This article is a study resource intended to help you focus on sharpening your knowledge of Theme 1 of the Edexcel A-Level Economics curriculum. Theme 1 covers the introductory concepts of microeconomics like supply and demand and the price mechanism. We’ve put together all the Edexcel Economics past paper Theme 1 questions we could find. You can find the answer key at the bottom of this page.

What is Edexcel A-Level Economics?

Edexcel A-Level Economics is a university-preparation course in economics offered to British students in their last two years of secondary school. There are many other A-Level Economics courses that cover similar material offered by exam boards like AQA , Eduqas, and CIE. All of these courses cover similar material. However, the Edexcel Economics A-Level is by far the most popular.

Edexcel is a privately-owned company and is the largest exam provider in the UK.

Where did we get these Edexcel Economics A-Level Past Paper Theme 1 Questions?

We went through all the A-Level Economics past papers published by Edexcel and picked out all the Theme 1 questions we could find. Our goal was to save you the hassle of going through these tests yourself. We do not claim the rights to any of these questions as they are the intellectual property of Edexcel. You can find the answer key as a downloadable pdf at the bottom of this page.

Want questions for other topics in A-Level Economics? You can find more A-Level Economics Past Paper Questions here.

What is included in Theme 1?

Theme 1 is the section of the Edexcel A-Level Economics specification that introduces the basic ideas of microeconomics like supply and demand and market failure. You should expect to cover topics like price determination, consumer and producer surplus, government intervention, public goods, and information gaps. Later on in your studies, you will build on Theme 1 with Theme 3, which covers microeconomics in a business context. The core topics covered in Edexcel A-Level Economics Theme 3 are as follows:

- Production possibility frontiers: Production possibility frontiers are a graphical representation of the production capacity of an economy or a company and represent the trade-offs that producers or governments make when choosing to make one product over another.

- Supply and demand: Supply and demand are the two factors that influence the price of a product and are represented on the supply and demand diagram. Supply is the amount of a good produced in an economy at a given price, which is influenced by factors like the cost of input goods and labour costs. Demand is the amount of a product consumers are willing to buy at a given price, which is influenced by consumer preferences and incomes.

- Price mechanism: The price mechanism is the role of price in a market economy in determining how much of a product is produced and who is allocated that produce.

- Behavioural economics: Behavioural economics is the study of how non-rational human behaviour influences our basic assumptions about market economies and can result in market failure.

- Externalities: Externalities are the difference between the societal harms and benefits of an exchange and that transaction’s private harms and benefits. The private benefit of driving a car is convenient transportation while the societal harm of a car is its pollution and impact on congestion.

- Public goods: Public goods are non-excludable and non-rivalrous goods, meaning that it is not possible to prevent someone from consuming the good and one person’s use of that good does not prevent someone else from using it. An example of a public good is a low crime level caused by effective policing.

You can check out our Edexcel A-Level Economics Notes here.

Question 1: Edexcel 9ECO November 2021 Paper 1

Extract A

Marginal productivity of cabin crew

Cabin crew are responsible for loading passengers and providing in-flight meals. United Airlines is planning to reduce the number of its cabin crew members onboard international flights. The airline currently operates its planes with one more cabin crew member than its competitors. The marginal productivity of this additional crew member may be low. By reducing the number of its cabin crew members United Airlines will be able to operate more efficiently and compete more effectively.

Extract B

Thomas Cook’s environmental impact

Thomas Cook Group plc’s operations included its airline and 560 high street travel agents providing flights, hotels and package holidays.

The environmental impact of the travel industry is significant. It accounts for 8% of all global carbon emissions. Thomas Cook recognised the risks presented by climate change and actively engaged in reducing their airline emissions. Its plans included using more efficient aircraft and using lower-carbon fuel. In 2018, Thomas Cook was included in the top 10 of the world’s most fuel-efficient airlines.

Extract C

Why did Thomas Cook shut down?

Thomas Cook Group plc ceased trading on 23 September 2019. The collapse of Thomas Cook left 600 000 travellers stranded overseas and approximately 21 000 worldwide employees were left without a job.

Thomas Cook’s management said that the failure of rescue talks between banks, shareholders and the UK Government meant it had no choice but to shut down the business. But in truth the tour operator’s problems go back much further. A disastrous merger in 2007, increased debts, the internet revolution in holiday booking and Brexit uncertainty all contributed to the failure of the business.

In 2007 it merged with MyTravel. Thomas Cook directors had an objective of rapid company growth over short-term profitability. The merger was supposed to create a European giant, promising £75 million-a-year cost savings and a springboard to challenge emerging internet rivals. In reality, Thomas Cook was merging with a company that had only made a profit once in the previous six years, and the deal left the Group with huge debts. In May 2019, the firm reported a £1.5 billion loss.

The role of the management in Thomas Cook’s collapse is being investigated by the UK Government. Thomas Cook executives’ salaries and bonuses have been questioned. Directors received salaries totalling £20 million in the five years before its collapse. The Chief Executive Officer (CEO) earned a £500 000 cash bonus in 2017 and about £8.5 million in his five years with the company. It seems that around £4 million of this was in the form of shares. The share price reached £1.46 in 2018, but each share is now worthless.

The CEO said that the directors had worked “exhaustively” to rescue Thomas Cook and create a long-term turnaround strategy. “It is a matter of profound regret to me and the rest of the board that we were not successful.”

The UK prime minister admitted that the government refused to grant £150 million as a subsidy to help rescue Thomas Cook in the short run. The UK prime minister stated: “Clearly, that is a lot of taxpayers’ money and sets up, as people will appreciate, a moral hazard in the case of future such commercial difficulties that companies face. I have questions about whether it’s right that the directors, or whoever, the board, should pay themselves large sums when businesses can go down the tubes like that. One is driven to reflect on whether the directors of these companies are properly incentivised to sort such matters out”.

(a) Explain the likely impact of diminishing marginal productivity of labour on cabin crew staffing levels. Refer to Extract A in your answer. (5 points)

(b) Examine the likely impact of Thomas Cook’s plan ‘to reduce their airline emissions’ (Extract B, line 6) on the social optimum position. Use an appropriate externalities diagram in your answer. (8 points)

(c) With reference to Extract C, assess whether Thomas Cook’s failure was caused by the principal-agent problem. (10 points)

(d) With reference to Extract C, discuss the proposed government subsidy to prevent Thomas Cook from reaching its shut-down point. (12 points)

