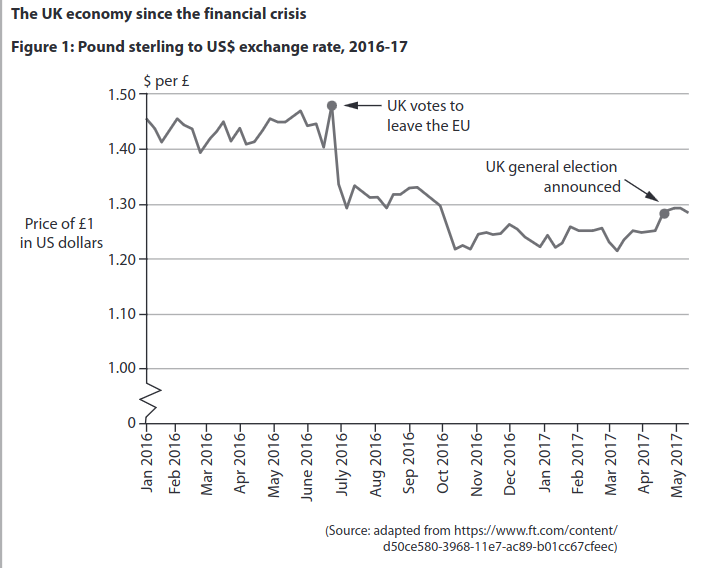

UK companies use forward currency market

The Norfolk-based picture frames maker Nielsen Bainbridge recently made forward contracts in the foreign exchange market to reduce the impact of currency fluctuations. The pound’s post-Brexit referendum depreciation has been a test of nerve for Nielsen Bainbridge and many other importers. At present the company’s suppliers are located in Europe or China. “Currency therefore has a big impact on our business and the margins we can obtain,” says Ms Burdett, the Finance Director. Forward contracts enable institutions, businesses and individuals to lock in an exchange rate over a certain period of time regardless of how the rate moves during that time. Ms Burdett buys currency as soon as Nielsen Bainbridge confirms a large order as a way to fix costs. One third of UK business managers are considering shifting from EU to UK suppliers.

Extract B

Bank of England seeking to prevent future bank bailouts

The Bank of England has ordered big lenders in the UK to find £116 billion of funding to ensure that taxpayers will never again have to bail out the banking sector. The Bank intends to publish details of how each of the big lenders would cope in the event they find themselves in a situation similar to Royal Bank of Scotland and Lloyds Banking Group, which needed £65 billion of taxpayer bailouts during the 2008 Global Financial Crisis. This had a significant negative impact on the UK government’s national debt and, many would argue, increased the need for contractionary fiscal policy. Having said that, the UK government sold all its shares in Lloyds Banking Group in 2017 and, according to the Chancellor of the Exchequer, “recovered every penny of its investment in Lloyds”.

Sir Jon Cunliffe, the deputy governor at the Bank responsible for financial stability, said regulators needed to let banks fail in a similar way that traditional companies collapse. This has not been possible in the past because of the risk that savers lose their money and because a system did not exist to allow banks to be put into insolvency. “Just like when other businesses fail, losses arising from bank failure would be imposed on shareholders and investors. This protects the public from loss and incentivises banks to operate more prudently,” said Cunliffe.

Extract C

Bank of England tells lenders to increase capital reserves

The Bank of England has told lenders they will need to build a special reserve worth £11.4 billion by the end of 2018 as it tries to make banks more resilient to the risk posed by mounting consumer debt. This reserve of assets that can be readily turned into cash is a way of forcing banks to set aside capital reserves in good times in order to keep lending to the wider economy at a steady level, even during an economic downturn. In 2017 the Bank of England told UK banks it would raise the reserve ratio, relative to all assets, from zero to 0.5% and also forecast a further increase to 1% by the end of 2017. The move is not intended to directly reduce consumer demand for credit, which in 2017 grew by 10.3% on an annual basis, but it may well lead to banks becoming less willing to lend to consumers.

Since the Bank of England has recently become increasingly concerned about consumer borrowing, including rising car loans and credit card debt, this may be no bad thing as far as the Bank of England is concerned, even if it does have a negative impact on the wider economy. Analysts are concerned about the impact on consumer confidence of rising inflation, partly caused by a falling pound. With falling real incomes consumers could become more vulnerable to falling behind with their credit card and personal loan repayments. Despite these concerns, the UK economy recently recorded the lowest rate of unemployment since 1975.

(a) With reference to Extract A, explain the role of forward markets in currencies. (5 points)

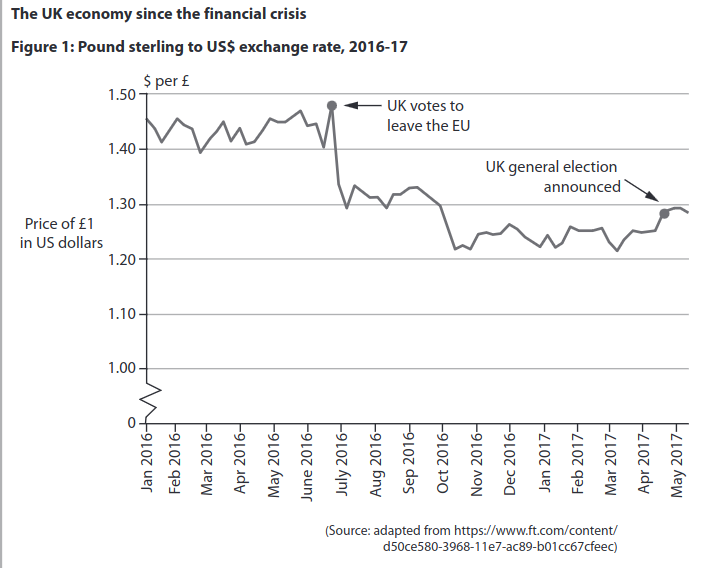

(b) With reference to Extract A and Figure 1, examine the likely impact of the change in the sterling exchange rate on the UK economy. (8 points)

