What is the Edexcel A-Level Economics test?

The Edexcel A-Level Economics test is an economics-focused qualification offered to British students in their final two years of secondary school study. A-levels are typically taken as courses intended to lead to University or other further education. A-level economics students will often go on to study economics or a similar subject at University. The Edexcel A-Level Economics test is offered by Pearson Edexcel. The main alternative to Edexcel is the AQA A-Level Economics course. Edexcel is a privately-owned British education and exams body founded in 1996. Edexcel has been owned by Pearson plc. since 2005. Edexcel produces qualifications and tests for the British education system and is the UK’s largest entity offering educational qualifications.

Where did we get these Edexcel Economics A-Level Past Paper Purchasing Power Parities Questions?

We found these Edexcel Economics A-Level Past Paper purchasing power parities questions by going through past Edexcel A-Level Economics papers according to the current specification. We picked out purchasing power parities questions and put them together in this list so that you can go through them without having to search through the different Edexcel A-Level Economics papers currently online.

Want questions for other topics in A-Level Economics? You can find more A-Level Economics Past Paper Questions here.

What are Purchasing Power Parity?

Purchaisng power parity is a way of comparing the value of two different currenices through a “basket of goods.” A basket of goods is a collection of commonly purchased goods and services that is used for measuring inflation as well as purchasing power parity. The best way to understand purchasing power parity is to look at it in action. One pound (GBP) is roughly equivalent to 1,000 Indian Rupees (RPS) according to the formal exchange rate. But, this measurement does not give you a whole picture. A simple lunch in the UK would cost you £5 whereas a comparable lunch in India would cost 300 Rupees, which is roughly 30p according to the formal exchange rate. If I converted my £5 to Indian Rupees and went to India, I would have effectively increased my purchasing power by 16 times. In the UK, I could only buy one lunch. Now in India, I have enough money for 16 lunches. Whereas the exchange rate is dictated by the supply and demand of different currencies, purchasing power parity is adjusted based on the differences in the cost of living between different countries.

What is an exchange rate?

The exchange rate is the rate at which one currency can be exchanged for another. If I can get $1.60 for my £1, then the exchange rate is 1:1.6. Exchange rates are often unstable and change depending on several factors, including the trade between two countires, the balance of tourism between them, and the level of confidence in a country’s economic future. Some traders will speculate on the value of currencies (placing bets on the future values of currencies, i.e. FOREX trading), which can cause the exchange rates to change. A good illustration of this principle is the sudden fall in the value of the pound following Liz Truss’ announcement of tax cuts for top-end earners. The government hadn’t actually done anything but the announcement spooked investor’s confidence in the UK economy and they converted their pounds to other currencies. A country’s exchange rate can have a profound effect on their economic fortunes. A low-value currency can make your exports cheaper for other companies in other countries to buy. Some developing countries – notably China – have enacted policies to intentionally keep the value of their currencies low so they can continue to grow their export industry.

You can check out our Edexcel A-Level Economics Notes here.

Question 1: Edexcel A-Level Economics 9EC0 November 2021 Paper 2

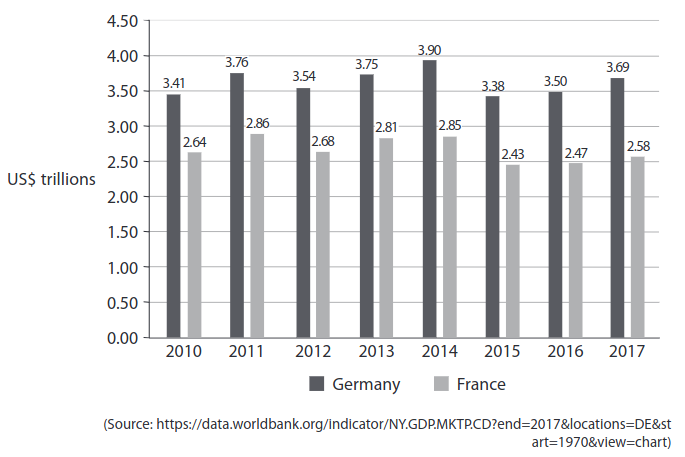

GDP at Purchasing Power Parities, Germany and France (nominal, trillions of US dollars) 2010–2017.