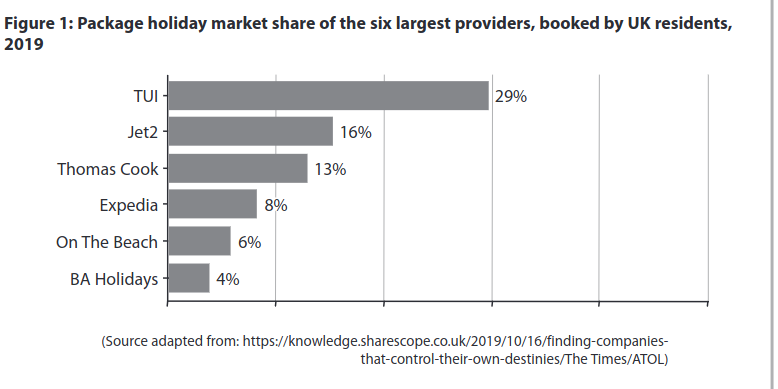

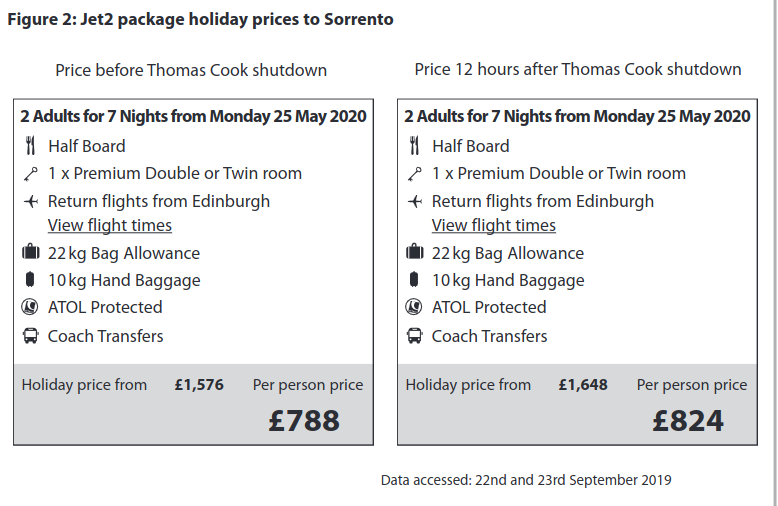

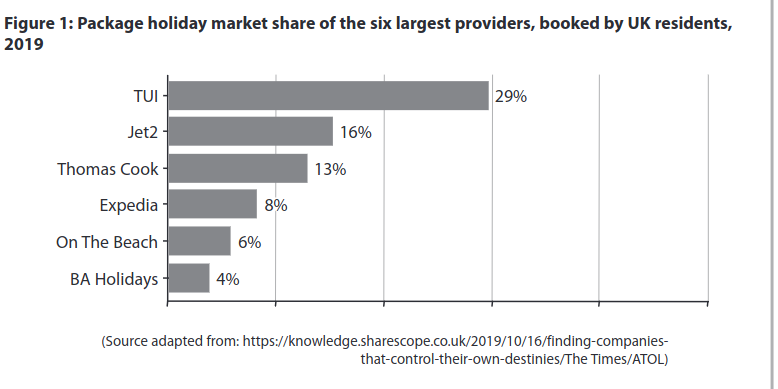

(e) With reference to the information provided, discuss the decision by Jet2 to increase its package holiday prices. (15 points)

Question 2: Edexcel 9ECO November 2020 Paper 1

The external benefits of higher education include increased tax revenue, faster economic growth, greater innovation and labour market flexibility.

(a) Draw an externalities diagram to show the likely impact of the consumption of higher education. (4 points)

(b) On average, in the UK, a working-age graduate earns approximately £10 000 more per year than a non-graduate.

This suggests a university degree provides a substantial (1 point)

A external benefit

B external cost

C private benefit

D social cost

Question 3: Edexcel 9ECO November 2020 Paper 1

The International Energy Agency has predicted that oil use by cars will peak in 2025 because of the increasing number of drivers switching to electric vehicles.

Evaluate the likely microeconomic consequences of consumers shifting from vehiclespowered by fuel obtained from oil to electric-powered vehicles. (25 points)

Question 4: Edexcel 9ECO June 2018 Paper 1

In September 2016 the government approved the building of an £18 billion nuclear power station, Hinkley Point C, which will supply 7% of UK electricity for up to 60 years. The power station is funded by Chinese and French investment. Evaluate the likely private costs and external costs involved in such major power station construction projects. Use an appropriate externalities diagram in your answer. (25 points)

Question 5: Edexcel 9ECO November 2021 Paper 2

It has been estimated that if climate change led to the world’s temperature rising 2.5 °C compared to the temperature in 2010, then global GDP per capita would be 15% lower by 2100. If temperatures rise by 4 °C compared to the temperature in 2010, then by 2100 global GDP per capita would decline by more than 30%.

Evaluate the potential trade-offs between environmental protection and other macroeconomic objectives. (25 points)

macroeconomic objectives. (25 points)

Question 6: Edexcel 9ECO June 2017 Paper 3

Extract A

Chile’s economic outlook brightens

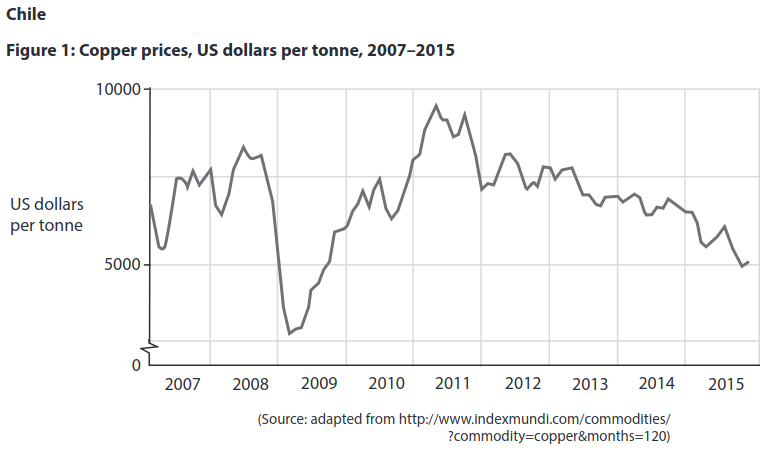

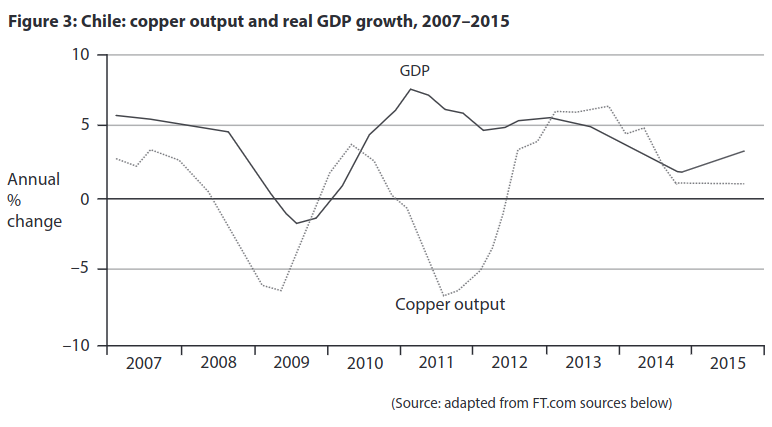

Chile has been hit hard by a worldwide fall in commodity prices since 2011. Copper accounts for 20% of Chile’s GDP and 60% of its exports; one third of the world’s copper is produced by Chile. China purchased 40% of the world’s copper, so a slowdown in China combined with increased global over-supply has meant copper prices have collapsed (see Figure 1). Chilean government income from copper exports had reached $11.5 billion a year before copper prices fell, but now tax revenues from this source have fallen drastically. Growing numbers of copper mines struggle to break even at current prices.

Chile’s GDP is now growing, helped by a weak currency that has boosted export industries outside the mining sector, such as its successful wine and salmon industries. There are strengths in tourism and high-tech products. Public services are good in Chile, and poverty rates have been falling fast. On top of this, a large and diversified financial sector with high domestic savings provides a useful safety net, given high levels of corporate debt and the government’s need to finance a fiscal deficit of 3% of GDP.