(c) With reference to the last paragraph in Extract C, assess the impact of a fall in real incomes on subjective happiness. (10 points)

(d) With reference to Extract C, discuss the potential conflicts between macroeconomic objectives when the central bank attempts to control inflation. (12 points)

(e) Discuss whether providing substantial government financial support to banks is the best policy response during a financial crisis. (15 points)

Question 4: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

Japan’s budget deficit for 2017/18 is expected to be 4.6% of GDP. Its national debt is forecast to increase to above 250% of GDP by 2019. Evaluate the impact of a large fiscal deficit and national debt on a country’s economy. (25 points)

Question 5: Edexcel A-Level Economics 9ECO November 2021 Paper 2

After the Global Financial Crisis of 2008, the US President introduced expansionary fiscal policies of $800 billion. The International Monetary Fund estimated that the multiplier at the time was approximately 1.5.

(a) Which one of the following is a withdrawal from the circular flow of income? (1 points)

A Exports

B Government spending

C Investment

D Taxation

(b) Calculate the total final increase in US aggregate demand as a result of the President’s ‘expansionary fiscal policies’, assuming no other changes. (2 points)

(c) Explain the impact of annual fiscal deficits on the US national debt. (2 points)

Question 6: Edexcel A-Level Economics 9ECO November 2020 Paper 2

In 2018, the International Monetary Fund (IMF) lent Argentina $57 billion as part of a bailout package to help prevent the country’s government defaulting on its debts. This financial crisis also caused significant capital flight out of Argentina’s economy.

(a) Explain the role of the IMF in providing financial assistance to countries such as Argentina. (4 points)

(b) Which one of the following is most likely to happen to Argentina’s currency value as a result of capital flight, assuming it is operating with a floating exchange rate system? (1 point)

A Appreciation

B Depreciation

C Devaluation

D Revaluation

Question 7: Edexcel A-Level Economics 9ECO June 2018 Paper

Japan’s budget deficit for 2017/18 is expected to be 4.6% of GDP. Its national debt is forecast to increase to above 250% of GDP by 2019. Evaluate the impact of a large fiscal deficit and national debt on a country’s economy. (25 points)

Question 8: Edexcel A-Level Economics 9ECO November 2021 Paper 3

Extract C

Why Germany keeps to budget rules despite a slowdown in growth

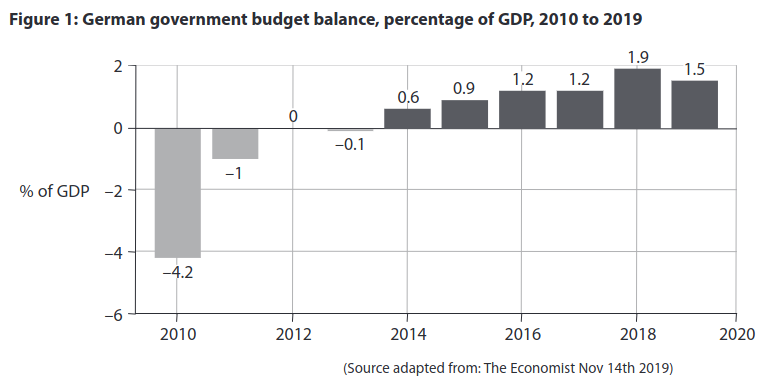

Germany’s economic boom is over, as it has entered recession. During the last ten years of economic growth well over 4 million jobs were created. The fear of recession has revived a debate in Germany: should the government spend more to stimulate growth? It is written into the German constitution that the fiscal deficit cannot be greater than 0.35% of GDP, once the effects of the economic cycle have been removed. Germany’s budget has been in surplus since 2014 and the government is always reluctant to increase spending which would create a deficit. In 2018, aided by booming employment and low interest costs on existing debt, the budget ran to a surplus 1.9% of GDP.

Germany’s main trading partners have long been angered by German fiscal policy. The French President criticised Germany’s budget and current account surpluses that “always occur at the expense of others”.

Large parts of Germany’s infrastructure need significant investment. As the economy has slowed, a decision to run a balanced-budget policy has become harder to defend. In wealthy regions of Germany, crumbling schools have been closed for fear of collapse, and information and mobile technology on a wide scale needs to be modernised. The World Economic Forum reported that accessibility of fibre optic broadband also “remains the privilege of the few”. However, private sector firms, such as major motor manufacturers, are still willing to invest in new technology and the profitability of some of these firms, in the long run, benefits as a result.

The state development bank puts Germany’s investment shortfall at €138 billion (£120 billion). Arguments for a much more expansionary fiscal policy have failed to influence government policy. Big government programmes, such as a recent package to reduce Germany’s carbon emissions, are only implemented when they satisfy fiscal rules.

Extract D

Germany drops to number 7 in the Global Competitiveness Index

Despite being the largest economy in the European Union, Germany’s competitiveness is declining, according to the World Economic Forum (WEF). Germany dropped four places in the WEF’s Global Competitiveness Index, coming in as the seventh-most competitive economy. Out of the 103 indicators used in the report, Germany received lower scores in 53 areas in 2019.

