Definitions

- Externality: A cost or benefit that affects a party who did not choose to incur that cost or benefit.

- Positive Externality: Occurs when the production or consumption of a good or service benefits a third party not directly involved in the transaction. For example, education benefits not just the individual but society as a whole.

- Negative Externality: Occurs when the production or consumption of a good or service imposes a cost upon a third party. Pollution is a classic example of a negative externality.

- Social Cost: The total cost of producing a good or service, including both the private cost and any external cost.

- Social Benefit: The total benefit from consuming a good or service, including both the private benefit and any external benefit.

- Private Cost: The cost borne by the producer of a good or service.

- Private Benefit: The benefit derived by the consumer of a good or service.

- Spillover: A situation where some of the costs or benefits associated with the production or consumption of a product “spill over” onto third parties not directly involved in the transaction.

- Internalizing an Externality: The process of adjusting the market mechanism to include external costs or benefits.

- Market Failure: A situation where the market does not allocate resources efficiently due to the presence of externalities.

Want to test your knowledge? You can find A-Level Economics Past Paper Questions here.

Diagrams

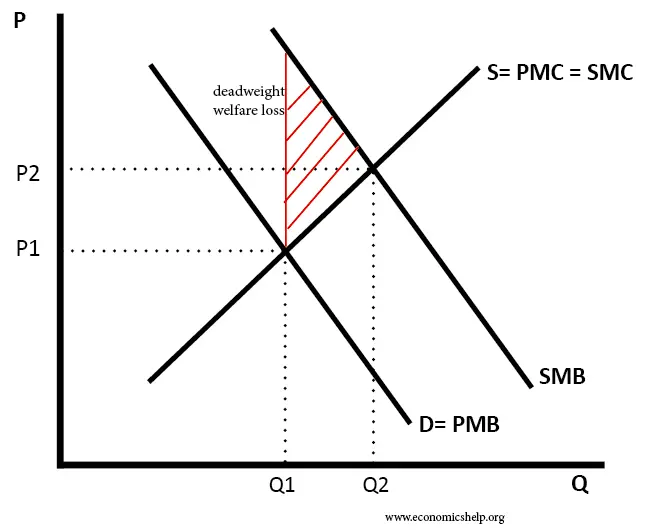

Figure 1. Positive Externalities

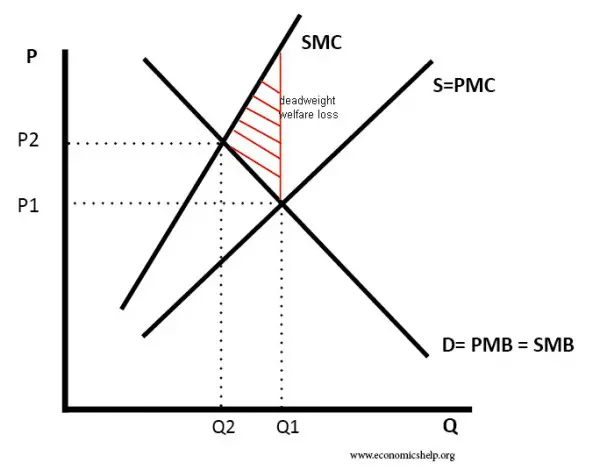

Figure 2: Negative Externalities

Positive Externalities

A positive externality occurs when the production or consumption of a good or service benefits a third party not directly involved in the transaction. This means the social benefits exceed the private benefits.

- Innovation: Innovations often create positive externalities. For instance, the development of the internet has led to numerous beneficial spillovers affecting education, communication, and business.

- Public Transport: Using public transport reduces traffic congestion and pollution, benefiting the community.

- Renewable Energy: Adopting renewable energy sources like solar or wind power reduces greenhouse gas emissions, positively affecting the environment.

- Community Gardens: These not only provide food but also improve neighborhood aesthetics and community well-being.

- Education: Beyond individual gains, education increases societal productivity and civic participation.

- Health Programs: Public health initiatives, such as anti-smoking campaigns, benefit society by reducing healthcare costs.

- Policy Implications: Governments often use subsidies or tax incentives to encourage activities with positive externalities.

- Market Failure: Positive externalities are a form of market failure because the market underproduces these goods or services. The social returns are higher than what is accounted for in the market.

Want notes on other topics? You can check out our Edexcel A-Level Economics Notes here.

Negative Externalities

A negative externality is a cost imposed on a third party not directly involved in an economic transaction. This often occurs when property rights are not clearly defined or allocated.

- Pollution: One of the most cited examples is industrial pollution affecting air and water quality for nearby residents.

- Traffic Congestion: Overuse of public roads leads to delays and increased vehicle maintenance for all users.

- Noise Pollution: Loud music or construction noise can disturb neighbors and reduce their quality of life.

- Overfishing: Depleting fish stocks affects not only the marine ecosystem but also future fishing opportunities.

- Social Costs: The social costs of negative externalities like pollution increase as production levels rise.

- True Cost Economics: This model aims to include the cost of negative externalities in the pricing of goods and services.

- Government Intervention: Regulatory measures such as taxes, quotas, or bans are often used to mitigate the impact of negative externalities.

- Market Failure: Negative externalities are a form of market failure, as they lead to overproduction of goods that have social costs.

Resolving Externalities

- Pigouvian Taxes: These are taxes imposed on activities with negative externalities. The aim is to internalize the external cost by making it more expensive to engage in the activity. For example, a carbon tax can reduce pollution.

- Subsidies: These are financial incentives given to promote activities with positive externalities. For instance, subsidies on electric cars can encourage more people to buy them, reducing greenhouse gas emissions.

- Market-Based Method: Both taxes and subsidies work through the price mechanism to correct externalities. They either increase the cost of harmful activities or reduce the cost of beneficial ones, thereby influencing behavior.

- Price-Based Measures: Taxes and subsidies are price-based tools that governments use to deal with externalities. They either discourage or encourage certain activities by altering their costs.

- Optimal Corrective Taxation: This involves calculating the optimal level of tax or subsidy needed to correct the externality. It considers the impact on related goods and aims for efficiency.

Quotas as an Alternative: Though the focus is on taxes and subsidies, it’s worth noting that quotas can also be used as an alternative to control externalities. These set limits on the activity.

Mark is an A-Level Economics tutor who has been teaching for 6 years. He holds a masters degree with distinction from the London School of Economics and an undergraduate degree from the University of Edinburgh.