Chile’s economy is often regarded as the best run in the region. This is attributed to the credibility of its financial institutions, relatively low levels of national debt (about 15% of GDP) and its free-trade model, which is unrestricted by government interventionism that has distorted the economies of countries such as Argentina and Venezuela. “Chile is an example of how credible institutions can smooth the economic cycle and make adjustments less traumatic,” said Mr Valdés, the minister of finance in Chile, pointing to its widely respected and independent central bank and a well-established fiscal rule that give officials the freedom to implement counter-cyclical policies.

However, there are worries that without enough spare capacity in the economy, expansionary fiscal and monetary policies could end up increasing inflation rather than economic growth. Meanwhile monetary policy is restricted by inflation that has reached 5%, well outside the central bank’s 2–4% target range, fuelled by a weaker exchange rate.

Crucially, investment remains low because of uncertainty over the outcome of the Prime Minister’s reforms, which are aimed at reducing inequality. A recent rise in corporation tax from 20% to 25% and labour market reforms that strengthen the power of trade unions may have a negative effect on business confidence.

Despite a “mildly contractionary” budget, Valdés insisted that the government would continue with costly reforms. Increased taxes on those on higher incomes are considered by the government to be necessary to sustain economic development in Chile. “We do want to change society, while recognising all the good things that have been done in the past 25 years,” said Mr Valdés, referring to an average growth rate of 5.3% over the past three decades, but under 2% in 2015. There is broad consensus that investment in education is the key to unlocking Chile’s growth potential.

Extract B

Chile’s copper mining on a downward track

There was a time when investing in Chilean mining meant guaranteed success. After 1990, when military rule was replaced by an elected government, market reforms and restored relations with the US and UK meant foreign companies were keen to exploit vast copper reserves. The existence of large copper reserves in a stable country with a business-friendly government is rare, making Chile much more attractive to investors than countries such as Zambia.

By mid-2015, however, the copper price hit a six-year low. Chilean mines are becoming less productive. After 20 years of heavy digging, the ore is lower grade, and much further down. The deeper pits take longer to mine, and use more fuel. Wages are high, and trade unions are powerful. A mining truck driver earns $70 000 a year, $10 000 more than the US equivalent. Many mining projects that were planned are being postponed, and investors are looking to Peru; even the US copper mining industry is becoming more competitive.

Energy supply is also a worry as Chile produces virtually no fossil fuels and relies on imported coal and liquid natural gas to power its mines. Energy costs account for 18% of the cost of copper production.

Water supply is also becoming a major problem. Farmers and communities accuse mining companies of causing water shortages to keep their operations running. A prolonged drought has not helped. Mining firms are turning to desalination plants or using untreated seawater. However pumping water 200 kilometres from the Pacific Ocean to the copper mines is costly.

Chile’s environmentalist movement has forced the government to tighten regulations. In 2001, it took 236 days to get an environmental impact assessment of a new mine approved. By 2013, this had increased to 506 days.

(a) With reference to Figure 2, explain one likely reason for the change in the Chile peso exchange rate between 2013 and 2015. (5 points)

(b) Examine the likely impact of externalities of copper mining on firms and communities within Chile. (8 points)

(c) Apart from externalities, discuss the problems that Chile faces as a result of its dependency on copper mining. (12 points)

EITHER

(d) With reference to the information provided and your own knowledge, evaluate the microeconomic and macroeconomic effects of policies that could be used to stimulate economic growth and development in Chile. (25 points)

OR

(e) With reference to the information provided and your own knowledge, evaluate the microeconomic and macroeconomic impact on Chile’s economy of changes in the level of investment. (25 points)

Question 7: Edexcel 9ECO June 2019 Paper 1

Between 2016 and 2017 the average price of new build houses in the UK rose by an estimated 5.4%

(a) With reference to the data provided, calculate the price elasticity of supply for new house builds between 2016 and 2017. You are advised to show your workings. (2 points)

(b) A 2.5% increase in new build house prices in one region of the UK causes a 10% increase in the number of houses built. Ceteris paribus, this suggests that supply of new house builds is: (1 point)

A perfectly price elastic

B perfectly price inelastic

C relatively price elastic

D relatively price inelastic

(c) Explain one factor that is likely to determine the price elasticity of supply of new house builds. (2 points)

Question 8: Edexcel 9ECO June 2019 Paper 1

Extract A

Energy price cap to fix ‘broken’ market in UK

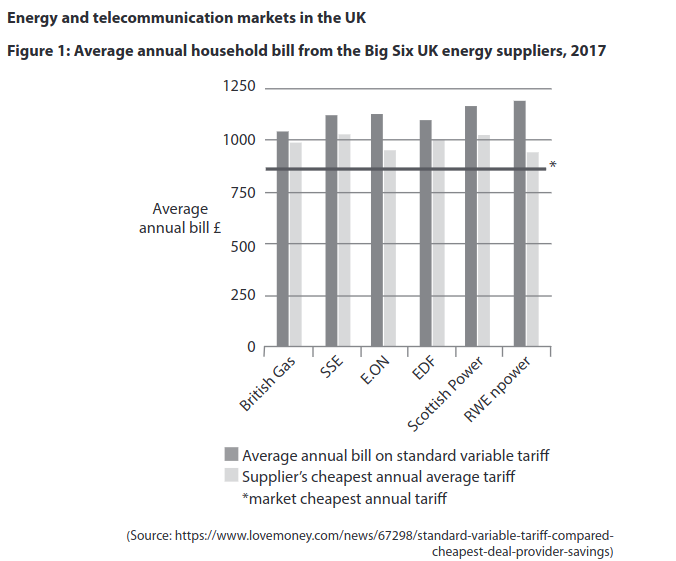

The Prime Minister recently said that the regulator Ofgem (Office of Gas and Electricity Markets) should limit electricity and gas suppliers’ most expensive tariffs. Under the planned new legislation, the energy bills of 11 million households will be capped for as long as five years. The government claimed this cap could save households up to £100 a year. This legislation would force Ofgem to change the licence conditions for energy suppliers so that they are required to cap electricity and gas prices. The measure will apply to anyone on a standard variable tariff, the expensive plans that customers are moved to when cheaper, fixed-price deals end. Ofgem will need to consult energy companies on how the cap is calculated, the government said. The Prime Minister repeated her claim that she had to act because the ‘market is broken’, a charge the big energy companies reject. “I have been clear that our broken energy market has to change – it has to offer fairer prices for millions of loyal customers who have been paying hundreds of pounds too much,” she said.

However, Michael Lewis, chief executive of E.ON said “the government must guard against any unintended consequences that undermine customer service and push up prices as a whole. A price cap will not be good for customers. It will reduce competition and innovation”. Smaller suppliers such as First Utility said the Big Six had only themselves to blame for the cap, because they had kept millions of people on standard variable tariffs.

Extract B

BT profit rises

BT Group, which includes BT Openreach and BT Retail, reported a rise in profit as revenue increased following the integration of the consumer mobile business, EE. BT finalised the takeover of EE in August 2016, and the integration has resulted in BT controlling 35% of the mobile consumer market. The profit of the UK-based telecommunication group in its second quarter 2017 rose to £566 million.

BT Group chief executive Gavin Patterson said: “We will operate a multi-brand strategy with UK customers being able to choose a mix of BT, EE or Plusnet services, depending on which suits them best. The acquisition enables us to offer great value bundles of services and customers are set to be the winners as we compete for their business”.