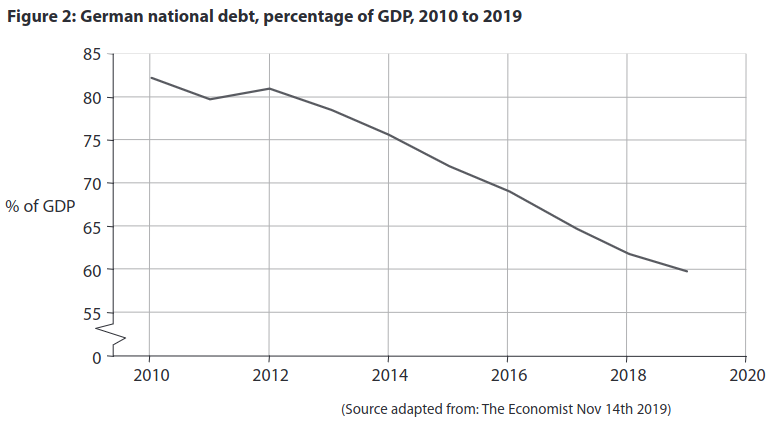

(a) Explain one reason why a country such as Germany wants to avoid an increase in the national debt relative to GDP (Figure 2). (5 points)

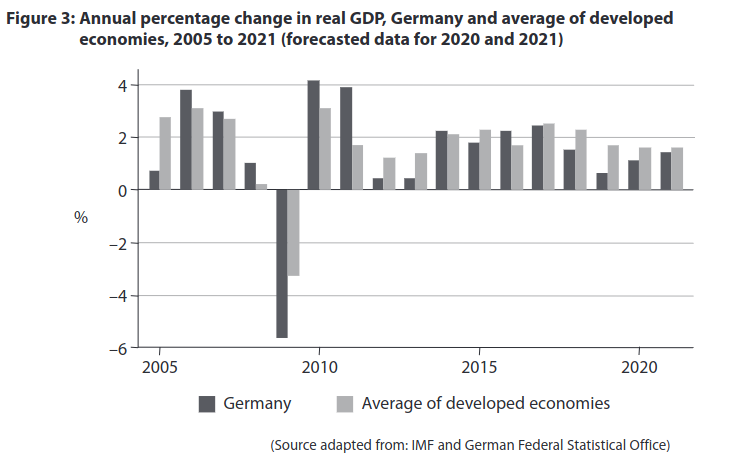

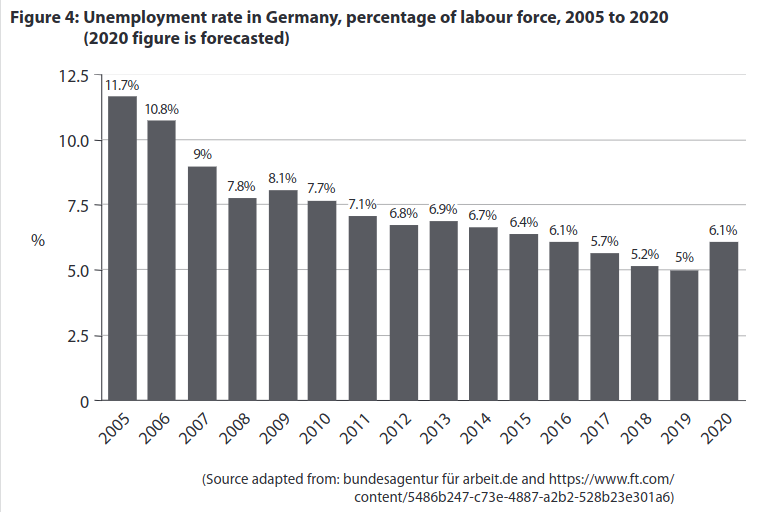

(b) Examine two likely effects of the forecast change in the rate of unemployment between 2019 to 2020, on firms in Germany. Refer to Figure 4 in your answer. (8 points)

(c) Discuss the likely impact of investment in new technology on the profitability of firms in Germany, as described in Extract C line 20. Use a cost and revenue diagram to support your answer. (12 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic factors which are likely to determine the rate of economic growth in Germany relative to other developed economies. (25 points)

OR

(e) Evaluate the microeconomic and macroeconomic impacts of ‘a much more expansionary fiscal policy’ (Extract C line 23) on the German economy. (25 points)

Question 9: Edexcel A-Level Economics 9ECO June 2019 Paper 3

Extract D

Rising debt levels in Africa

Increases in national debt have brought several African governments towards a debt-servicing crisis when the repayment of debt and interest become unsustainable. Between 2010 and 2015, many sub-Saharan countries raised debt totalling more than £20 billion. Back then, with commodity prices soaring and foreign loans available at very low interest rates, everyone agreed that borrowing was the way to grow an economy with expansionary fiscal policy. Since 2015, some African governments – beneficiaries of big debt write-offs at the start of the century – have taken to private debt markets too eagerly, leaving them with heavy repayment schedules at a time of lower commodity prices.

Until recently, the International Monetary Fund (IMF) has played down African debt concerns, pointing to better management of public resources and greater transparency. But it was shaken by Mozambique’s default on more than £2 billion of secret loans used to purchase a non-existent tuna-fishing fleet, raising fears of hidden debt in other African countries with similar levels of corruption. The median level of debt in sub-Saharan Africa had risen sharply from 34% of gross domestic product in 2013 to 48% in 2017. Although that is low by international standards, analysts said debt burdens were heavier than they appeared because of most African countries’ low tax base. “The real thing to look for is debt to revenue, or debt-service as a percentage of government spending,” said John Ashbourne, Africa Economist at Capital Economics. In several countries, he said, debt payments were above 20% of government revenue, with an opportunity cost in terms of government spending.