(a) From the data in the graph above, which one of the following may be deduced? (1 point)

A France’s rate of inflation was lower than Germany’s in 2017

B Germany’s GDP is smaller than France’s in every year shown

C In every year that France’s GDP fell compared to the previous year, Germany’s GDP did too

D The GDP of both Germany and France fell between 2015 and 2016

(b) Calculate the percentage change in Germany’s nominal GDP from 2016 to 2017. (2 points)

(c) Explain one reason why Purchasing Power Parities are used. (2 points)

Question 2: Edexcel A-Level Economics May 2019 Paper 2

Extract A

UK companies use forward currency market

The Norfolk-based picture frames maker Nielsen Bainbridge recently made forward contracts in the foreign exchange market to reduce the impact of currency fluctuations. The pound’s post-Brexit referendum depreciation has been a test of nerve for Nielsen Bainbridge and many other importers. At present the company’s suppliers are located in Europe or China. “Currency therefore has a big impact on our business and the margins we can obtain,” says Ms Burdett, the Finance Director. Forward contracts enable institutions, businesses and individuals to lock in an exchange rate over a certain period of time regardless of how the rate moves during that time. Ms Burdett buys currency as soon as Nielsen Bainbridge confirms a large order as a way to fix costs. One-third of UK business managers are considering shifting from EU to UK suppliers.

Extract B

Bank of England seeking to prevent future bank bailouts

The Bank of England has ordered big lenders in the UK to find £116 billion of funding to ensure that taxpayers will never again have to bail out the banking sector. The Bank intends to publish details of how each of the big lenders would cope in the event they find themselves in a situation similar to Royal Bank of Scotland and Lloyds Banking Group, which needed £65 billion of taxpayer bailouts during the 2008 Global Financial Crisis. This had a significant negative impact on the UK government’s national debt and, many would argue, increased the need for contractionary fiscal policy. Having said that, the UK government sold all its shares in Lloyds Banking Group in 2017 and, according to the Chancellor of the Exchequer, “recovered every penny of its investment in Lloyds”. Sir Jon Cunliffe, the deputy governor at the Bank responsible for financial stability, said regulators needed to let banks fail in a similar way that traditional companies collapse. This has not been possible in the past because of the risk that savers lose their money and because a system did not exist to allow banks to be put into insolvency. “Just like when other businesses fail, losses arising from bank failure would be imposed on shareholders and investors. This protects the public from loss and incentivises banks to operate more prudently,” said Cunliffe.

Extract C

Bank of England tells lenders to increase capital reserves

The Bank of England has told lenders they will need to build a special reserve worth £11.4 billion by the end of 2018 as it tries to make banks more resilient to the risk posed by mounting consumer debt. This reserve of assets that can be readily turned into cash is a way of forcing banks to set aside capital reserves in good times in order to keep lending to the wider economy at a steady level, even during an economic downturn. In 2017 the Bank of England told UK banks it would raise the reserve ratio, relative to all assets, from zero to 0.5% and also forecast a further increase to 1% by the end of 2017.

The move is not intended to directly reduce consumer demand for credit, which in 2017 grew by 10.3% on an annual basis, but it may well lead to banks becoming less willing to lend to consumers. Since the Bank of England has recently become increasingly concerned about consumer borrowing, including rising car loans and credit card debt, this may be no bad thing as far as the Bank of England is concerned, even if it does have a negative impact on the wider economy.

Analysts are concerned about the impact on consumer confidence of rising inflation, partly caused by a falling pound. With falling real incomes consumers could become more vulnerable to falling behind with their credit card and personal loan repayments. Despite these concerns the UK economy recently recorded the lowest rate of unemployment since 1975.

(a) With reference to Extract A, explain the role of forward markets in currencies. (5 points)

(b) With reference to Extract A and Figure 1, examine the likely impact of the change in the sterling exchange rate on the UK economy. (8 points)

(c) With reference to the last paragraph in Extract C, assess the impact of a fall in real incomes on subjective happiness. (10 points)

(d) With reference to Extract C, discuss the potential conflicts between macroeconomic objectives when the central bank attempts to control inflation. (12 points)

(e) Discuss whether providing substantial government financial support to banks is the best policy response during a financial crisis. (15 points)

Question 3: Edexcel A-Level Economics 9EC0 November 2020 Paper 3

Extract D

The end of the High Street?

Homebase, the UK’s second‑largest do‑it‑yourself (DIY) retailer, made £20–40 million a year profit up to 2016. The Australian conglomerate Wesfarmers bought Homebase for £340 million in 2016, and began to rebrand 24 stores under its own name. It scaled back on curtain, cushion and other homeware sales in favour of power tools and building materials.

In 2018 Wesfarmers sold the DIY chain for £1, in the face of “extremely challenging” market conditions and excess store space. The chain was bought by restructuring specialist Hilco, which had also rescued the music chain HMV in 2013, and the stores have gone back to using the Homebase name. Over 70% of Homebase stores are currently losing money and the new owner wants to exit loss‑making stores and agree to rent reductions, as sales fell 10% in 2018. Homebase has gone back to popular products and brands dropped by its previous owner Wesfarmers.