Extract C

BT to slash landline charges for 1 million customers

Rental charges for landline-only customers – households with a telephone-only contract but no BT broadband – will fall from £18.99 to £11.99 per month after the regulator attacked existing deals as ‘poor value for money’. This rental reduction will save a million landline-only customers £84 a year.

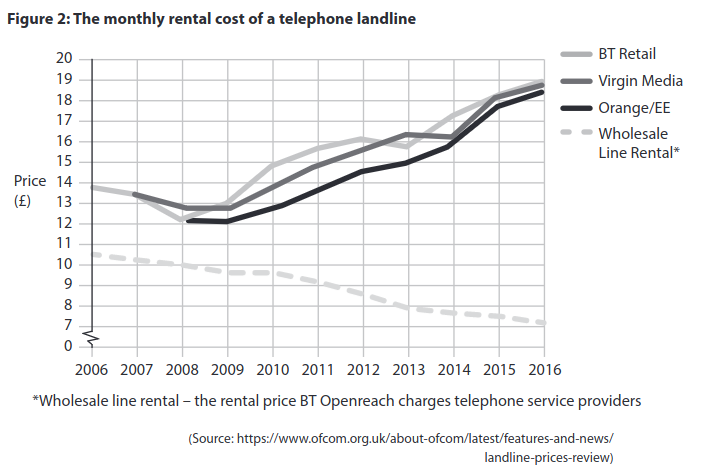

The regulator Ofcom (Office of Communications) said it stepped in because these bills for landline-only customers – nearly two-thirds of whom are over 65 – have “soared” in recent years. This is despite BT and other landline providers benefiting from significant cuts in the wholesale line rental cost of providing the service by BT Openreach. Many landline-only customers are elderly, and have been with BT for decades. Ofcom has focused on BT because it accounts for two-thirds of the UK’s 1.5m landline-only customers.

A spokesperson for Ofcom said “This position [of dominance] has allowed BT to increase prices without much risk of losing customers, and other providers have followed BT’s pricing lead. We expect BT’s price cut to mean other providers will follow suit”. Ofcom said that over three-quarters of BT’s landline-only customers have never switched provider, which has left them a prime target for price rises. The regulator said that all major landline providers have increased their line rental charges by between 23% and 47% in recent years, while their own costs for providing the service have fallen about 27%. Ofcom said it is also looking at measures to help people shop around for better deals with more confidence.

(a) With reference to Extract A, explain the difference between a positive statement and a normative statement. (5 points)

(b) With reference to Extract B, examine the likely benefits to consumers of the integration between BT and EE. (8 points)

(c) With reference to Extract C, assess possible reasons why many ‘landline-only’ customers do not switch to a cheaper telephone provider. (10 points)

(d) Discuss one likely reason for the rise in BT’s profit (Figure 2, Extracts B and C). Use a cost and revenue diagram to support your answer. (12 points)

(e) Discuss methods of government intervention to protect consumers within the utilities markets, such as energy and telecommunications. (15 points)

Question 9: Edexcel A-Level Economics 9ECO June 2018 Paper 1

Extract A

Competition and Markets Authority (CMA) report into the UK energy market

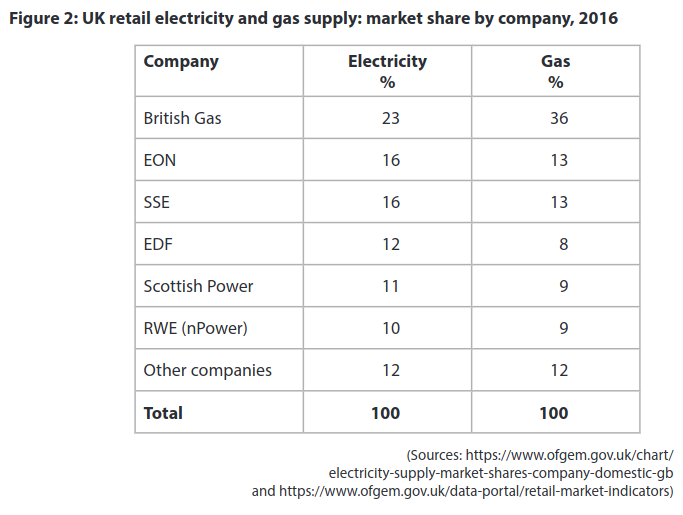

An investigation into the UK energy market by the CMA concluded that customers have been paying £1.4 billion a year more than they would in a fully competitive market. It found that 70% of domestic customers of the six largest energy firms were on an expensive standard rate. These customers could each save over £300 a year by switching to a cheaper deal but appear reluctant to do so.

However, the CMA investigation found no evidence of anti-competitive practices by firms. There has even been an increase in new entrant energy suppliers over recent years and their combined market share has reached 12% in both gas and electricity supply. To protect consumers, the CMA has introduced various measures to open up and increase competition in the UK energy market. These include:

- the creation of a database designed to help consumers switch energy suppliers – rivalsuppliers can directly contact these customers

- the conversion of all homes to smart energy meters making it easier for customers to measure energy consumption and switch supplier

- new rules to protect the four million vulnerable customers using prepaid meters – this includes a temporary price cap until smart meters have been installed.

Extract B

Proposals to regulate profits in the UK energy market

Currently energy retail companies make an average profit of 7% of total revenue. The Chairman of the Competition and Markets Authority (CMA) suggested that these profits are as much as five times higher than they should be, given the companies’ limited role in marketing, metering and billing customers. He recommended a profit cap of 1.25% of total revenue.

However, Scottish Power criticised proposals for regulating profits saying that it would reduce investment in the energy industry and undermine long-term energy provision. The firm claimed that such a low rate of return is below the profit margin made by supermarkets.

All six large energy firms are vertically integrated – producing as well as distributing gas and electricity. This can provide efficiency benefits but also harm competition.

Extract C

Skills shortages in the UK energy sector

The energy sector is facing a skills shortage of engineers and technicians. Some 29% of employers in the gas and electricity industries report unfilled job vacancies compared with an average of 18% across all industries.

A lack of information and advice on career prospects for young people is partly to blame – many graduates have a negative image of the work involved. There is also a lack of students taking science, technology, engineering and maths-based subjects at school and university. Less than one-fifth of the energy sector’s workforce are women.

The energy sector is characterised by an ageing workforce – data from the UK Labour Force Survey reveal that around two-thirds of workers are aged over 50. These cannot easily be replaced as a long time period is required for training and developing workers’ skills in a highly regulated industry.

Urgent action is required by businesses and the government to reduce labour immobility to benefit the energy sector. This action could include policies to increase investment in training programmes, recruit skilled workers from overseas, change the industry image and deal with its ageing workforce.