Extract E

Mozambique’s economic stability is being put to the test

The economy of Mozambique, which gained independence from Portugal in 1975, has continued to under-perform. Large-scale emigration, especially of skilled workers, economic dependence on South Africa, a severe drought, a prolonged civil war and political tensions have hindered the country’s development. More than half of Mozambique’s 26 million people continue to live below the poverty line.

GDP growth declined to 3.6% in 2016 due to fiscal tightening and a slowdown in foreign direct investment. A weak manufacturing sector employs just 3.2% of the population, and is made up of small enterprises (90%), many of which were set up with the aid of microfinance. Traditional export earnings dropped due to depressed global demand.

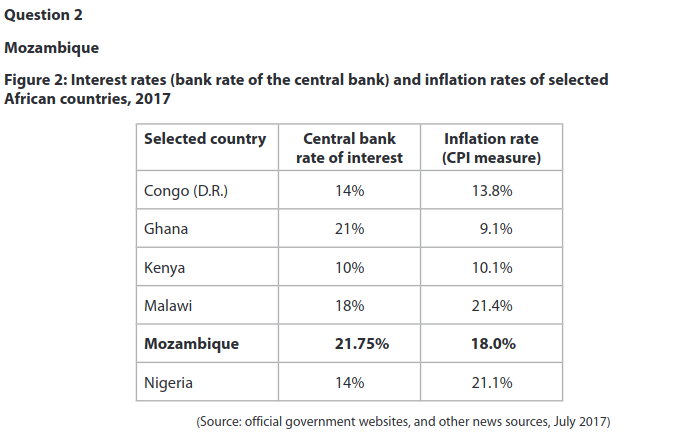

In addition a wide-scale drought seriously affected agricultural production. Foreign currency inflows have weakened – as large-scale gas projects were put on hold, and 14 external lenders suspended direct budget support, as a lesson to be learned from the tuna-fleet scandal. The state budget deficit was 10.7% of GDP in 2017. High interest rates have reduced aggregate demand, and import costs added to inflation following further depreciation of Mozambique’s currency, the metical, to a new low of 100 meticals to £1. Mozambique needs urgently to improve its investment environment and confidence in its institutions. The World Economic Forum’s global competitiveness ranking placed Mozambique 136 out of 137 countries.

Longer term, Mozambique’s economic prospects are promising. There has been progress in talks on restoring international confidence in the government’s running of the economy, leading to a lasting and sustainable agreement between rival political groups. The development of gas fields off Mozambique’s coast discovered in 2011 is set to transform the economy, coming into production in the 2020s. A rise in coal and electricity exports should help growth to increase. But in the short term, it remains uncertain whether Mozambique can deliver badly needed economic stability.

Extract F

Microfinance in Mozambique

Microfinance in Mozambique started in the late 1980s through projects initiated by international relief organisations. The sector has expanded to include many private banks and non-government organisations (NGOs), see Figure 3. This has resulted in wider use (over 100 000 borrowers) and many new business start-ups which could not have gained finance from any other source. Evidence suggests that there is unfulfilled demand for microfinance and a large potential for expansion.

(a) With reference to Extract D line 21, explain why ‘opportunity cost’ is a problem for governments of developing countries when servicing debt. (5 points)

(b) Examine two reasons, apart from access to finance, why 90% of the manufacturing sector in Mozambique ‘is made up of small enterprises’ (Extract E, line 9). (8 points)

(c) Discuss whether borrowers benefit from microfinance. Make reference to Mozambique in your answer. (12 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic factors, apart from access to credit and banking, influencing growth and development in Mozambique. (25 points)

OR

(e) Evaluate the likely microeconomic and macroeconomic effects of relatively high inflation rates in many African countries. (25 points)

Question 10: Edexcel A-Level Economics 9ECO June 2017 Paper 3

Extract C

The National Living Wage (NLW)

The Government has announced that from 2016 it will introduce a Living Wage Premium that will apply on top of the National Minimum Wage (NMW) for employees aged 25 and over to deliver a National Living Wage (NLW) for those people. The main NMW will continue to be set for all employees aged 21 and over, so that those aged 21 to 24 will continue to be subject only to that rate.

The effective minimum wage for the 25+ age group will therefore be over 13% higher in 2020 than would otherwise have been the case, and result in a 0.3% increase in wage costs overall. Further impacts on real GDP are estimated to be higher productivity (+0.3%) but lower average hours worked (-0.2%) and higher unemployment. Overall real GDP is forecast to fall by 0.1% as a result of the NLW. However these forecasts depend on estimates of the likely elasticity of demand for labour.

Academic evidence suggests that changes to the NMW since 1999 have led to only limited effects on demand for labour in the UK. The types of work that will be affected are relatively labour intensive, which may limit the scope for firms to substitute toward using capital. Firms may also be expected to shift demand in favour of the under-25s given that they will not be subject to the NLW, which all else being equal would lead to a smaller reduction in overall labour demand. Some of the reduction in employees could also be partially offset by a rise in self-employment. But increasing the NLW to a higher proportion of median earnings may lead to bigger effects than have been experienced in the past.