The closures will add to the mounting job losses on Britain’s high streets. About 25 000 jobs have gone in the first seven months of 2018, according to analysis by an economics thinktank. A further 8 300 jobs are under threat at suppliers, with the multiplier effect meaning that GDP is £1.5 billion less than projected.

Several Marks & Spencer clothing stores closed their doors for the last time as the high‑street chain pushes ahead with a transformation plan. It plans to close 100 stores by 2022. Toys R Us, Poundworld and Maplin have shut down completely, while New Look, Mothercare and Carpetright have plans to close hundreds of stores as losses rise sharply.

Increasing rents and higher business rates have occurred at the same time as falling consumer confidence. Meanwhile, House of Fraser employees and pensioners are nervously awaiting more details about their future. The £90 million rescue deal by Sports Direct, the sportswear chain controlled by Mike Ashley, will protect 16 000 jobs for the time being.

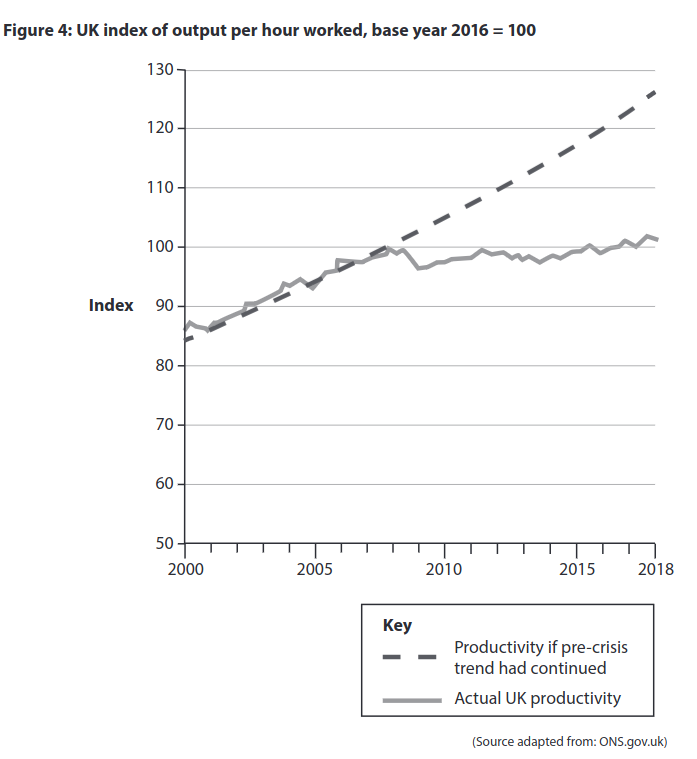

(a) With specific reference to Figure 3, explain why productivity is measured by ‘GDP per hour worked, nominal values at PPPs’. (5 points)

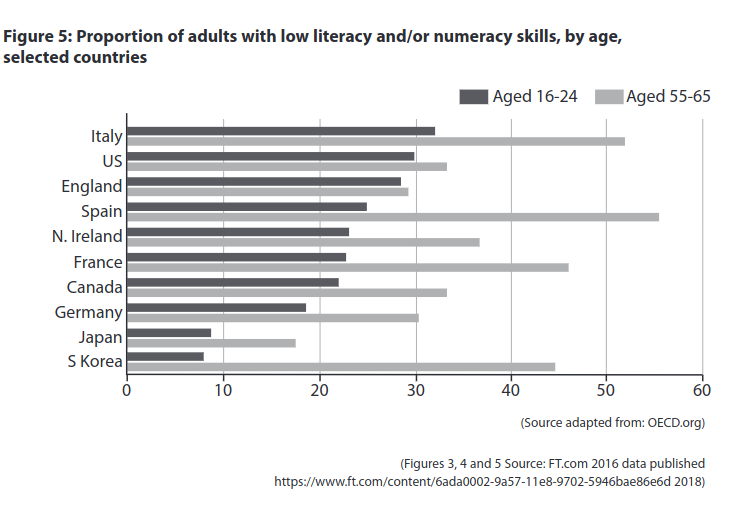

(b) Apart from literacy and numeracy skills in young workers, examine one reason for the trend in productivity in the UK, over the period shown in Figure 4. (8 points)

(c) Discuss factors that are causing many high street retailers in the UK to close some branches or shut down completely. Use a cost and revenue diagram to support your answer (12 points).

EITHER

(d) Evaluate possible microeconomic and macroeconomic policies which could be used to improve UK competitiveness. (25 points)

OR

(e) Evaluate the microeconomic and macroeconomic effects of a decline in the literacy and numeracy skills of a country’s young workers. (25 points)

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.