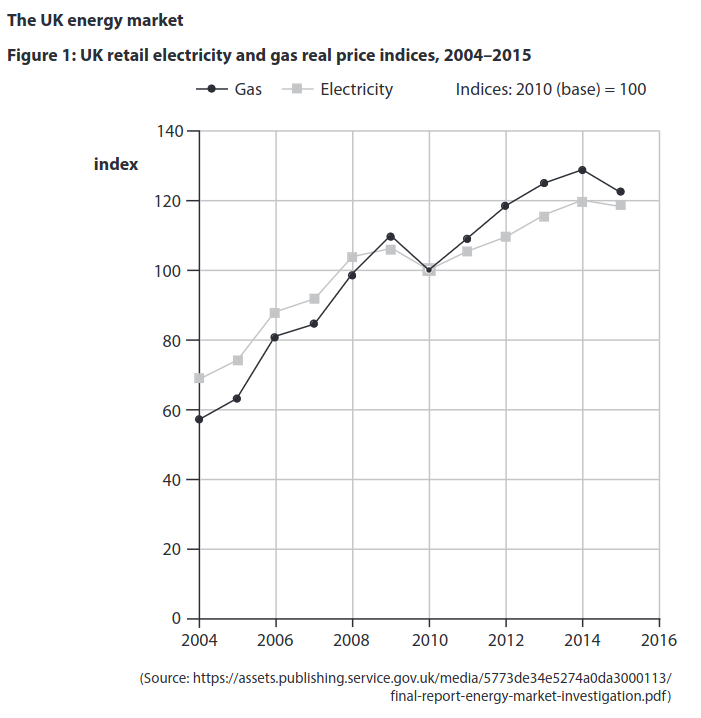

(a) With reference to Figure 1, explain one likely reason for the overall trend in the real price of gas and electricity. (5 points)

(b) With reference to Extract A, discuss the likely effectiveness of ‘measures to open up and increase competition’ in the UK energy market. (12 points)

(c) With reference to Extract B, assess how the regulation of energy suppliers’ profits is likely to affect consumers and suppliers in the energy market. (10 points)

The price elasticity of demand for electricity in the UK is estimated to be –0.35 in the short run and –0.85 in the long run.

(d) With reference to Extract A and your own knowledge, examine two possible reasons for the change in price elasticity of demand for electricity over time. (8 points)

(e) With reference to Extract C and your own knowledge, discuss policies businesses and government might implement to reduce labour immobility to benefit the energy sector. (15 points)

Question 10: Edexcel 9ECO June 2017 Paper 1

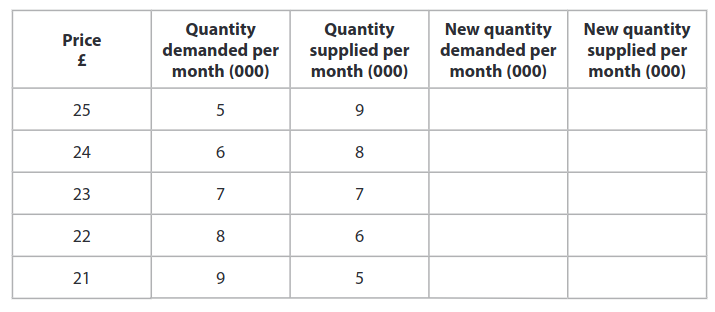

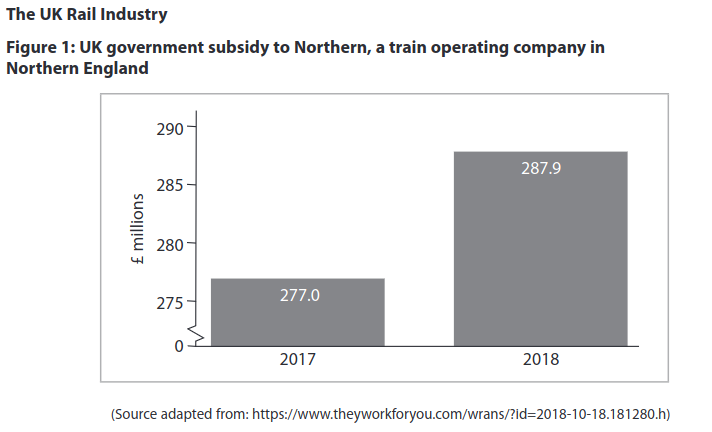

The table shows market data for e-cigarette kits. The original equilibrium price is £23.

As a result of a successful advertising campaign, demand increased by 3 000 e-cigarette kits at all prices. At the same time production costs fell leading to an increase in supply of 1 000 e-cigarette kits at all prices.

(a) Calculate the new equilibrium price and quantity following the successful advertising campaign and the fall in production costs. Use the last two columns for your working. (4 points)

(b) Research conducted in New Zealand in 2014 estimated the cross elasticity of demand for e-cigarettes to be 0.16 in response to changes in the price of tobacco. This implies that a 5% increase in the price of tobacco will cause the percentage change in demand for e-cigarettes to be: (1 point)

A -31.25

B -0.16

C 0.8

D 31.25

Question 11: Edexcel 9ECO November 2021 Paper 1

Patrick Street Productions produces musicals. Its latest production is ‘It’s a Wonderful Life’ and the total cost of this production is $200 000. The ticket price is $40. The theatre has a capacity of 300 seats. The company aims for revenue maximisation. If this is achieved, revenue from ticket sales will cover 30% of total costs. Charitable donations contribute 12.5% towards total cost and a government subsidy ensures the production covers all of its costs.

(a) Calculate the total revenue from ticket sales for ‘It’s a Wonderful Life’, assuming it is shown only five times, all at full capacity. You are advised to show your working. (2 points)

(b) Calculate the value of the government subsidy necessary for this production to cover all of its costs. (2 points)

(c) Which one of the following conditions is necessary for revenue maximisation to occur? (1 point)

A Average revenue equals average cost

B Average revenue equals marginal cost

C Marginal revenue equals average revenue

D Marginal revenue equals zero

Question 12: Edexcel 9ECO November 2021 Paper 1

Extract A

Marginal productivity of cabin crew

Cabin crew are responsible for loading passengers and providing in-flight meals. United Airlines is planning to reduce the number of its cabin crew members onboard international flights. The airline currently operates its planes with one more cabin crew member than its competitors. The marginal productivity of this additional crew member may be low. By reducing the number of its cabin crew members United Airlines will be able to operate more efficiently and compete more effectively.

Extract B

Thomas Cook’s environmental impact

Thomas Cook Group plc’s operations included its airline and 560 high street travel agents providing flights, hotels and package holidays.

The environmental impact of the travel industry is significant. It accounts for 8% of all global carbon emissions. Thomas Cook recognised the risks presented by climate change and actively engaged in reducing their airline emissions. Its plans included using more efficient aircraft and using lower-carbon fuel. In 2018, Thomas Cook was included in the top 10 of the world’s most fuel-efficient airlines.

Extract C

Why did Thomas Cook shut down?

Thomas Cook Group plc ceased trading on 23 September 2019. The collapse of Thomas Cook left 600 000 travellers stranded overseas and approximately 21 000 worldwide employees were left without a job.

Thomas Cook’s management said that the failure of rescue talks between banks, shareholders and the UK Government meant it had no choice but to shut down the business. But in truth the tour operator’s problems go back much further. A disastrous merger in 2007, increased debts, the internet revolution in holiday booking and Brexit uncertainty all contributed to the failure of the business.

In 2007 it merged with MyTravel. Thomas Cook directors had an objective of rapid company growth over short-term profitability. The merger was supposed to create a European giant, promising £75 million-a-year cost savings and a springboard to challenge emerging internet rivals. In reality, Thomas Cook was merging with a company that had only made a profit once in the previous six years, and the deal left the Group with huge debts. In May 2019, the firm reported a £1.5 billion loss.

The role of the management in Thomas Cook’s collapse is being investigated by the UK Government. Thomas Cook executives’ salaries and bonuses have been questioned. Directors received salaries totalling £20 million in the five years before its collapse. The Chief Executive Officer (CEO) earned a £500 000 cash bonus in 2017 and about £8.5 million in his five years with the company. It seems that around £4 million of this was in the form of shares. The share price reached £1.46 in 2018, but each share is now worthless.