Extract D

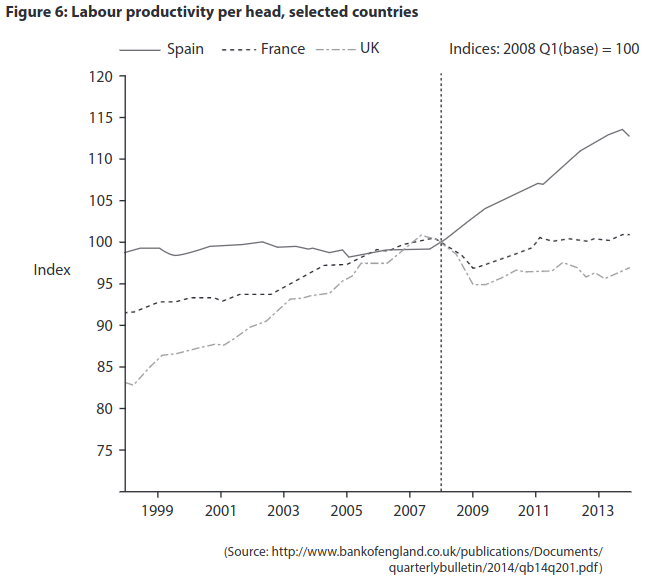

The productivity puzzle in the UK

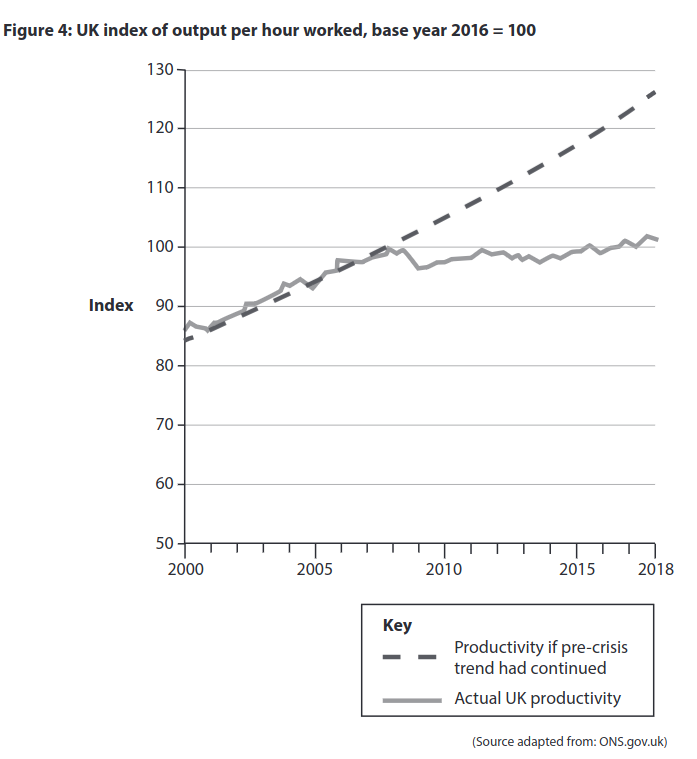

Since the onset of the 2007–2008 financial crisis, labour productivity growth in the UK has been exceptionally weak. Despite some modest improvements in 2013, whole-economy output per hour remains around 16% below the level implied by its pre-crisis trend. Even taking into account possible measurement issues and changes in the size of the service sector, this shortfall is large and is often referred to as the ‘productivity puzzle’.

Measures of productivity can be used to inform estimates of an economy’s ability to grow without generating excessive inflationary pressure, which makes understanding recent movements important for the conduct of monetary policy. During the initial phases of the recession, companies appear to have acted flexibly by holding on to labour and lowering levels of capacity utilisation in response to weak demand conditions. But the protracted weakness in productivity and the strength in employment growth over the past two years suggest that other factors are likely to be having a more persistent impact on the level of productivity. These factors are reduced investment in both physical and intangible capital, such as innovation and training, and failings in the labour market such as immobility of labour and under-employment of skilled workers. Some economists explain this by using the concept of an output gap.

(a) With reference to Extract D (line 18), explain the meaning of the term ‘output gap’. Use an aggregate demand and aggregate supply diagram in your answer. (5 points)

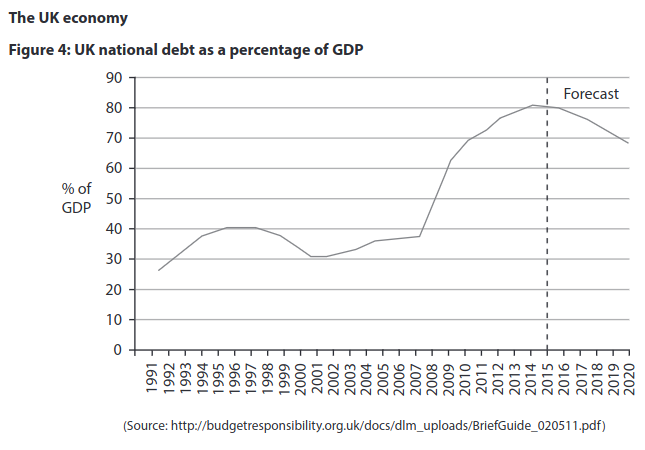

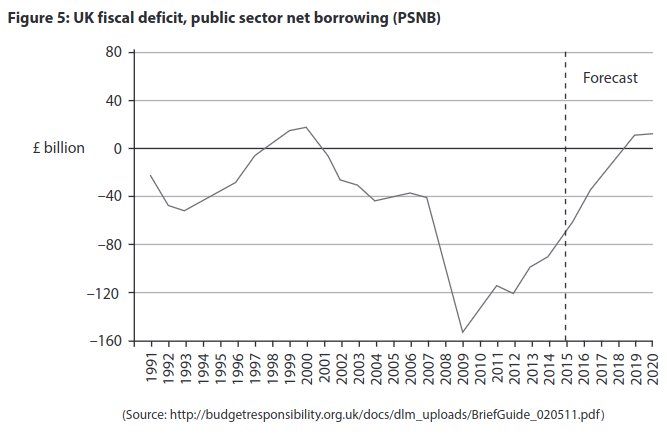

(b) With reference to Figures 4 and 5 and your own knowledge, examine the relationship between the national debt as a proportion of GDP and the fiscal deficit. (8 points)

