Definitions

- Aggregate Supply (AS): The total quantity of goods and services produced across all levels of an economy at a particular price level and in a given period.

- Short-Run Aggregate Supply (SRAS): The relationship between the total production of goods and services (GDP) and the overall price level in an economy during a short period. Factors like labor and raw materials are variable, but capital is fixed[2,5].

- Long-Run Aggregate Supply (LRAS): The total amount of goods and services produced when both labor and capital are fully utilized. It’s represented by a vertical line, indicating that it’s not influenced by changes in the price level[3,4].

- Price Level: The average level of prices in the economy, often measured by a price index.

- Gross Domestic Product (GDP): The total value of all goods and services produced within a country in a specific time period.

- Production Possibility Curve (PPC): A curve that shows the maximum feasible amount of two goods that a country can produce, given its level of technology and inputs. For LRAS, the economy needs to be at a point on its PPC[1].

- Capital: The machinery, tools, and buildings used to produce goods and services.

- Wage Rates: The average level of wages paid to labor in an economy.

- Sticky Prices/Wages: Prices or wages that do not adjust quickly to changes in supply or demand.

Want notes on other topics? You can check out our Edexcel A-Level Economics Notes here.

Diagrams

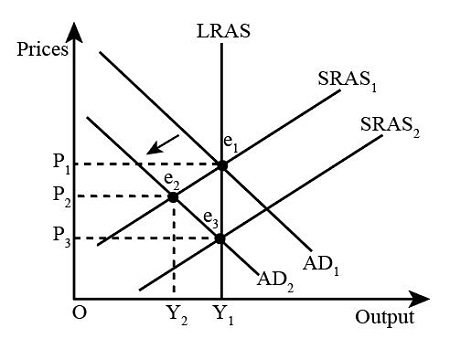

Figure 1: LRAS Diagram with a Traditional Interpretations

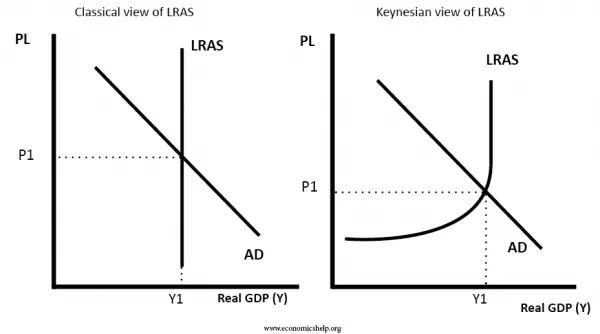

Figure 2: SRAS and LRAS Keynesian and Classical Diagrams

Long Run Aggregate Supply

Long-Run Aggregate Supply (LRAS) is a curve that shows the total amount of goods and services (real GDP) that an economy can produce when it fully utilizes all of its resources.

In economic graphs, the LRAS curve is vertical. This means that in the long run, changes in price levels do not affect the total output of the economy[2].

What Affects LRAS?

- Technology: Advances in technology can shift the LRAS curve to the right, indicating an increase in potential output.

- Education and Training: A more skilled workforce can also increase potential output[3].

- Capital: Investment in machinery and infrastructure can improve productivity, affecting LRAS.

LRAS Diagram’s Movement

- Rightward Shift: Indicates economic growth. For example, the advent of the internet shifted the LRAS curve rightward.

- Leftward Shift: Indicates economic decline. Natural disasters can cause this shift.

Implications for Economic Growth and Inflation

- Economic Growth: A rightward shift in the LRAS curve indicates that the economy can produce more at full capacity, leading to economic growth.

- Inflation: Since the LRAS curve is vertical, it suggests that inflation doesn’t impact the long-term output. However, inflation can still occur due to other factors like increased demand.

Want to test your knowledge? You can find A-Level Economics Past Paper Questions here.

Short Run Aggregate Supply

Short-run aggregate Supply (SRAS) represents the total output an economy can produce in the short term at different price levels.

Diagram: The SRAS curve is upward-sloping, showing a positive relationship between the price level and real GDP[2].

What Affects SRAS?

- Price Stickiness: Firms respond to price stickiness, or the resistance of prices to change, by adjusting their output[1].

- Input Costs: Higher costs for raw materials can reduce SRAS.

- Government Policies: Taxes and subsidies can also affect SRAS.

SRAS Diagram’s Movement

- Rightward Shift: Indicates economic growth. For example, a decrease in oil prices can lower production costs and shift SRAS rightward.

- Leftward Shift: Indicates economic contraction. A tax hike can increase costs and shift SRAS leftward.

Implications for Economic Growth and Inflation

- Economic Growth: A rightward shift in SRAS can lead to economic growth but may also cause inflation.

- Inflation: A leftward shift can lead to stagflation, a situation of stagnant growth and high inflation[6].

SRAS vs LRAS

- Time Frame: SRAS is short-term, while LRAS is long-term.

- Wage and Price Flexibility: SRAS assumes fixed input prices, while LRAS assumes variable input prices[3].

Relationship Between SRAS and Aggregate Supply

- Aggregate Supply: It’s the total supply of goods and services in an economy. SRAS is a component of it, focusing on the short-term supply.

Real-World Example

- Oil Price Fluctuation: A sudden increase in oil prices can shift the SRAS curve leftward, leading to higher costs for consumers and lower economic output.

Keynesian vs Traditional Interpretations

Keynesian Perspective on SRAS and LRAS

- Short-Run Aggregate Supply (SRAS): Keynesians believe that in the short run, prices and wages are sticky, meaning they don’t adjust quickly. Therefore, SRAS can be influenced by demand.

- Long-Run Aggregate Supply (LRAS): Keynesians argue that the economy often operates below full employment. They suggest that government intervention is sometimes needed to reach full potential[2].

Real-World Example:

- Great Depression: Keynes developed his theories in response to the economic downturn, advocating for government intervention to stimulate demand[4].

Free Market Perspective on SRAS and LRAS

- SRAS: Free-market economists believe that the SRAS is vertical, meaning that changes in demand don’t affect the total output in the short run.

- LRAS: They argue that the economy will naturally reach full employment in the long run without government intervention[6].

Real-World Example:

- Dot-Com Bubble: Free-market advocates would argue that the market corrected itself without the need for significant government intervention.

Key Differences

- Government Role: Keynesians often advocate for government intervention, while free-market proponents prefer minimal government involvement[5].

Flexibility: Keynesians see more room for change in SRAS and LRAS based on economic conditions, while free-market perspectives consider these more fixed.

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.