The CEO said that the directors had worked “exhaustively” to rescue Thomas Cook and create a long-term turnaround strategy. “It is a matter of profound regret to me and the rest of the board that we were not successful.”

The UK prime minister admitted that the government refused to grant £150 million as a subsidy to help rescue Thomas Cook in the short run. The UK prime minister stated: “Clearly, that is a lot of taxpayers’ money and sets up, as people will appreciate, a moral hazard in the case of future such commercial difficulties that companies face. I have questions about whether it’s right that the directors, or whoever, the board, should pay themselves large sums when businesses can go down the tubes like that. One is driven to reflect on whether the directors of these companies are properly incentivised to sort such matters out”.

(a) Explain the likely impact of diminishing marginal productivity of labour on cabin crew staffing levels. Refer to Extract A in your answer. (5 points)

(b) Examine the likely impact of Thomas Cook’s plan ‘to reduce their airline emissions’ (Extract B, line 6) on the social optimum position. Use an appropriate externalities diagram in your answer. (8 points)

(c) With reference to Extract C, assess whether Thomas Cook’s failure was caused by the principal-agent problem. (10 points)

(d) With reference to Extract C, discuss the proposed government subsidy to prevent Thomas Cook from reaching its shut-down point. (12 points)

(e) With reference to the information provided, discuss the decision by Jet2 to increase its package holiday prices. (15 points)

Question 13: Edexcel 9ECO November 2020 Paper 1

Fuel duty is an excise tax imposed on the sale of petrol, included in the price paid by consumers, set at 58 pence per litre.

(a) Draw a supply and demand diagram to show the incidence of a specific petrol tax on consumers and producers. (4 points)

(b) The indirect tax on fuel is increased in a market in which the price elasticity of demand is −0.1. Which one of the following is the most likely effect on consumer and producer surplus? (1 points)

A Consumer surplus and producer surplus both decrease

B Consumer surplus and producer surplus both increase

C Consumer surplus decreases and producer surplus increases

D Consumer surplus increases and producer surplus decreases

Question 14: Edexcel 9ECO November 2020 Paper 1

Extract A

The case for nationalisation

Privatisation has not made the rail industry cheaper to operate, despite the promise from one government source that it would see private companies bringing: “more competition, greater efficiency and a wider choice of services”.

One reason, suggest the critics, is fragmentation. Instead of pushing British Rail into the private sector as a single supplier the government chose to break it into three components of track, train operators and rolling stock i.e. the trains and carriages. This has encouraged each part of the rail industry to prioritise its own profits rather than collaborating to improve the system.

Privatisation, meanwhile, never really worked. The rail network of 2 500 stations and 32 000 km of tracks was renationalised in 2001. This has encouraged the government’s transport secretary, a supporter of private sector involvement, to argue that the state Network Rail monopoly should be removed so that companies can bid to build new rail lines to upgrade the railway.

The privately-owned train operators are now the subject of fierce criticism, due to overcrowding and cancelled services. Private companies are supposed to compete to win a bid to be the train operator for a region for a short number of years. However in recent years the number of private companies bidding or renewing their contract as rail operators has fallen. In May 2018 the government rescued the East Coast line by renationalising it. The line had been run by the private rail operator Virgin Rail, which was suffering lower passenger numbers and revenue than forecast.

Some argue that there is a simple solution: reunite track and train in the only feasible manner, nationalisation.

Extract B

Southern Rail boss paid £495 000

The Chief Executive of Southern Rail, the private-sector train operator that has become associated with delays, losses, cancellations and strikes, was paid £495 000 last year. This increased calls for nationalisation and a maximum wage for executives at companies with government contracts. In contrast the average base pay for a train driver in the UK is £47 705, although they can earn up to £63 000.

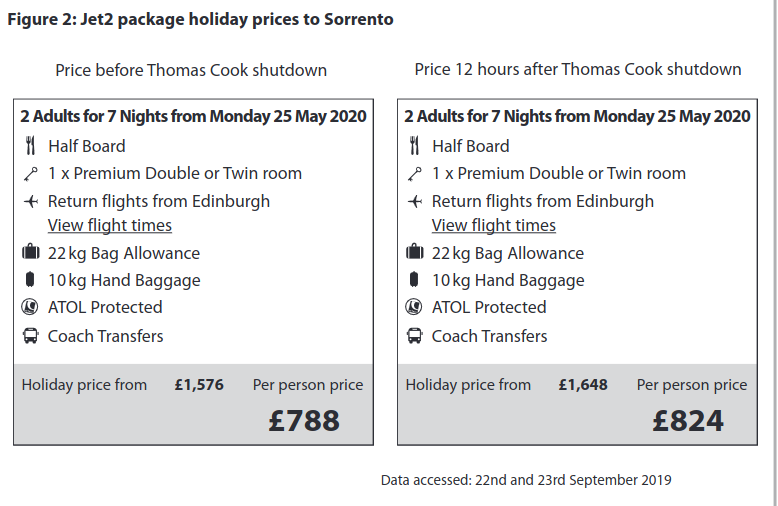

(a) Refer to Figure 1. Explain the likely effect of the change in subsidy levels between 2017 and 2018 on rail fares. Include a supply and demand diagram in your answer. (5 points)

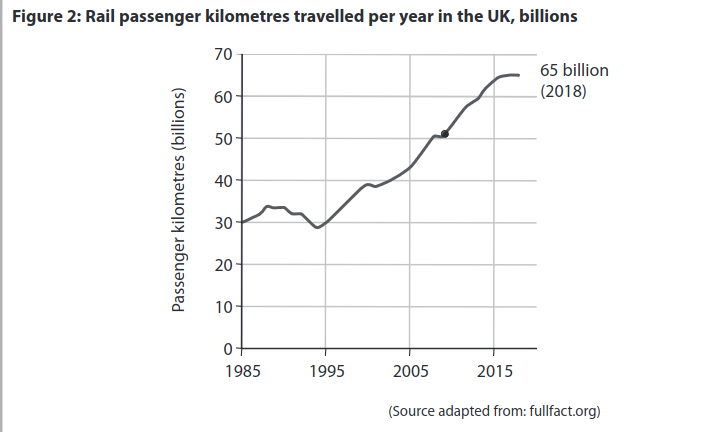

(b) With reference to Figure 2, examine two possible factors which may have influenced demand for rail travel since 2008. (8 points)

(c) Assess whether complete nationalisation of the rail industry might protect employees. (10 points)

(d) With reference to Extract A, paragraph 3, discuss whether the rail network can be considered to be a natural monopoly. (12 points)

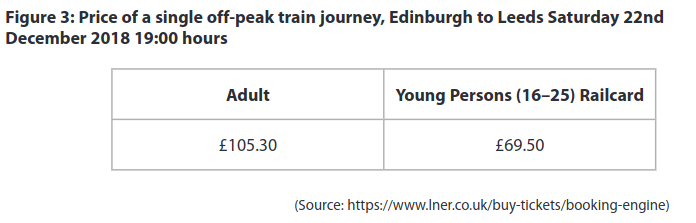

(e) Discuss the likely benefits of price discrimination to rail passengers. Use a diagram to support your answer. (15 points)

Question 15: Edexcel 9ECO June 2017 Paper 1

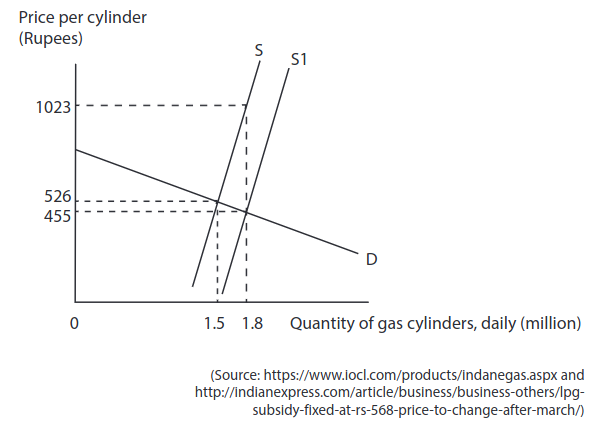

The Indian government has introduced a subsidy on domestic cooking gas cylinders in the city of Mumbai. The diagram below shows the effect following the introduction of the subsidy.