(c) Discuss the likely impact of the National Living Wage on the profitability of firms. Use a cost and revenue diagram in your answer. (12 points)

EITHER

(d) With reference to the information provided and your own knowledge, evaluate the likely microeconomic and macroeconomic influences on the UK’s international competitiveness. (25 points)

OR

(e) With reference to the information provided and your own knowledge, evaluate the microeconomic and macroeconomic effects of a government policy of cutting public expenditure rather than raising taxes as a means of reducing a fiscal deficit. (25 points)

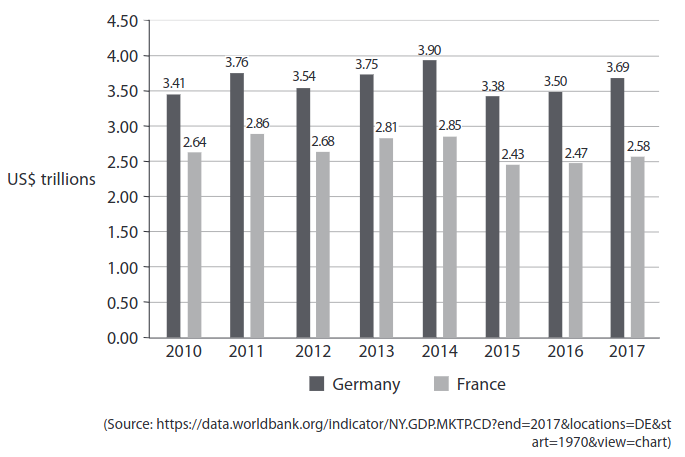

Question 11: Edexcel A-Level Economics 9EC0 November 2021 Paper 2

GDP at Purchasing Power Parities, Germany and France (nominal, trillions of US dollars) 2010–2017.

(a) From the data in the graph above, which one of the following may be deduced? (1 point)

A France’s rate of inflation was lower than Germany’s in 2017

B Germany’s GDP is smaller than France’s in every year shown

C In every year that France’s GDP fell compared to the previous year, Germany’s GDP did too

D The GDP of both Germany and France fell between 2015 and 2016

(b) Calculate the percentage change in Germany’s nominal GDP from 2016 to 2017. (2 points)

(c) Explain one reason why Purchasing Power Parities are used. (2 points)

Question 12: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

Extract A

UK companies use forward currency market

The Norfolk-based picture frames maker Nielsen Bainbridge recently made forward contracts in the foreign exchange market to reduce the impact of currency fluctuations. The pound’s post-Brexit referendum depreciation has been a test of nerve for Nielsen Bainbridge and many other importers. At present the company’s suppliers are located in Europe or China. “Currency therefore has a big impact on our business and the margins we can obtain,” says Ms Burdett, the Finance Director. Forward contracts enable institutions, businesses and individuals to lock in an exchange rate over a certain period of time regardless of how the rate moves during that time. Ms Burdett buys currency as soon as Nielsen Bainbridge confirms a large order as a way to fix costs. One-third of UK business managers are considering shifting from EU to UK suppliers.

Extract B

Bank of England seeking to prevent future bank bailouts

The Bank of England has ordered big lenders in the UK to find £116 billion of funding to ensure that taxpayers will never again have to bail out the banking sector. The Bank intends to publish details of how each of the big lenders would cope in the event they find themselves in a situation similar to Royal Bank of Scotland and Lloyds Banking Group, which needed £65 billion of taxpayer bailouts during the 2008 Global Financial Crisis. This had a significant negative impact on the UK government’s national debt and, many would argue, increased the need for contractionary fiscal policy. Having said that, the UK government sold all its shares in Lloyds Banking Group in 2017 and, according to the Chancellor of the Exchequer, “recovered every penny of its investment in Lloyds”. Sir Jon Cunliffe, the deputy governor at the Bank responsible for financial stability, said regulators needed to let banks fail in a similar way that traditional companies collapse. This has not been possible in the past because of the risk that savers lose their money and because a system did not exist to allow banks to be put into insolvency. “Just like when other businesses fail, losses arising from bank failure would be imposed on shareholders and investors. This protects the public from loss and incentivises banks to operate more prudently,” said Cunliffe.

Extract C

Bank of England tells lenders to increase capital reserves

The Bank of England has told lenders they will need to build a special reserve worth £11.4 billion by the end of 2018 as it tries to make banks more resilient to the risk posed by mounting consumer debt. This reserve of assets that can be readily turned into cash is a way of forcing banks to set aside capital reserves in good times in order to keep lending to the wider economy at a steady level, even during an economic downturn. In 2017 the Bank of England told UK banks it would raise the reserve ratio, relative to all assets, from zero to 0.5% and also forecast a further increase to 1% by the end of 2017.

The move is not intended to directly reduce consumer demand for credit, which in 2017 grew by 10.3% on an annual basis, but it may well lead to banks becoming less willing to lend to consumers. Since the Bank of England has recently become increasingly concerned about consumer borrowing, including rising car loans and credit card debt, this may be no bad thing as far as the Bank of England is concerned, even if it does have a negative impact on the wider economy.

Analysts are concerned about the impact on consumer confidence of rising inflation, partly caused by a falling pound. With falling real incomes consumers could become more vulnerable to falling behind with their credit card and personal loan repayments. Despite these concerns the UK economy recently recorded the lowest rate of unemployment since 1975.