(a) Calculate the total domestic cooking gas subsidy paid daily by the Indian government. You are advised to show your working. (2 points)

(b) Calculate the percentage share of the total subsidy received by:

(i) consumers (1 point)

(ii) producers (1 points)

(c) One effect of the subsidy is to increase: (1 point)

A consumer surplus

B market failure

C public good provision

D tax revenue

Question 16: Edexcel 9ECO June 2017 Paper 1

In 2015 a report by Public Health England recommended the imposition of a 20% tax on the sale of soft drinks that contain high levels of sugar. Evaluate the likely microeconomic effects of such a tax. (25 points)

Question 17: Edexcel 9ECO June 2019 Paper 3

Extract A

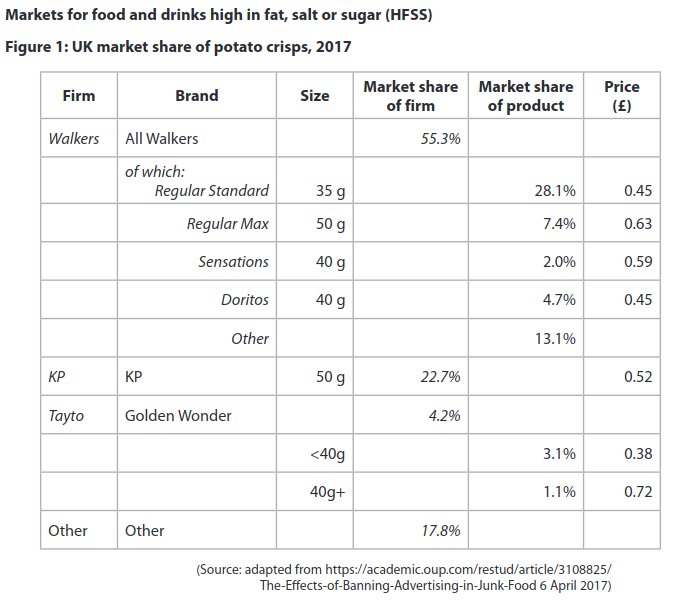

The effects of a total ban on advertising of HFSS foods

Food and drinks which are high in fat, salt or sugar (HFSS) tend to be sold in highly concentrated markets. Tough new rules banning advertisements for HFSS products, such as those for confectionery, fizzy drinks and potato crisps, come into effect in July 2017 as means to reduce consumption. The rules apply to media targeted at under-16s and will mean a major reduction in the number of advertisements children see for HFSS products in posters near schools, in films targeted at children, on catch-up television and in social media if it is directed at children.

There are three main factors that will determine the effectiveness of the intervention: first, whether advertising acts to expand the market share or steal rivals’ market share. Secondly, how firms in the market adapt their behaviour in response to the ban. Thirdly, what substitute products do consumers turn to if they opted out of the targeted market.

Results from a recent survey in the UK suggest that the total quantity of crisps sold would fall by around 15% in the presence of an advertising ban, or by 10% if firms respond with price cuts, since the ban acts to make the market more competitive and firms respond to the ban by, on average, lowering their prices.

The survey showed that following a ban, consumers are more likely to switch to another junk food than to a healthy food, which (in addition to the pricing response of firms) acts to partially offset any health gains from the policy.

Extract B

Taxing HFSS foods and subsidising healthy eating widens inequality

Since low-income groups spend a higher proportion of their income on food and tend to eat less healthily, they are the main targets of taxes on products that are high in fat, salt or sugar (HFSS). Subsidies on healthy food are seen as an alternative policy approach to encourage healthy eating. While data on the impact of such policies are scarce, a recent study on the distributional impacts of HFSS taxes and healthy food subsidies found that these actually widened health and fiscal inequalities. The policies tend to be regressive and favour higher-income consumers. Taxes on unhealthy food increase prices which have a greater impact on low income groups rather than higher income groups. Lower income groups prefer to buy HFSS food.

Subsidies encouraged all income groups to buy more fruit and vegetables. However, those on higher incomes proved more responsive and the average share of budget spent on healthy food actually increased for the higher income groups who were more likely to buy the subsidised healthy food and then spend the savings they had enjoyed on yet more healthy food. The diets of the higher income groups before the subsidy tended to be healthier. The choices of the higher income groups are more responsive to price changes. By contrast, lower income groups, if they responded to lower prices, often used the money saved to buy unhealthy items or something else entirely. The long-term benefits of a healthier diet are harder to grasp for consumers when information gaps exist. Often the immediate boost of a tasty treat is more appealing. Taxes and subsidies do not change that. Other strategies are needed to promote healthy eating, especially education.

Extract C

Tax on fatty foods in Denmark is an economic disaster

Denmark introduced a specific tax on saturated fat in October 2011. Recognised as a world-leading public health policy, it was abandoned just 15 months later having been both an economic and political disaster.

Indirect taxes of this sort are invariably regressive, disproportionately affecting the elderly and the poor. The specific tax led to prices rising on average 15% for highest-fat products, yielding a total decrease of 5% in the intake of saturated fat from products such as minced beef and cream. 80% of Danish consumers did not change their shopping habits at all. The behavioural change was economically damaging as consumers switched to cheaper brands and crossed the border to Sweden and Germany to do their shopping. Danish tax revenue fell as a result.

(a) With reference to Figure 1 and Extract A, explain what is meant by a ‘highly concentrated’ market for potato crisps (Extract A, lines 2–3). (5 points)

(b) Apart from changes in indirect taxes and subsidies, examine two causes of income inequality within a developed economy such as the UK. (8 points)

(c) In Extract A, lines 15–16, it was suggested that some firms may respond to the advertising ban by cutting the prices of their products.

Using game theory and the information provided in Figure 1 and Extract A, discuss the effects on firms of cutting prices in an oligopolistic market. (12 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic effects of increased government spending on education to promote healthy eating in the UK. (25 points)

OR

(e) Evaluate the likely microeconomic and macroeconomic effects of imposing a tax

on HFSS foods. (25 points)

Question 18: Edexcel 9ECO June 2018 Paper 3

Extract A

Starbucks in Britain – a loss-making business?

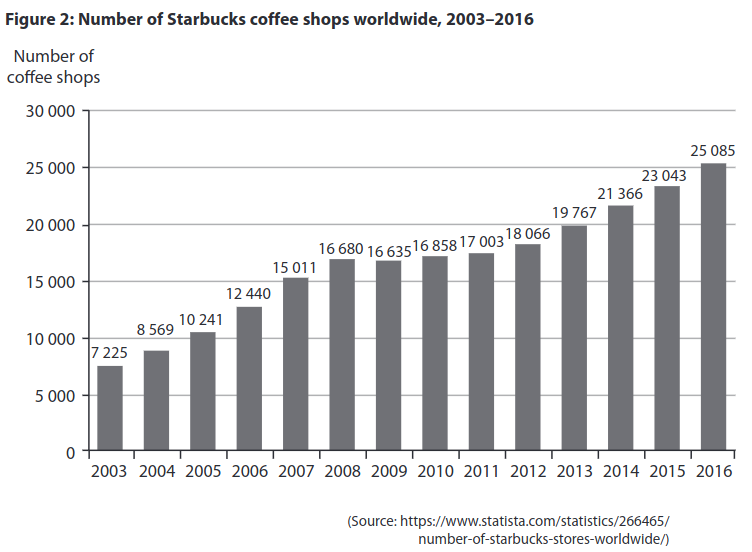

Coffee shops are among the most profitable parts of the food and drink industry, and few are doing quite as well as Starbucks, a US-based transnational company. Starbucks may be complaining of adverse global market conditions but that did not stop the world’s biggest coffee chain from reporting record annual profits in 2016. It made a profit of almost US$4.2 billion for the year, up 16% on 2015. That was mainly the result of a strong performance in its biggest market, America, where revenue rose 11%. The fastest growth was in the China and Asia Pacific region, with revenue up 23%. Howard Schultz, the CEO of Starbucks, said its Chinese coffee shops were the most efficient and profitable. While Starbucks still makes most of its profit in the US, Mr Schultz has said expansion in China will secure its future for “decades to come” and announced plans to more than double the number of shops in China to 5 000 by 2021.

However its British subsidiary, at first glance, appears to be doing less well. It has announced its first ever profit in Britain in 2015 – of just £1 million – despite opening its first coffee shop in the UK in 1998. It now has 849 UK outlets. The main reason why Starbucks has reported persistent losses in the UK is not due to a lack of demand for its coffee, but to minimise its tax bill. It is claimed that some of Starbucks’ revenue earned in the UK is transferred to its Dutch subsidiary, which is charged lower rates of tax.

Starbucks is not finding life as easy in Britain as in the USA. It faces competition from home-grown chains such as Costa and Caffè Nero. Accusations of tax avoidance have also damaged Starbucks’ sales to the benefit of its competitors. A survey found that a third less people rated Starbucks as their preferred coffee shop than they did before the tax- avoidance allegations were first published.

These issues have forced Starbucks to change its strategy. It has slowed down its expansion plans in the UK and has closed 67 underperforming coffee shops over the past year. It has also tried to repair its reputation by transferring its European headquarters from Amsterdam to London.

Extract B

Tax on disposable coffee cups?

Two and a half billion disposable cups are thrown away every year in the UK, that is, seven million every day. Only one in 400 is recycled. The UK Environment Minister has suggested that a coffee cup tax could work in a similar manner to the plastic bag charge. The 5 pence a bag charge has led to an 85% reduction in the number of bags being given out since October 2015. It is estimated that introducing a tax on disposable coffee cups would cut usage by two billion every year. One environment spokesperson, Kate Parminter, said: “We’ve seen how dramatically a small charge has affected public behaviour when it comes to the plastic bags and it is clearly time to extend it to coffee cups. Most people purchase a tea or coffee and throw away the cup without even thinking about it, but a charge would increase our awareness of the environmental impact.”

In response, another MP welcomed her comments but said he did not believe a tax was the solution. He said: “My initial reaction is charging 5p or 10p for the cup will not work. It will not encourage people to take their own cups in if a coffee goes up from £2.60 to £2.65. I suspect a more technological answer is what we need – either the composition of the disposable cups being changed so they’re more easily recyclable, or changing the technology in the recycling.”

Disposable coffee cups contain a plastic coating inside the cups which prevent them from becoming soggy, making them difficult to recycle. There are just two specialist facilities in the UK that have the required equipment to separate plastic from paper for recycling. Almost no recycled paper is used in the production of disposable cups, meaning that some 43 000 trees must be cut down annually to keep up with the demand. CO emissions of around 83 000 tonnes are generated every year for their production.

Extract C

German city of Freiburg takes action on cutting the use of disposable coffee cups

The ‘Freiburg cup’, made from dishwasher-proof plastic, can be reused hundreds of times. Cups are issued with a one-euro deposit, and can be returned to any of the participating coffee shops in the German city. The cups, which are provided to coffee shops by local councils, are washed in the cafés and bakeries that have signed up to the scheme before being reused. 56 coffee retailers have signed up, and 10 000 cups are being used.

One of the main obstacles facing a wider-reaching scheme, however, is the number of café chains in Germany that are unwilling to use unbranded multi-use cups, particularly Starbucks and McDonald’s. Starbucks already offers a discounted coffee for customers with a multi-use cup, but only if it is bearing the unmistakable Starbucks logo.

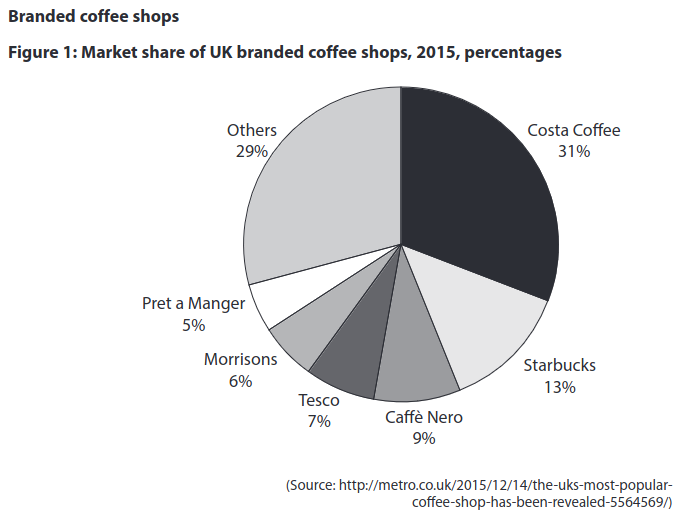

(a) With reference to Figure 1, briefly explain the market structure that best describes the UK branded coffee shop market. (5 points)

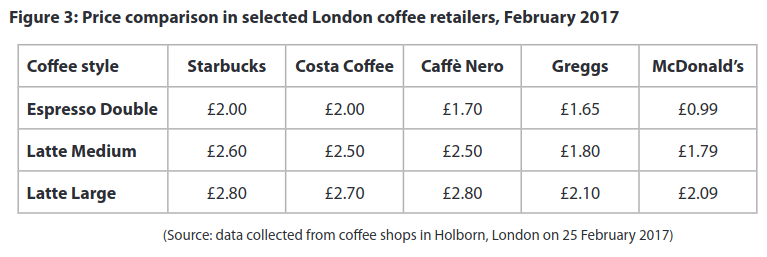

(b) With reference to Figure 3 and other information provided, discuss the price and non-price strategies that Starbucks may use to increase profitability. (12 points)

(c) Examine the advantages of using an indirect tax as a means of reducing the use of disposable coffee cups. (8 points)

EITHER

(d) Evaluate the microeconomic and macroeconomic factors that may influence Starbucks’ decision whether to expand in a particular country. (25 points)

OR

(e) With reference to the information provided and your own knowledge, evaluate the microeconomic and macroeconomic effects of increased UK demand for coffee at branded coffee shops. (25 points)

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.