(a) With reference to Extract A, explain the role of forward markets in currencies. (5 points)

(b) With reference to Extract A and Figure 1, examine the likely impact of the change in the sterling exchange rate on the UK economy. (8 points)

(c) With reference to the last paragraph in Extract C, assess the impact of a fall in real incomes on subjective happiness. (10 points)

(d) With reference to Extract C, discuss the potential conflicts between macroeconomic objectives when the central bank attempts to control inflation. (12 points)

(e) Discuss whether providing substantial government financial support to banks is the best policy response during a financial crisis. (15 points)

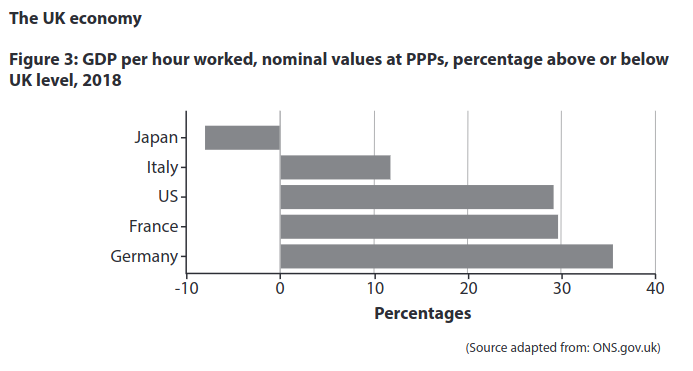

Question 13: Edexcel A-Level Economics 9EC0 November 2020 Paper 3

Extract D

The end of the High Street?

Homebase, the UK’s second‑largest do‑it‑yourself (DIY) retailer, made £20–40 million a year profit up to 2016. The Australian conglomerate Wesfarmers bought Homebase for £340 million in 2016, and began to rebrand 24 stores under its own name. It scaled back on curtain, cushion and other homeware sales in favour of power tools and building materials.

In 2018 Wesfarmers sold the DIY chain for £1, in the face of “extremely challenging” market conditions and excess store space. The chain was bought by restructuring specialist Hilco, which had also rescued the music chain HMV in 2013, and the stores have gone back to using the Homebase name. Over 70% of Homebase stores are currently losing money and the new owner wants to exit loss‑making stores and agree to rent reductions, as sales fell 10% in 2018. Homebase has gone back to popular products and brands dropped by its previous owner Wesfarmers.

The closures will add to the mounting job losses on Britain’s high streets. About 25 000 jobs have gone in the first seven months of 2018, according to analysis by an economics thinktank. A further 8 300 jobs are under threat at suppliers, with the multiplier effect meaning that GDP is £1.5 billion less than projected.

Several Marks & Spencer clothing stores closed their doors for the last time as the high‑street chain pushes ahead with a transformation plan. It plans to close 100 stores by 2022. Toys R Us, Poundworld and Maplin have shut down completely, while New Look, Mothercare and Carpetright have plans to close hundreds of stores as losses rise sharply.

Increasing rents and higher business rates have occurred at the same time as falling consumer confidence. Meanwhile, House of Fraser employees and pensioners are nervously awaiting more details about their future. The £90 million rescue deal by Sports Direct, the sportswear chain controlled by Mike Ashley, will protect 16 000 jobs for the time being.

(a) With specific reference to Figure 3, explain why productivity is measured by ‘GDP per hour worked, nominal values at PPPs’. (5 points)

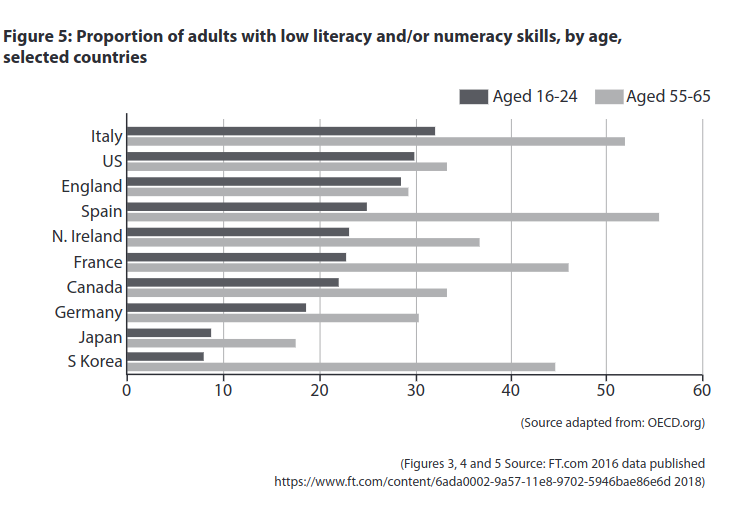

(b) Apart from literacy and numeracy skills in young workers, examine one reason for the trend in productivity in the UK, over the period shown in Figure 4. (8 points)

(c) Discuss factors that are causing many high street retailers in the UK to close some branches or shut down completely. Use a cost and revenue diagram to support your answer (12 points).

EITHER

(d) Evaluate possible microeconomic and macroeconomic policies which could be used to improve UK competitiveness. (25 points)

OR

(e) Evaluate the microeconomic and macroeconomic effects of a decline in the literacy and numeracy skills of a country’s young workers. (25 points)

Question 14: Edexcel A-Level Economics 9EC0 November 2020 Paper 2

Extract A

Cheap cocoa is costing farmers dear

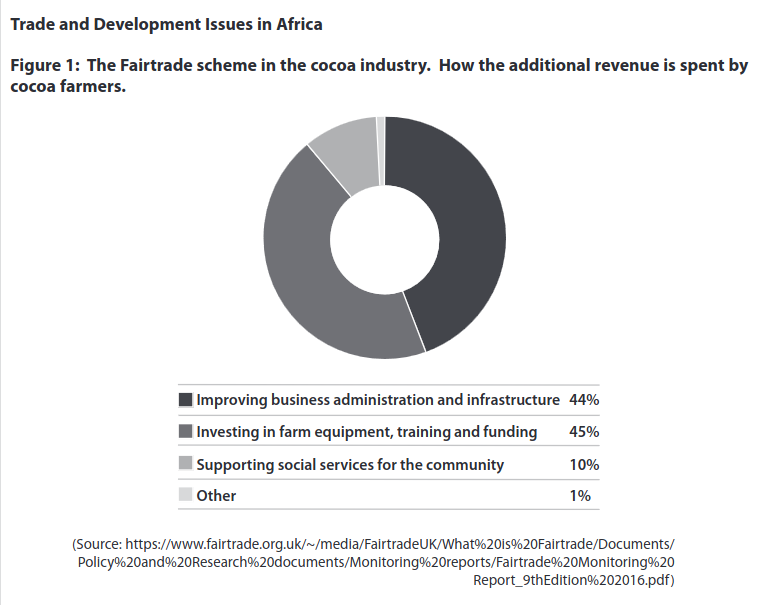

The median annual income of cocoa farmers in the west African country, Ivory Coast, is just US$2 600. Research suggests that an annual income of US$6 133 is needed for this country’s farmers to have a decent, living income. This situation is even worse for farmers who are not part of a Fairtrade scheme.

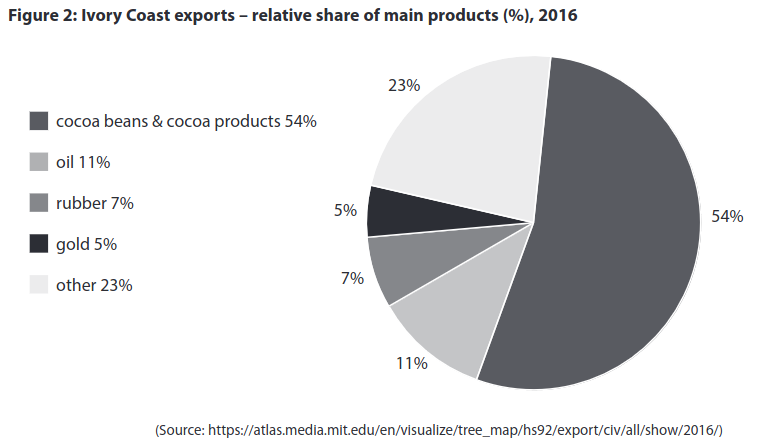

World cocoa prices fell by more than a third in 2017. Cocoa farmers have to accept all the risk from price volatility, putting a significant strain on their fragile incomes. On the other hand, cocoa processors and chocolate manufacturers are able to adapt or even make high profit and consumers continue to enjoy their chocolate.

This is still happening despite considerable investment in agriculture to build a sustainable cocoa sector. The focus has been on raising productivity and diversifying crops. The average cocoa farm in the Ivory Coast produces only around half of the output that could be achieved with training and resources such as fertilisers, equipment and replanting. If farmers diversify into other crops, livestock or non‑farm activities, they lower the risk they face of fluctuating world cocoa prices.

Even tripling farm output would not provide the average cocoa farmer with a living income. Diversification alone will not always make farms more profitable. If we want farmers to earn a living income, we must also be willing to pay farmers more.

Extract B

Sub‑Saharan Africa is becoming more integrated

After two years of negotiations, representatives of a large number of African countries signed the African Continental Free Trade Agreement (AfCFTA) in Kigali on March 21, 2018. This created a trading bloc of 1.2 billion people with a combined gross domestic product of more than US$2 trillion. The agreement committed countries to removing tariffs on 90% of goods and to liberalise services.

This can be seen as a sign of rapid and steady regional integration. Sub‑Saharan Africa in particular is much more integrated today than in the past. The level of integration in sub‑Saharan Africa is now similar to that in the world’s other developing and emerging market economies.

However, the two largest African economies, Nigeria and South Africa, refused to sign the agreement. Nigeria’s manufacturers and trade unions are concerned about the potential negative impacts of becoming more open to imports from other African countries with lower labour costs.

Greater interdependence can expose small economies to their partners’ recessions. After nearly 20 years of strong economic activity, sub‑Saharan Africa experienced the downside of integration in 2015. The collapse in commodity prices and the slowdown in economic activity in Nigeria and South Africa contributed to sub‑Saharan African growth slowing sharply. Since 2017 growth has begun to recover. The recovery is mixed, though, and it is unclear to what extent the slow recovery of the larger economies is still affecting the rest of sub‑Saharan Africa.

(a) With reference to Figure 1 and Extract A, explain the likely impact of a Fairtrade scheme on agricultural communities. (5 points)

(b) Examine two ways, apart from Fairtrade schemes, in which cocoa farmers could boost their incomes despite the falling price of cocoa. (8 points)

(c) Discuss the problems for the Ivory Coast of dependency on cocoa for a large proportion of their exports. Refer to Figure 2 in your answer. (12 points)

(d) Nigeria is considering joining the African Continental Free Trade Agreement. Assess policies the Nigerian government could use in response to the concerns of the country’s ‘manufacturers and trade unions’ (Extract B paragraph 3) if they join this trading bloc. (10 points)

(e) Discuss the likely benefits of increased economic integration for sub‑Saharan African countries. (15 points)

Question 15: Edexcel A-Level Economics 9EC0 May 2019 Paper 2

Three of Africa’s main trading blocs have agreed to form the Tripartite Free Trade Agreement (TFTA). This will create one of the world’s largest free trade areas, stretching across 26 countries with a combined GDP of around £1 trillion.

Evaluate the effects of the growth of trading blocs such as the TFTA on global trading patterns (25 points).

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.